People often ask me, “is now the right time to get into the market?” If I had a crystal ball that told me when to buy and when to sell, I probably would not be writing this piece! With the highest inflation numbers since the 1980s, concerns about an economy potentially in recession, and the most prolonged downturn in stocks since the Great Financial Crisis, there is no question that investors have been challenged this year.

The good news is that there are always opportunities for long-term investors with the right plan.

Whether you are an experienced investor, have recently come into cash, or are new to the financial markets, below I discuss some things to consider when asking if now is the right time to invest.

How much cash should I invest?

Not only do you have to figure out when to invest, but you also must decide how much. In other words, what is the right amount of cash to keep on hand and could some of that savings work harder for your long-term goals in investments?

First, you must look at your current financial needs. It is important that you have cash for your anticipated expenses and a cushion for an emergency. I like to think of an emergency fund as a personal buffer against market volatility. If you invest without a source of liquidity, when an unexpected expense or emergency comes up, you may find yourself selling investments at the worst possible time. Being prepared for your immediate needs can help you wait out the market volatility.

Figuring out the right amount for an emergency fund requires that you consider your essential expenses and sources of income. Conventional wisdom suggests 3 to 6 months of readily available savings, but your situation and risk tolerance are important to factor in as well. You can learn more about right-sizing your emergency fund here.

Cash savings is the most common tool to prepare for immediate needs and emergencies, but a different approach may make sense for you, like how my colleague Andrew Denenberg wrote in this piece. With our team’s approach to planning, we delve into your situation to understand any alternatives available and how they may add value to your overall finances.

Once you determine the right amount of savings that makes you feel comfortable, you can look to investments to put your excess cash to work.

Why are you investing?

My favorite way to figure out how to invest starts with building a plan for what I am trying to achieve.

Ask yourself, “how much money do I need for this goal” and “when do I need it?”

Are you investing for next year’s vacation? With a short time horizon, I would prefer to hold cash and not invest in the stock market. It would be great to sell for profits, but it would feel much worse to sell for a loss and not be able to take your trip as planned.

If, on the other hand, you have a longer time horizon, like when you invest for retirement and through retirement, the risk and return of the stock market start to look much more favorable. Benjamin Franklin famously said, “Money makes money. And the money that money makes, makes money.” When time is in your favor, the power of compounding returns becomes clear.

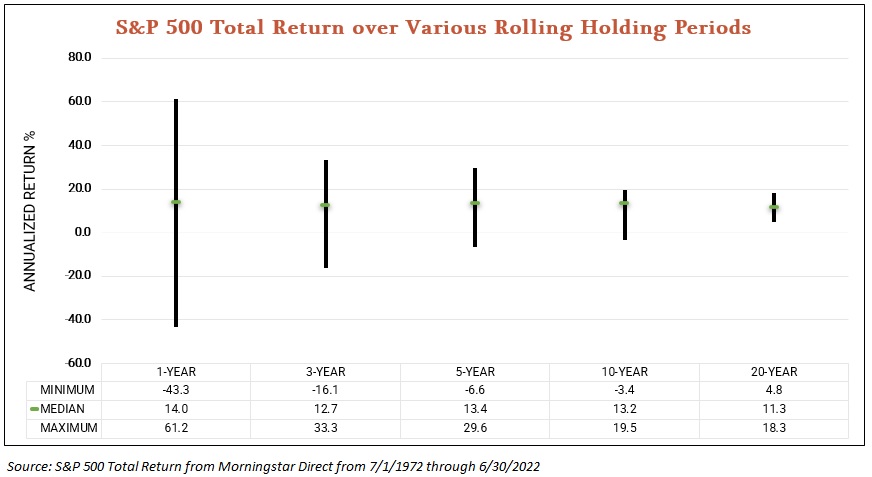

The chart below illustrates the importance of time horizon. It shows the rolling returns of the S&P 500 over increasing lengths of time. As you can see, while the median return does not vary widely, the longer your stay invested, the tighter the range of potential outcomes. Being able to stay focused on the long-term allows you to withstand the less predictable outcomes in the short-term.

Why we don’t time the market

There is no shortage of reasons that we could find to justify saying that the market is going to go down, such as an economy potentially in recession and stubbornly high inflation. When you can keep your long-term objectives in mind, it becomes easier to accept short-term volatility and reap potential long-term results (like we saw in the exhibit above).

