A new school year just started for my daughters, Myles and Sawyer. And with this came A LOT of emotions in the Karmin household. There were tears of sadness for the summer ending (my wife and my daughters) and perhaps some tears of happiness in anticipation of everyone being out of the house (me).

Over the past few weeks, we have spent time picking out our first-day outfits (new, white Nikes for everyone, of course), designing new backpacks and rubber band bracelets, and connecting our daughters with their classmates. No rest for the weary.

When we took them to their respective first days of school, I had a bit of déjà vu as I very clearly remembered doing virtually the same thing with them during previous years. There was the sleepless night beforehand, the family breakfast the day of, and the slow walk to school as they tightly clenched our hands. Every moment felt so familiar from previous years.

But as this emotional fog has since lifted, I’m now realizing that these girls have, in fact, changed so much over the past years. Myles, now in second grade, is reading chapter books, doing Olympic-caliber cartwheels, and rolling her eyes at me countless times daily. Sawyer, entering pre-kindergarten, is writing out her name (backwards, but we must start somewhere), fully dunking her head in the swimming pool, and ordering me to make her s’mores on demand.

I’ve come to realize that, while it may not seem like my daughters have changed much over the past years, when I take a step back, the changes are actually jaw-dropping.

And because I spend virtually all my time focusing on either my family or my work, I also can’t help but think of all the changes over the past couple of years in how I think about the financial markets and economy (that was a masterclass in transitions, I know).

We Are In A Brand-New Interest Rate Regime

Over the past year and a half, the interest rate environment effectively got flipped on its head. Increases in interest rates were driven by several factors, including but not limited to the Federal Reserve’s efforts to combat inflation, the strong economic recovery from the COVID-19 pandemic, and the supply chain disruption from the ongoing war in Ukraine.

The new interest rate environment has completely changed the way I think about many of our clients’ needs.

First, let’s consider a young borrower. My friends and I bought our first condos or houses in the late 2000s. And for the next dozen years, we would routinely have conversations about refinancing our mortgages and locking in rates that started with a 3, or in some cases, even a 2. Perhaps it’s recency bias, or maybe it’s all I have seen during my professional career, but I assumed that a mortgage under 4% was to be expected. As a result, I was always in the camp that taking on “good debt” (like a fixed-rate mortgage) would never be a financial burden.

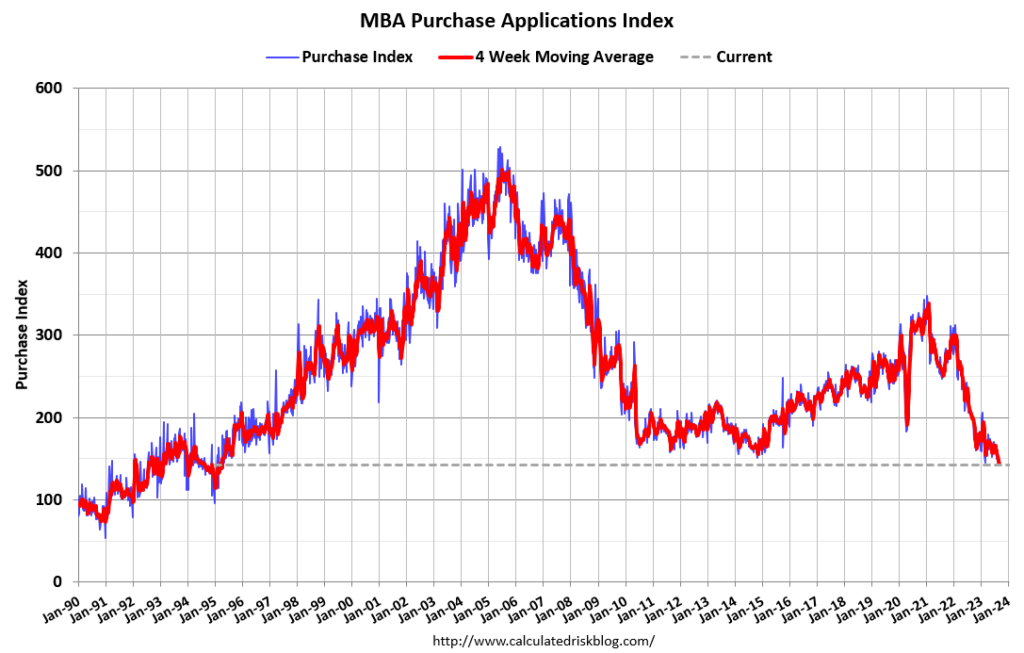

This is certainly no longer the case, as rising rates have pushed mortgage costs higher, thus making homes for first-time buyers much less affordable. The graph below shows that new mortgage applications are as low as they have been since the 1990s!

