I was talking with an acquaintance at a social gathering recently. Small talk over drinks on a Saturday evening. The question “What do you do for a living?” inevitably surfaced, and when I told him I worked in wealth management, he was curious about my assessment of the markets and predictions for 2025.

My canned response to this question always starts with a friendly chuckle before explaining that my crystal ball is cloudy and no one can accurately and consistently predict short-term outcomes. He then told me about a few individual stocks in his portfolio and how he’s diversified across domestic, international, large, mid, and small companies. His follow-up comment struck me: “Given that, I own the broader economy,” and that became the catalyst for this article.

On the surface, it’s logical that owning a diversified basket of public stocks (individual companies and/or indexes) is reflective of the broader economy, but the data doesn’t support it. In 1996, roughly 8,000 companies were listed in the U.S. stock market. Today, that number is fewer than 4,000.[1] Despite all the economic growth over the last (nearly) three decades, the number of publicly listed companies has been halved. Effectively, as the economy has grown, public markets have become increasingly concentrated in fewer and larger companies, meaning the stock market is less reflective of the broader economy. Consider this: only 13% of U.S. companies with $100mm+ annual revenue are publicly traded.[2] The other 87% are privately held – that’s nearly 7x private to public companies!

As a result, isn’t my acquaintance missing a massive chunk of the U.S. economy?

How do we invest in these privately held businesses? Enter private equity (PE).

Whether you realize it or not, many of the goods, services, and products you regularly consume are PE-backed companies. Picking up dog or cat food at PetSmart? It’s PE-backed. Grabbing Panera Bread or Portillio’s on the way home? Both are PE-backed. Booking your next annual physical or dental cleaning? These businesses are increasingly PE-backed. Given the 87% data point above, it makes sense that PE is literally all around us.

What is PE?

In short, investing in private equity is similar to investing in public companies, like Apple or Google, but instead of seeing the share price valued five days a week on a public exchange like NYSE or NASDAQ for buyers and sellers to transact, investors are financing privately held businesses in return for an ownership stake and future growth. PE invests in a wide range of industries and businesses, from startups to mature enterprises. Below are the most common categories of PE investing.

- Venture Capital (VC) provides access to ownership in small early-stage companies with attractive long-term growth prospects. Of these categories, VC offers the most upside, but also the most risk and it usually takes the longest duration to achieve the desired appreciation. At the risk of oversimplification and splitting hairs between VC and “angel investors,” think Shark Tank, the popular reality TV series that premiered in 2009.

- Leveraged Buyouts (LBOs) are the largest and most common category of PE. In fact, they accounted for 66% of all PE deals in 2021.[3] LBOs apply debt or “leverage” to purchase mature companies with the goal of increasing efficiency and profitability for eventual resale and return on investment. They generally have an attractive risk-return profile and shorter duration than VC or growth equity.

- Growth Equity is the hybrid of VC and LBOs. This strategy invests in proven companies in need of capital to fund additional expansion. These businesses were often “bootstrapped” by the founders but now need institutional ownership and a capital infusion to take them to the next level.

With all that as necessary background, is PE new? Hardly. While PE carries a certain mystique and has become in vogue, it dates to WWII when the first VC firm was established to provide capital to private businesses operated by soldiers returning from war. Furthermore, the first LBO was completed in 1955, and the first PE fund – still in existence today – was launched in 1960. Still, there was limited awareness and understanding of this niche industry through the 1970s, with the first PE boom occurring in the 1980s.

Why invest in PE?