Despite recognizing the facts, money is emotional. It is much easier to buy when investing feels good and stocks are rising than to buy when prices are falling and things feel dire.

According to DALBAR’s Quantitative Analysis of Investor Behavior, the Average Equity Fund Investor underperformed the S&P 500 by more than 10%.

Timing the market involves two decisions: when to sell and when to buy. By staying invested, you can earn a higher return over a longer period, helping you achieve the investing goals that are personally meaningful to you.

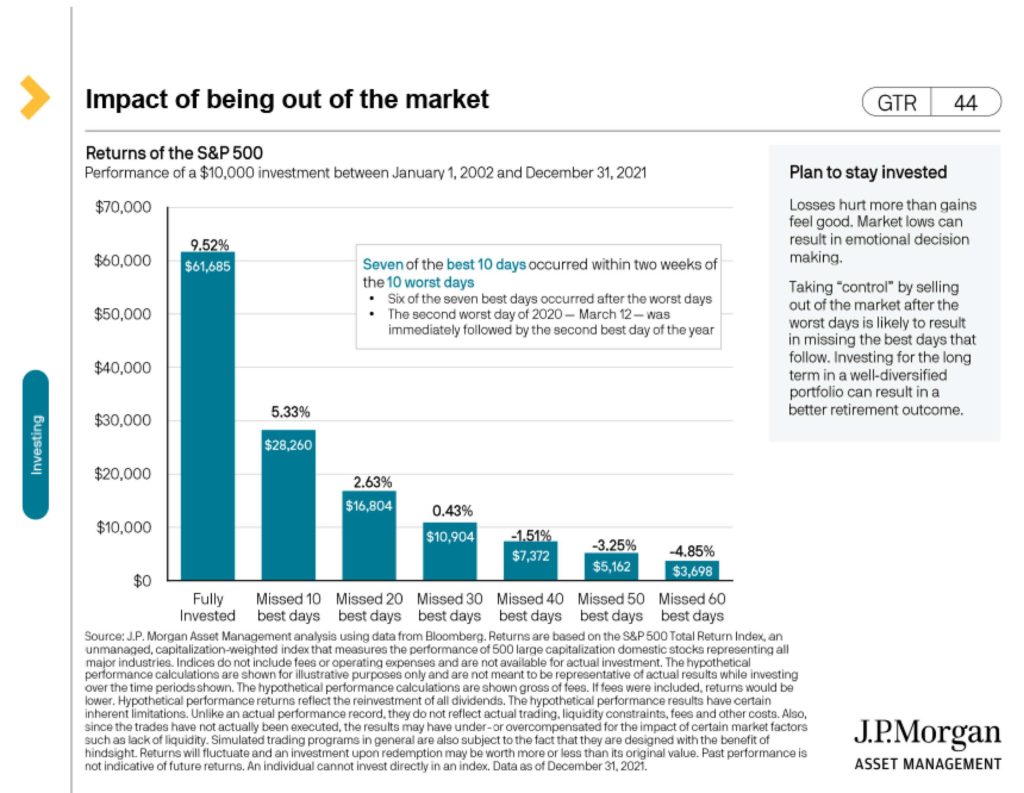

The exhibit below demonstrates the risk you take by attempting to time the market. The best days in the stock market tend to occur shortly after the worst days in the market. When you put yourself in the position of having to both get out and back in at the same time, it’s easy for you to miss out on the best days. As you move across the chart from left to right, you can see the danger it poses to your investment plan and outcomes. If you look at the bar on the far left, you see that the S&P 500 earned 9.52% per year from January 1, 2002 through December 31, 2021. However, if you missed just the ten best days in that same 20-year period, like in the second blue column, your return would have dropped all the way to 5.33% per year. That’s a lot of lost performance!

Some closing thoughts

Seeing the minute-by-minute performance of the stock market on TV can make investing seem like a game of chance akin to a Vegas casino. But, when you take the time to understand your short-term cash needs and develop a plan to reach your goals, you can withstand the near-term market volatility and stay invested in the pursuit of them. And the truth is, investing is actually the opposite of gambling; the longer you do it, the more likely you are to make money!

If you or someone you care about needs guidance in understanding if now is the right time to invest, please reach out to see how our team can help.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).