Investing is not supposed to be easy. If it was, I might not have a job (or at least this job). Undoubtedly though, this summer was as confusing as ever. The stock market reversed course when we didn’t quite expect it, the retail industry went from struggling to get goods on the shelves to looming price cuts to clear out inventory, and mortgage rates started fluctuating like the latest cryptocurrency.

Rather than becoming discouraged by the often counterintuitive nature of the financial markets, I’m going to stay positive – just like my wife always reminds me to do! I feel fortunate to have made it through this challenging period, having learned a few new things about the markets and the economy.

As we pass Labor Day, I want to share lessons from the summer that I will not forget anytime soon…

In the short-term, relative data can be more important for the stock market than absolute data

Some of the economic and corporate data from this summer was objectively bad. Take inflation, for example. On August 10th, the CPI reading came in at 8.5%. This means that consumer prices were higher by 8.5% from a year earlier. On the same day, the stock market, as measured by the S&P 500, was up 2.1%. This is not a typo. On a day when inflation was reported to be about as high as it’s been in over 40 years, the stock market was up over 2%.[1]

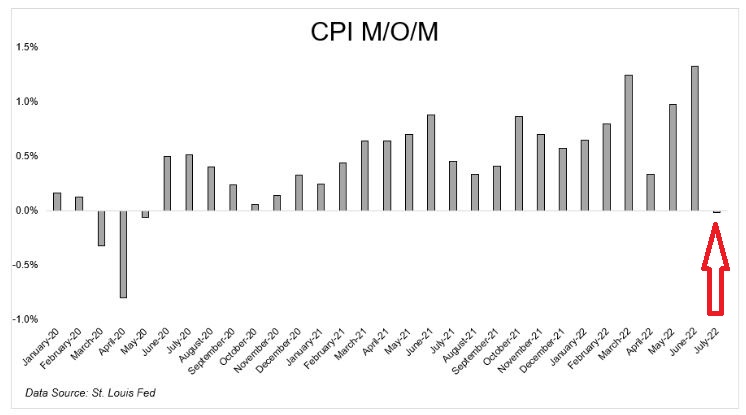

Why was the market up? Well, this was the first time since early 2020 that inflation dropped month-over-month. The chart below shows the month over month increase or decrease in inflation dating back to the beginning of 2020. The red arrow on the right-hand side shows that there was actually a slight decline in inflation from June 2022 to July 2022.

So, we have a situation where the absolute number was very high and therefore very bad, but on a relative basis, the month-over-month number was encouraging. And stocks reacted accordingly.

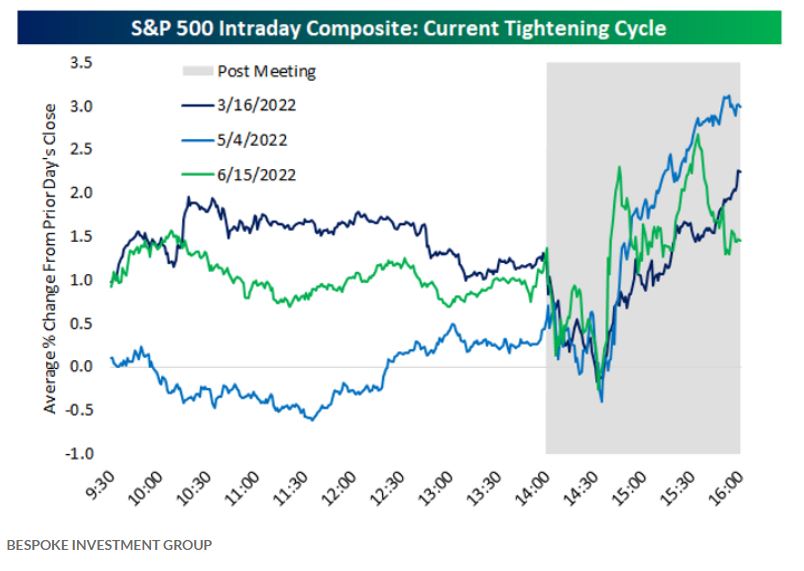

This absolute versus relative data paradox also played out over the summer as the Federal Reserve (“Fed”) continued to hike interest rates. While the S&P 500 has declined since the Fed began raising rates, the index was up at least 1.5% during the trading sessions after the March, May, and June announcements. The Fed announces rate changes at 2pm EST, which is shown in the shaded area of the chart below:

The Fed is raising rates due to their concern about inflation, and everyone is worried that higher rates may push us into a recession. But the market has been positive after each of these rate announcement hikes because on a relative basis, the size of the hike could have been larger.

Speaking of the Fed….

It is impossible to predict what the Federal Reserve is going to do, even if you are an “expert”

I do not know what the next policy steps will be for the Fed, you do not know, and quite frankly, nobody knows. Not even the so-call pundits know what is next. Case in point, here are three quotes from reputable Wall Street analysts[2]:

- Goldman Sachs Chief Economist – Jan Hatzius: “I think he will lay out a case… for slowing the pace of increases….”