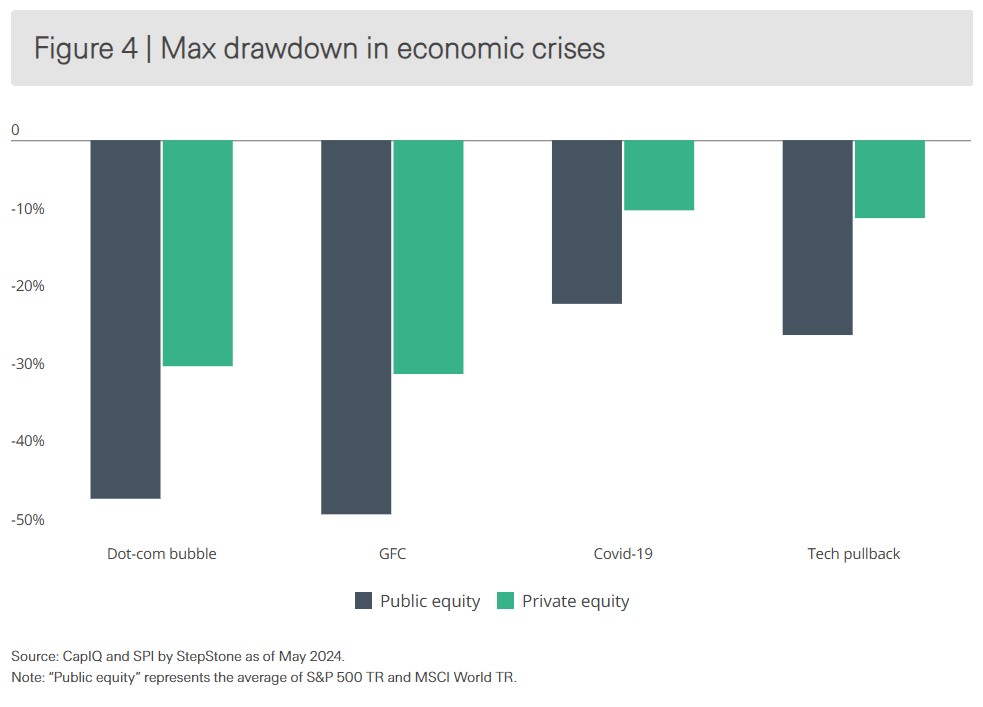

PE has historically delivered strong results, surpassing returns in public markets over the past four decades.[4] Additionally, PE has demonstrated resilience during economic declines by preserving capital more effectively than public markets.[5] Human behavior and psychology undoubtedly play a role. Unlike public markets, where the value of a company is posted daily and influenced by emotions and headline news, PE doesn’t have those same instant reaction pressures. As an example, Nvidia (NVDA) dropped nearly 17% in a single day recently on the news and speculation about Chinese AI startup DeepSeek’s R1 LLM model. The next day, the stock rallied nearly 9%. That’s the kind of volatility, based on emotion and conjecture, that public markets endure. Private equity largely avoids that and instead takes a longer-term view that isn’t judged by daily news or the next quarterly earnings report.

None of this is to say public markets are bad. The S&P 500 has averaged over 10% annually going back to the 1950s.[6] However, there are diversification benefits to adding PE to a portfolio for exposure to both public and private companies.

Source of chart: 1,000 words or less: Introduction to private equity – StepStone Group

Institutions (i.e., sovereign wealth funds, pensions, foundations, endowments, family offices, etc.), often viewed among the most shrewd and sophisticated investors, have long valued PE for its access to these successful but relatively unknown private companies. A recent report capturing target allocations for these institutions showed they generally hold anywhere from 28-38% of their total portfolio in private assets, which includes PE.[7]

As the alternatives industry continues to innovate and evolve, PE investments are becoming more accessible for individual investors. With that in mind, let’s explore the various structures of PE investments.

PE Structures:

- Primary Funds are blind pools of capital where an investor (limited partner of LP) commits capital before the manager (general partner or GP) has identified specific underlying investments. Upon the GP finding an attractive investment, they call capital from LPs and continue the process until the fund is fully invested. The invested capital is held anywhere from five to twelve years (depending on a variety of factors).

- Co-investments allow access to invest alongside a GP, often with favorable economics in the form of “no management fee, no carry basis.” As the name suggests, these investments are not the primary investments and are usually relatively small in scale, involving large institutional investors. These investments require specialized teams to execute deals and tend to move quickly.

- Secondaries offer the ability to acquire a stake in an individual company or primary fund, often at a discount, and usually occur later in the lifecycle when cashflows are trending upwards. A simple example is CalPERS, California Public Employees’ Retirement System, which owns a successful investment but needs to trim per its strict investment policy statement. As such, they might offer a piece of their investment to a PE fund at 95 cents on the dollar giving them liquidity while maintaining a majority piece of a good investment.

- Evergreen funds provide an efficient and convenient way to access PE. Per its namesake, this structure draws and deploys investors’ capital continually, which mitigates challenges of other vehicles, such as investment minimums, vintage risk, liquidity, and complex taxation. It also relieves some headaches for managers, given the perpetual pool of capital vs. the need to raise capital on a fund-by-fund basis.

PE is complex, and this primer just scratched the surface. Part of our role as advisors and fiduciaries is to educate clients and provide access to unique investment opportunities. While there is no such thing as a perfect investment (including PE), we hope this piece helped simplify an unknown and/or misunderstood strategy.

As with any investment, it’s important to assess your objectives, time horizon, risk tolerance, and liquidity needs. If you’re interested in learning more about the PE investments we have access to and recommend, please contact your advisor.

[1] Nicole Goodkind, “America has lost half its public companies since the 1990s. Here’s why.” CNN, June 9, 2023. 1,000 words or less: Introduction to private equity – StepStone Group

[2] Capital IQ (February 2023/Most Recent Available Data). Note: 87% represents private US companies with >$100M in revenue.

[3] PitchBook, What is Private Equity and How Does it Work? 6/25/24 What is private equity and how does it work? – PitchBook

[4] Source: SPI by StepStone, as of March 31, 2024. Includes all funds going back to 1970 through 2024.

[5] Source: CapIQ and SPI by StepStone as of May 2024.

[6] S&P 500 Average Returns and Historical Performance

[7] Preqin Global Report 2022, Hodes Weill & Associates: Institutional Real Estate Allocations Monitor and UBS Global Family Office Report 2022/Most Recent Available Data. From StepStone’s investor deck.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).