I recently “met” – via Zoom, of course – with a prospective client, let’s call her Mary. It was a pretty typical meeting. I got to know Mary personally, learned about her financial situation, and described how we work with clients. Towards the end of our conversation, Mary said, in a sheepish tone, “Tom, I have to be honest, I’m not going to look at the portfolio very often. Is that bad?”

I immediately smiled and responded, “No, not at all. You’re hardly alone, and it’s actually quite healthy.”

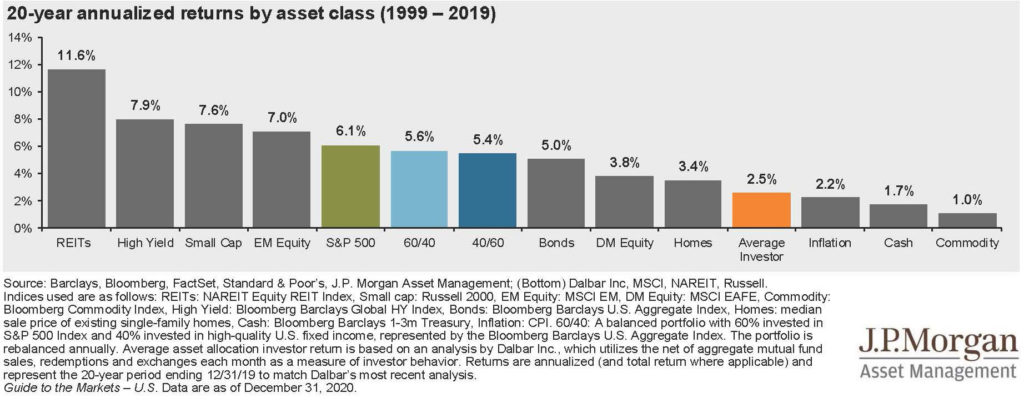

This is a wonderful reminder highlighting the importance of investor behavior. Financial publications, media outlets, and the unbashful know-it-all at the cocktail party obsess over investor “skill” and beating benchmarks. [There’s an argument that luck is often disguised as a skill, but that’s a different topic for a different day.]

Sure, in a perfect world, consistently beating benchmarks sounds great – sign me up! But in reality, here is the blunt truth: very few investors will consistently outperform benchmarks over the long-term. Why? Mostly because of poor investor behavior.

The best-designed financial plan and portfolio won’t overcome “investor misbehavior” or not sticking with the plan. This is exactly why there is a meaningful gap between investment returns and investor returns:

Investment returns are featured in marketing materials and are based on the assumption that an individual invests a lump sum at the beginning of the period and leaves it alone – classic buy and hold. Investor returns measure an individual’s real-life experience, accounting for changes from one investment to another, typically driven by emotions.

Essentially, benchmarks have a major psychological and behavioral advantage over humans – they don’t have emotions.

Consider the recent example provided by the S&P 500. For the calendar year 2020, the index finished the year up over 18% (total return with dividends). But in late spring, the index was down about 34% from its February-peak. Gross, nobody wants that.

Things must be bad; let’s sell, right? Wrong.

From that point, the market rallied 68% to finish the year…in spite of the mountain of challenges and avalanche of continuous bad news about COVID and the economy. So, the well-behaved investor who had a plan and stuck with it finished the year up over 18%, in-line with the index. But what about the investor who sold when things “looked” ugly and then reentered when things “felt” better? Their results were significantly worse. Unfortunately, the market has endless history lessons similar to 2020.

In no way am I advocating that you should stick your head in the sand and not be involved or educated on your investments. I strongly believe knowledge is power. However, I think it’s also beneficial to acknowledge the emotional hurdles and roadblocks that prevent investors from reaping the full potential of a well-designed financial plan and portfolio.

Years ago, I heard an analogy that stuck with me about planting a tree and investing. Much like a well-designed financial plan, you give time and thought to where you’ll plant the tree, the care it will require, how it will grow over time, and the eventual shade it will provide. Storms and bad weather, much like volatility in the markets and economy, are unavoidable. Surely, we wouldn’t dig-up our newly planted tree after a bad storm to check the health of its roots. Shouldn’t we take the same approach to our investments?

Set a plan and stick with it; stop digging up your tree.

Of course, the plan may change as life happens and circumstances evolve – we need those adaptive levers at our disposal. Think of this as landscaping and maintenance for your tree. But the plan should not change based on your emotions – that’s bad investor behavior.

I’m reminded of the quote that Matthew McConaughey’s character delivered in The Wolf of Wall Street; “OK, the first rule of Wall Street – nobody – and I don’t care if you’re Warren Buffett or Jimmy Buffet – nobody knows if a stock is going up, down, or sideways.” Sadly, this is true. I have no idea when the next market correction is coming, what will trigger it, how long it will last, etc. But I do know this – the next time the market doesn’t eventually bounce back and provide long-term growth will be the first time. Given that, I will use history as a guide and commit to good investor behavior. At Strategic Wealth Partners, we encourage all our clients to do the same.