Every year, experts, analysts, and pundits flood the financial media with bold market predictions. Some forecasters claim markets will soar; others warn of impending doom. These predictions often grab headlines, but they also mislead investors, tempting them to make decisions that may derail their long-term financial goals. The truth? Most market predictions are wrong. Below are several reasons why predictions are often incorrect, why ignoring them works, and a few tips to focus on the longer term.

The Problem With Predictions

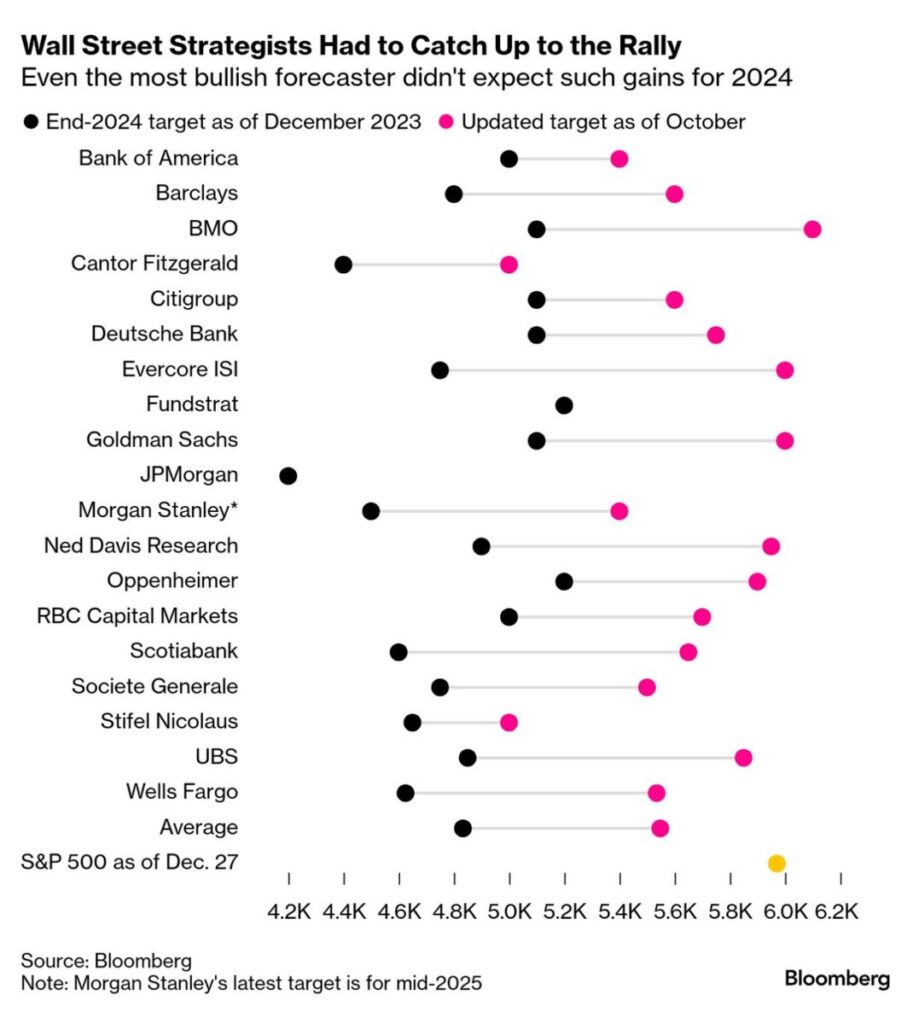

Inaccuracy Is Commonplace

Even the most seasoned market analysts struggle to make accurate predictions. Markets are influenced by countless variables—interest rates, geopolitical events, consumer behavior, corporate earnings, and unforeseen crises—all of which are impossible to predict consistently. One of my favorite new year charts (below) is a review of Wall Street’s crystal ball.  The chart shows S&P 500 (U.S. Large Company Stocks) predictions for 2024 as of December 2023 (black dots). Also included are updated predictions (pink dots) as of October 2024 (which doesn’t seem all that fair, given only two or three months remained in the year!). The point is that even predications of the largest Wall Street firms were materially off to start the year and remained materially off as the year moved to a close. Investors following these predictions would have missed more than a 20% return on equities (likely impacting their financial goals).

The chart shows S&P 500 (U.S. Large Company Stocks) predictions for 2024 as of December 2023 (black dots). Also included are updated predictions (pink dots) as of October 2024 (which doesn’t seem all that fair, given only two or three months remained in the year!). The point is that even predications of the largest Wall Street firms were materially off to start the year and remained materially off as the year moved to a close. Investors following these predictions would have missed more than a 20% return on equities (likely impacting their financial goals).

