Over the past two months, there has been no shortage of articles, interviews, and headlines discussing inflation. This is because several notable economic reports tracking the prices of goods and services in the United States have seen price movements not observed in decades.

On June 10th, a Wall Street Journal headline read “Inflation Rate Hits Nearly 13-Year High,” after the Bureau of Labor Statistics released its May inflation report. In that report, it was noted that the inflation rate “surged” 5% in May from the same period last year, while the core index (which excludes food and energy prices) rose 3.8%. This is the highest core index reading since June of 1992.

At time of publication, the June inflation report showed nearly the same year-over-year increase as published for May, while the core reading increased to 4.5%.

Understandably, many investors want to better understand what all this means, but media coverage can make the topic seem daunting. We find a good way to analyze this type of information is to ask questions and do some additional homework. Below is a framework we use to help provide additional perspective when confronted with an issue like inflation.

- What is inflation?

- Is it good or bad?

- Most importantly, what does this mean for my investments and long-term plan?

I’ll address each question in the segments below.

What is inflation?

Inflation simply means a state of positive price change. There are many reasons for rising prices, but most boil down to the balance of economic supply and demand. When the demand for goods and services outpaces supply, prices generally rise; conversely, when the demand for goods and services lags behind supply, prices generally fall.

One textbook example of this relationship has been lumber prices. A recent Bloomberg article stated, “Lumber, which at one point was among the world’s best-performing commodities as the pandemic sent construction demand soaring and stoked fears of inflation, has officially wiped out all of its staggering gains for the year.” Prices had skyrocketed amid the surging demand for lumber products. As this was happening supply increased in response to these earlier gains. However, demand has now fallen to a level that does not support such high prices, which is why lumber prices have fallen so precipitously.

Is inflation good or bad?

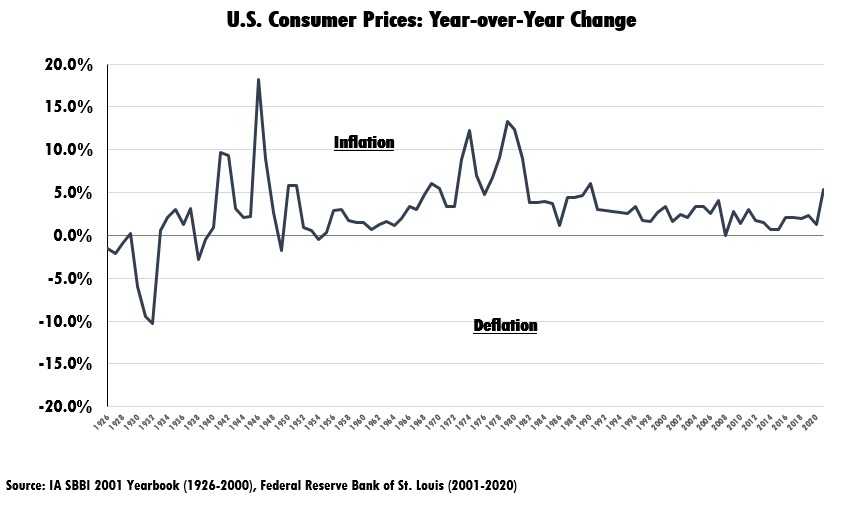

With all of this said, it’s important to note that this phenomenon is not new, and the year-over-year change in U.S. consumer prices is typically positive. And an annual increase in prices at a moderate pace can be a good thing. On average, consumer prices have increased by roughly +2.9% per year from 1926-2020.[1] However, today’s readings have been well above the historical average, which many people fear is not a good thing. For example, the May and June consumer price increases were approximately 5%, respectively.

