In the 1950s, Harry Markowitz was one of the creators of Modern Portfolio Theory (MPT). In summary, he was able to create an “optimal” portfolio of 60% stocks and 40% bonds. Over time, this mix generated most of the returns of stocks with much less downside risk. This was the early introduction of the asset allocation issue that is critical to portfolio construction. However, is this still the optimal way to create a portfolio?

Stocks vs. Bonds

To start, let’s look at some fundamental differences between stocks and bonds.

In theory, stocks (also commonly referred to as “equities”) are a bet on economic growth and innovation. We truly do not know where growth and innovation lead us. Stocks have infinite upside; the sky is the limit. That growth comes with a price, uncertainty. One must accept this uncertainty to experience the upside of the stock market.

The other piece is typically referred to as “bonds.” Bonds are part of a larger universe of investments which involves a contract between borrowers and lenders. One side loans money to the other on a contractual basis. A broader term would be “debt.” When the borrower fulfills their obligations, the contract is satisfied. Both sides are happy.

Here is the difference between equity and debt investing. The equity investor can wait indefinitely to be “paid off” in terms of a higher stock price. There is no maturity. With debt investments, there is always a maturity. This maturity creates limits as to how high and low the price of the security can be during its life, assuming the debt is to be paid off. This results in a lower volatility stream of returns that can dampen the higher volatility stream of returns from stocks. Markowitz felt mixing the two concepts together would result in a “better” portfolio than either category on their own.

While we can demonstrate that combining stocks and bonds can generate reasonable risk adjusted results, is it really appropriate in today’s environment? Does diversifying between stocks and traditional bonds work?

Are Stocks and Bonds Negatively Correlated?

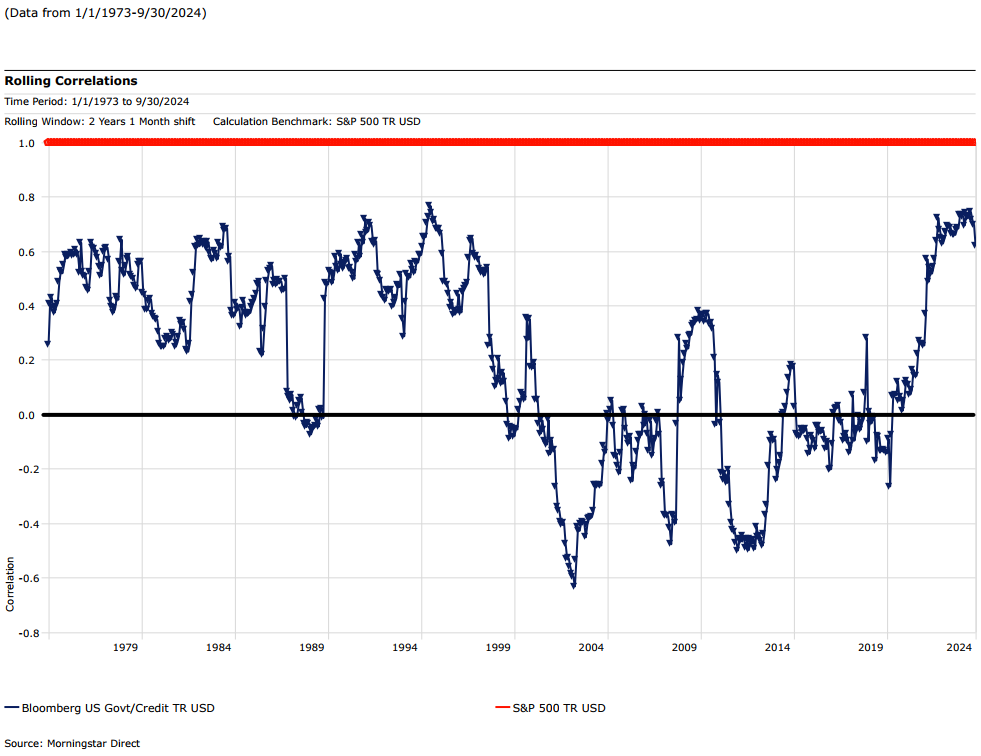

A key aspect of combining stocks and bonds rests on the concept of “negative correlation,” i.e., that one category may move up in value when the other moves down. This can smooth out the overall portfolio return stream, providing portfolio protection when needed. Has this actually been the case over time, though?

As demonstrated below, the relationship between the stock market and the bond market over the past 50 years has been anything but negatively correlated. Sometimes it is negatively correlated, and sometimes it isn’t. This result does not provide much comfort when creating a portfolio if one is investing based on the premise of negative correlation.

Expected Absolute Returns

Additionally, one should look at expected absolute returns from the bond market to determine if the expected returns are worth the risk. Remembering that bonds have limited returns, how should we evaluate the future returns on bonds?

One way is to examine the returns offered by various maturities on the bond spectrum. This is what is known as the “yield curve.” While interest rates may decline, offering price appreciation, the subsequent opportunity is ultimately reduced. If the whole yield curve is near zero, how could an investor expect any sort of reasonable future return?

We saw this case 12 years ago when interest rates along the whole yield curve were no higher than 1.2%. What were the subsequent returns? For the trailing 12 years, through Oct 23, 2024, the Bloomberg Aggregate Bond Index has generated an annualized total return of 1.5%. Even in today’s environment, where rates are around 4%, what is your expected annual return after inflation and taxes? If you earn 4%, taxes are 40%, and inflation is 2%, what are you left with? In this case, 0.40%.

If inflation or taxes are higher, you end up losing purchasing power! Is this worth the price of lowering the volatility of your portfolio? Is this worth allocating such a large portion of your portfolio, 40%, to a category with such limited possibilities?

With these drawbacks in mind and assuming you want a positive return contribution from the non-stock part of a portfolio, how does one create a portfolio that allows for growth without all the volatility of stocks? I’ve been working on this concept for over 30 years. We have been looking for ways to provide clients with alternative return streams that will dampen the volatility of the stock market while generating acceptable after-tax and after-inflation results.

We do this by using a variety of strategies that did not exist when Markowitz developed his concept of a 60/40 blend. Structured notes, hedged equity strategies including hedge funds and other concepts, dampen the volatility of the stock market. Structured credit, private credit, and relative value debt strategies offer different ways to view the debt side of a portfolio, instead of just using “bonds.”

When we look for these various alternatives, we examine any number of issues before opting to utilize a strategy. We examine the sensitivity of a strategy to stock market returns. We look at how strategies respond to interest rate changes. We see how a strategy holds up under economic stress. Basically, we question what could go wrong. What we are really looking for are ways clients can achieve their goals while earning reasonable returns on all the pieces of their portfolio and controlling the volatility of their total investments.

Let us know if this concept is of interest to you. We are happy to examine if it could be a piece of your overall investment mix.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).