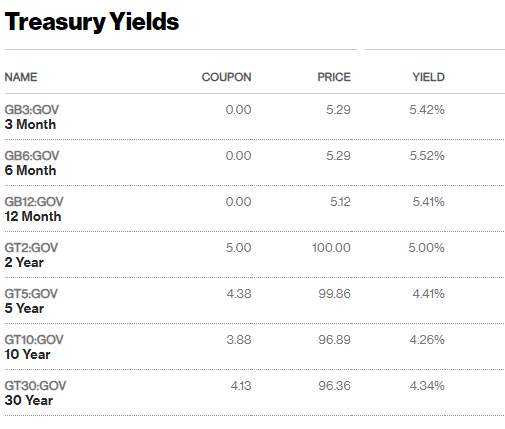

Conversely, let’s now look at a new retiree. The higher rate environment has changed how I think about generating income in retirement. At SWP, we work with many clients who are either approaching retirement or newly retired, and a core focus of our relationship with this segment is on generating cash flow. Two years ago, I would have laughed at the idea that short-term U.S. Government securities would be part of these conversations. And now, look at the “Yield” column in the table below.

Source: Bloomberg – Treasury Yield Data as of 9/13/23

It’s not the yield curve of the 1980s, but it’s not bad either!

I often think about financial markets in the context of “challenges and opportunities.” And for the longest time, I viewed the low interest rate environment as a challenge for lenders (retirees) and an opportunity for borrowers (first-time home buyers). With this new interest rate regime, I’ve been forced to consider the opposite to now be true.

Many of the Largest Companies In the U.S. Are Actually Not At the Mercy of This Higher Rate Environment

One thing I was very concerned about coming into this year was that higher interest rates were going to really hurt large publicly traded U.S. companies. I saw how much the changing rate environment has affected individuals, and I thought there would also be an impact on many of the biggest companies in the world.

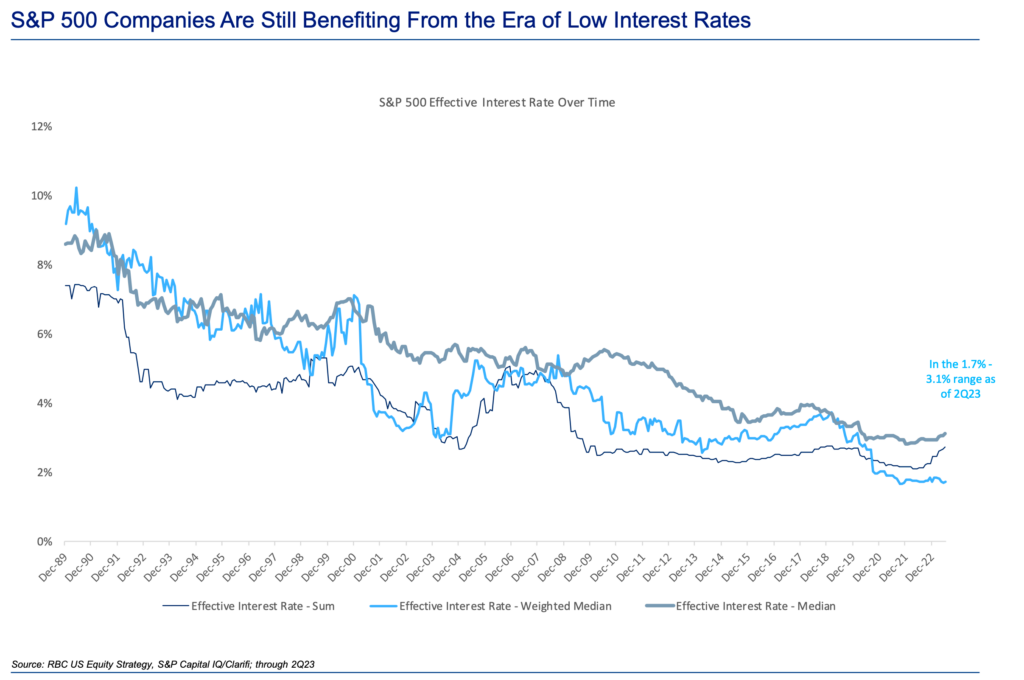

What I did not consider was that many of these companies were actually able to take advantage of the low-rate environment over the past couple of years and lock in lower rates on their longer-term debt. In fact, RBC capital markets calculated that the effective interest rate S&P 500 companies are currently paying on their debt is between 1.7% – 3.1%[1].