Short-Term Thinking Hurts Long-Term Goals

Predictions are often focused on the short term, encouraging investors to make frequent adjustments to their portfolios. This short-sighted approach leads to market timing, emotional decision-making, and missed opportunities for growth. Long-term investors, on the other hand, benefit from staying invested and allowing their portfolios to grow through market cycles.

The Media’s Role in Sensationalism

Many stock market predictions are designed to grab attention, not to guide sound investment decisions. Headlines like, “Markets Set to Crash 20%!” or “The Next Big Investment to Double Your Money!”, are meant to evoke fear or greed – two emotions that can cloud judgment.

Why Ignoring Predictions Works

Markets Are Resilient

History shows that markets tend to recover and grow over time despite short-term volatility. The S&P 500, for instance, has delivered average annual returns of about 10% over the last century – weathering wars, recessions, and pandemics.

Timing the Market Is Impossible

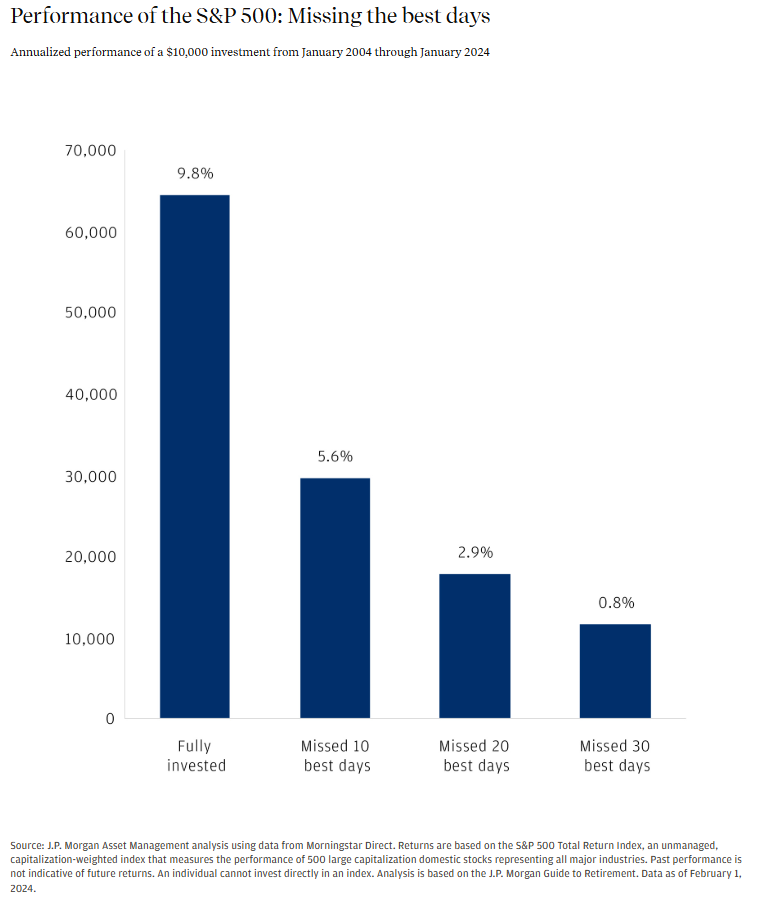

Trying to buy at the bottom and sell at the top—based on predictions—is a recipe for failure. Missing just a few of the best-performing days in the market can significantly reduce your returns. The chart below shows the impact on returns from missing only 10, 20, and 30 days over a two-decade period.

Consistency Beats Forecasting

Rather than reacting to predictions, consistent contributions and a disciplined strategy lead to better outcomes. Strategies like dollar-cost averaging and diversification remove the guesswork from investing.

How to Tune Out Predictions

Focus on Your Goals

Align your investment strategy with your financial goals, risk tolerance, and time horizon. This personalized plan should guide your decisions—not what a pundit says will happen next quarter.

Adopt a Long-Term Perspective

Short-term predictions matter little when your investment horizon spans decades. Focus on the power of compounding, knowing that markets historically trend upward.

Diversify and Stay Invested

A diversified portfolio spreads risk and reduces the need to rely on market timing or predictions. Staying invested ensures you benefit from the market’s long-term growth. Our team has written extensively on the importance of alternative investments that diversify risks while still potentially earning attractive returns.

Trust the Process

Successful investing isn’t about predicting the future; it’s about having a plan, sticking to it, and avoiding emotional reactions to market noise.

The Bottom Line

Stock market predictions may be entertaining, but they’re not a reliable guide for making investment decisions. Ignoring the noise, staying focused on your long-term goals, and trusting in the resilience of the markets is the best course of action.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).