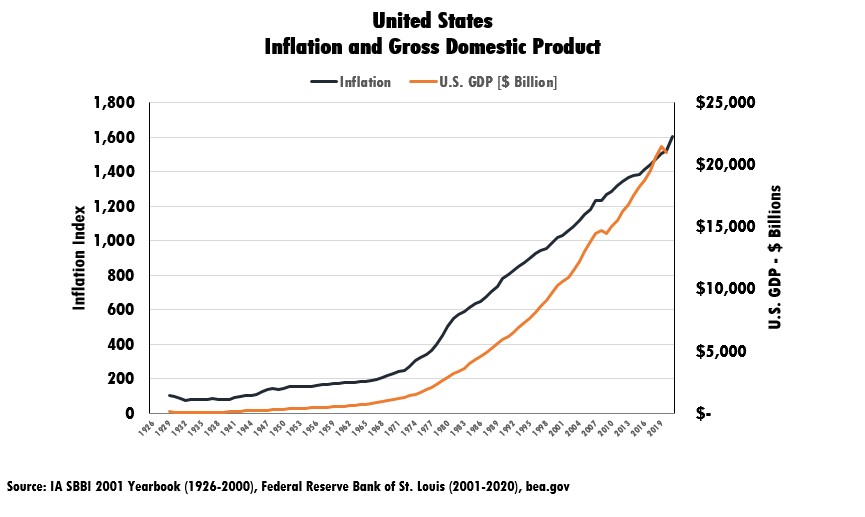

The next chart compares the trend in consumer prices (left side) to the trend in U.S. economic growth (right side), as measured by U.S. Gross Domestic Product — a widely-used measure of U.S. economic health. As you can see, from 1929 to 2020, positive price changes for goods and services have coincided with positive changes in the level of Gross Domestic Product. We’ve shared a lot of data, but here’s the key takeaway: the long-term data indicates that inflation has generally been a reflection of a growing economy, so naturally, these pieces should fit together.

Although there have been, and will continue to be, periods of rapidly rising prices, we expect that prudent monetary and fiscal policy decisions will balance the scales long-term.

What does all this mean for my investments and long-term plan?

So, if U.S. prices for goods and services are generally rising every year, what is the impact on an individual, including their long-term investment and planning strategy?

Rising prices generally make it costlier to live our life and satisfy our needs. Whether it is utility bills, grocery prices, tuition costs, health care needs, gas for our cars, home construction, remodeling, or Amazon deliveries… rising prices have a meaningful impact. Simply put, inflation reduces our “purchasing power.”

In an effort to mitigate this impact, a minimum requirement for most investors is to establish a baseline return objective that accounts for the impact of inflation. In fact, when working with our clients, we integrate inflation into the planning and investment process so that it’s accounted for. The difficult part today is that traditional bond market segments do not offer a lot of protection against the prospect of sustained inflation. Therefore, we are doing a lot of education and coaching on the trade-offs between allocations to stock, bonds, and alternatives.

While we think traditional bond market segments still make sense from a diversification perspective, other segments such as non-traditional bonds, stocks, and alternatives are likely to play an important role in helping our clients stay the course in achieving their long-term goals and objectives.

The road ahead

Though we don’t know with certainty how long the current inflation situation will persist, we do know that having a long-term savings and investment program that keeps pace with inflation is important. Whether sustained inflation mirrors the higher levels of the 1970s or falls back below the historical average, as has been the case the last 12.5 years, we will continue to actively engage in discussions with our clients about the benefits and drawbacks of building investment portfolios using a combination of stocks, bonds, and alternatives.

Two phrases you may have heard before are: 1) the only thing that is certain is uncertainty, and 2) this too shall pass.

Today, investors must carefully weigh the trade-offs between bonds and stocks when constructing a portfolio to meet their long-term objectives. Because alternatives share qualities of both stocks and bonds, we find it can be an effective “all-weather” solution to navigating uncertain periods, which is how we would classify today and the all the years ahead. If you have any additional questions about inflation and how we’re using different investment strategies to build customized portfolio solutions, don’t hesitate to connect with your SWP team. We are always happy to help.

[1] IA SBBI 2001 Yearbook (1926-2000), Federal Reserve Bank of St. Louis (2001-2020).