- BMO Capital Markets Rates Strategist – Ian Lyngen: “It’s safe to assume one of Powell’s objectives will be to communicate that the… hiking cycle isn’t nearing its end…”

- J.P. Morgan Chief Global Markets Strategist Marko Kolanovic: “In Chair Powell’s remarks… we believe he will push back against the idea that a dovish policy pivot is coming soon.”

A great thing about these quotes is that they came out just one day before Fed Chair Jerome Powell’s speech from Jackson Hole. It is not like the analysts are trying to predict something six months out…we are talking about one day! As it turned out, Powell warned of ‘some pain’ ahead and talked about the Fed’s continued focus on bringing down inflation.[3]

While I have always thought that the stock market reaction to a Fed policy decision is impossible to predict, I have long felt that there should be consensus around the actual policy itself. Based on the inconsistencies of Wall Street’s expectations of future Fed policy, I’ve learned that even the most clued-in professionals do not know where we go from here.

Bad bond returns feel worse than bad stock returns

Through the end of August, the S&P 500 was down 16% for the year. Virtually all of our portfolios have lost value, and this decline is frustrating. But, periods of decline are what we expect from investing in stocks. Dating back to 1980, the annualized return on the S&P 500 is greater than 10% per year, but during this time, the average intra-year stock market decline is 14%[4]. In other words, on average, the stock market has one 14% drop per year. Nobody said making money in the stock market was going to be easy, but we have come to expect volatility, and if the stock market does not eventually recover, it will be the first time.

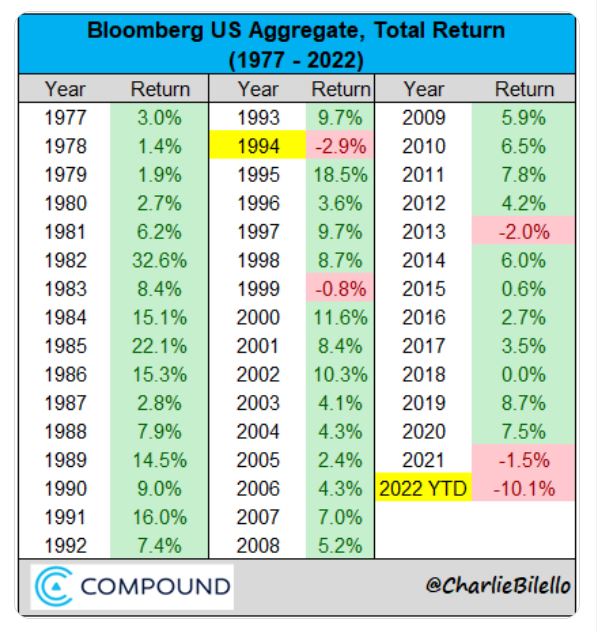

The bond market is also down this year. In fact, the bond market is down substantially more this year than any year since we’ve had a bond index:

This table shows that the year-to-date bond return of -10.1% (through 8/22) is over three times worse than 1994, which was the previous worst year for bonds.[5] Moreover, there have only been five years of negative bond returns, dating back to the inception of the Bloomberg US Aggregate Bond Index.

Even though the bond market is technically down less than the stock market this year, after going through this information with countless clients, I have learned that negative bond returns actually feel worse to many people than negative stock returns.

Losing money in bonds is painful because we are all used to bonds buffering stock market losses I’ll save the discussion on long-term correlations of asset classes for another day.

Many investors rely on their bonds for short-term needs, and it has been hard to see values decline. Stocks, on the other hand, are typically held for longer-term growth, and the periodic drops are easier to take in stride. Therefore, I’m finding that bad bond returns just feel worse.

When you convince yourself prices must keep going up, they’ll go down

There was a certain point earlier this summer where I was convinced gas prices had no ceiling. The war in Ukraine continued to threaten Russian oil exports, domestic production was slow to reach pre-pandemic levels, and people seemed to have an insatiable appetite for travel.

But then this happened….

I honestly can’t believe this chart. Gas prices remain elevated but have effectively gone down every day for the past 2.5 months. I really thought that gas prices were going to $6, $7, or $8 per gallon.

This may have been a situation where high prices cure high prices. Whatever the reason is, it doesn’t seem very intuitive to me. All of the global macro and domestic economic factors had me convinced that I’d be paying a cool $150 to fill up my tank by Labor Day.

But I’ve learned a lesson. Prices won’t go up forever.

Closing thoughts

I love working in an industry where there are endless lessons to learn. As confusing as things get, it is important that we don’t get discouraged and we stick with our investment plan. I did not change course for any clients this summer because of what was happening in the market. Quite honestly, everything I learned this summer gave me even more confidence in one of my foundational wealth management beliefs – investments should be made based on our respective situations and not our expectation guess of what the market may do.

If you’d like to discuss any of the concepts covered above, or if you’d like to share what lessons you learned this summer, please do not hesitate to connect with our team.

[1] The Irrelevant Investor, What Moves Markets? (Link)

[2] Seeking Alpha, Big Wagers on What to Expect During Powell’s Speech at Jackson Hole (Link)

[3] CNBC, Powell warns of ‘some pain’ ahead as the Fed fights to bring down inflation (Link)

[4] JP Morgan, Guide to the Markets (Link)

[5] Charlie Bilello, Twitter (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).