The graph below shows the effective interest rates that these companies have been paying on their debt dating back to 1989. The Y-axis on the left-hand side shows that in the early 1990s, the effective interest rate was between 8%-10%. The light blue bar, which is the median interest rate on the outstanding debt in the sample, has declined all the way to ~2% (bottom right-hand corner).

Not bad, paying just 2% on your debt when 2-year Treasuries are yielding almost 5%!

In addition to interest rates being lower, companies also issued longer-term debt to lock in the benefit of paying low interest expense. The average length of corporate debt issuance was 7 years in 2016 and now, in 2023, is up to 11 years. Over half of the debt in the S&P 500 matures after 2030. Over the past couple of years, companies refinanced and extended the duration of the debt.

We Should Never Again Doubt the Strength of the U.S. Consumer

The U.S. consumer is very important to the U.S. economy. So important, in fact, that personal consumption expenditures (aka consumer spending) account for approximately 70% of U.S. GDP.

Over the last couple of years, however, I found myself worrying multiple times about the U.S. consumer. In 2021, inflation was at a 40-year high, and it felt like you had to take out a second mortgage to fill up a tank of gas. In 2022, investor’s stock portfolios materially dropped, and many family’s pandemic reserves began to dwindle.

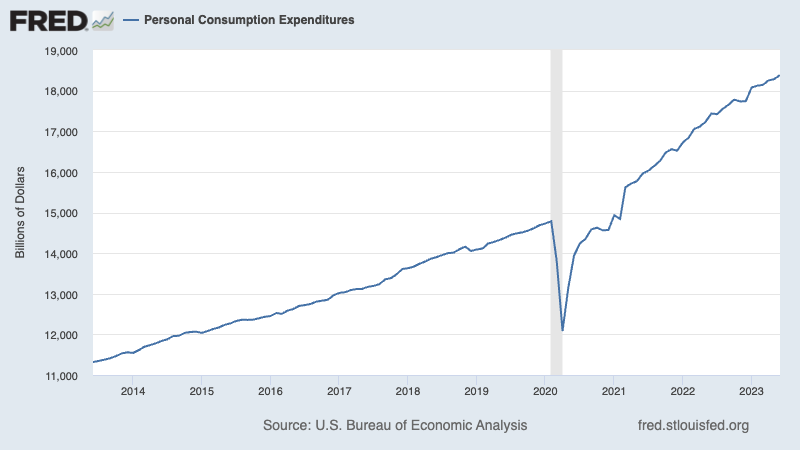

But then, I looked at this chart, which shows the growth in consumer spending over the past decade.

Look at the recovery in consumer spending since the early 2020 Covid decline! Spending is not only back in line with pre-pandemic levels, but it actually appears to be growing more quickly.

In his piece, Don’t confuse ‘normalizing’ with something more alarming, Sam Ro writes, “…economic activity can continue to grow even in an environment where consumer finances are showing signs of more stress — as long as that stress isn’t significantly more intense than normal.”

Two of the stresses he refers to are credit card debt and auto loan delinquency rates, which have both risen recently and are causing concern among some economists and investors.

Perspective, however, is important. While credit card and auto loan delinquency rates are higher, they are really just back at historical norms after being unusually low coming out of Covid.

I think I worry so much about the U.S. consumer because I am a U.S. consumer. But considering what we’ve been through over the past few years and where we are now, I’m not going to doubt the resiliency of the U.S. consumer moving forward.

In Conclusion

At their core, the foundational components of the economy and financial markets are the same as they always have been. But just like with my two daughters, I’ve realized that some changes are inevitable. The funny thing is, I feel way more prepared for future changes in the markets than I am for the changes I’ll face as my kids become teenagers!

If you’d like to discuss any recent changes to the markets and what those changes might mean for you, please reach out to the team at SWP.

[1]Why higher interest rates haven’t crushed corporate profits (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).