One central truth of investing is that it inherently involves risk—investments might result in losing some or even all of the money invested. However, the returns we enjoy from investing are the payment for taking these risks. In general, the higher the risk, the higher the reward; however, it’s crucial to acknowledge that there is simply no reward without some element of risk.

By embracing the risk-reward trade-off, we gain the power to ask two pivotal questions: “How much risk can I comfortably handle (i.e., what is my risk tolerance)?” and “How much risk am I financially capable of taking (i.e., what is my risk capacity)?” This self-awareness and level of knowledge will help to construct an appropriate portfolio to meet one’s financial goals.

What is My Risk Tolerance?

Risk tolerance is one’s comfort level and willingness to engage in uncertain scenarios, recognizing the potential for both success and failure. This willingness is not a one-size-fits-all thing; it varies from individual to individual and is influenced by personal factors.

Risk tolerance is more emotional, like how one might think or feel in a certain situation, and it is less about the “hard data” or the facts. Risk tolerance often stems from prior experiences.

The idea of “risk tolerance” is not just a financial concept but one that plays out in everyday life. Consider trying a new restaurant, for example. There’s some element of risk to that. What if you don’t like the food? What if you spend a little more money than expected on a subpar meal? There are negative consequences (although lower stakes) associated with this activity.

For example, recently my family and I tried a new restaurant together in Chicago, and we have a “high risk tolerance” when it comes to exploring like this. If the food isn’t tasty, or the experience is underwhelming, we’re still comfortable with the results, knowing that this was still a positive experience in the long run.

Investors with a higher risk tolerance are typically more willing to accept greater losses in exchange for the chance of better results. On the other hand, those with a lower risk tolerance may view such scenarios as overly threatening, preferring to steer clear and focus instead on safeguarding their initial capital.

Regardless of its level, risk tolerance isn’t inherently good or bad. Ultimately, it’s just important to be aware of your comfort with risk so that you can make better investment decisions.

Further, research has shown[1] that a person’s risk tolerance isn’t a fixed measurement; it can be scenario-specific or change over time, so making long-term investment decisions in conjunction with other tools, such as data demonstrating risk capacity, is important.

What is My Risk Capacity?

Risk capacity refers to the level of risk you can take without threatening your financial goals. It’s a more objective measurement based on factors such as income, assets, liabilities, insurance, dependents, investment horizon, the size of your portfolio, and the reliability of income from other sources.

Risk capacity is commonly linked to volatility. Investments frequently move up and down in value, sometimes wildly so. The more one’s investments can swing in value without jeopardizing his/her financial stability, the more risk capacity that individual would be said to have. It’s less about emotions and more about one’s true ability.

For instance, younger investors, like those in their 20s, often have a higher risk capacity. This is because they have more time to recover from losses when retirement is many decades away. Conversely, older investors generally have a lower risk capacity due to a shorter investment time frame.

Overall, risk capacity is a crucial concept in personal finance. It offers investors a realistic perspective on their ability to handle investment risk based on their actual situation.

How Do Risk Tolerance & Risk Capacity Interact?

Understanding the relationship between risk tolerance and capacity is critical for sound investment decision-making. Together, they make up an investor’s risk profile.

For example, an investor may have a high-risk capacity due to a substantial income but may be conservative in their approach due to a low-risk tolerance. On the other hand, we’ve seen investors with an aggressive risk tolerance but lower risk capacity, suggesting they might do better exploring less risky opportunities.

Finding the right risk profile range can help direct the overall portfolio risk and expected return that is appropriate for your unique situation.

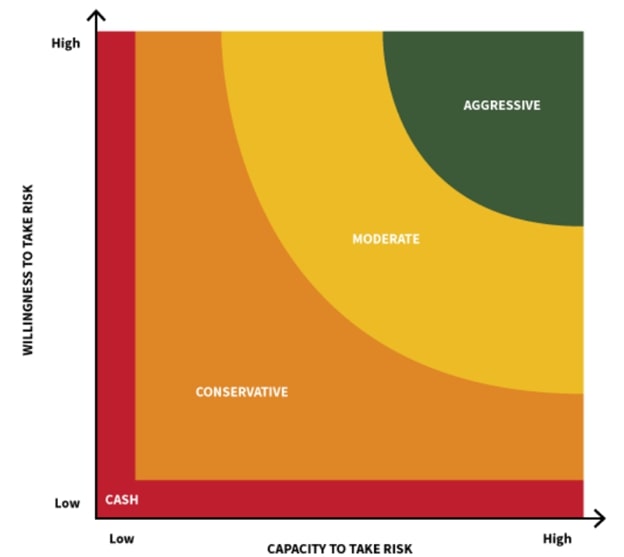

The graph below shows the relationship between one’s risk tolerance and one’s risk capacity. As you can see, the more willingness for risk someone has, and the more capable they are to take on risk, the more aggressive a portfolio can be (green part of the graph). On the other hand, someone who has a low risk tolerance along with minimal resource (a low capacity for risk) would be considered a conservative investor (orange part of the graph).

Source: Michael Kitces, www.kitces.com

Aligning an investor’s portfolio with their risk capacity and risk tolerance is very important. Ultimately, this will 1) help the individual to make progress towards achieving their goals and 2) make them feel comfortable.

For example, take a young individual with a high-risk tolerance. If their portfolio is too conservative, this could be detrimental to their financial situation and long-term goals. On the other hand, take a retiree with a low-risk tolerance. Exposing this client to too much risk could make them feel uncomfortable.

Keep in mind that one’s risk profile is not static. Life events can influence an individual’s risk tolerance and capacity. It is advisable to reassess your risk profile regularly and adjust your investment strategy accordingly.

Closing Thoughts

When investing, it’s essential to consider both your personal risk tolerance and your risk capacity.

To ensure your investments align with your financial goals and accurately reflect your risk profile, schedule a time with an advisor to review your risk profile and ensure it’s accurately reflected in your current portfolio.

[1] Sahm, CR. How Much Does Risk Tolerance Change? (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).