As you are likely aware, ongoing volatility and rising interest rates made 2022 a very challenging year in the capital markets. We believe that this past year has highlighted the need for advisors to explore investment opportunities that exist beyond the traditional stock and bond markets.

The private markets are one such opportunity set. In this article, we discuss what the private markets are, how these investments may fit into a diversified portfolio, and how we use them.

What are the private markets?

The “private market” describes assets that are not traded on a public exchange. Examples of these assets include, but are not limited to, investments in the debt or equity of privately held companies as well as investments in privately held real estate. These private investments contrast with publicly traded securities that trade on exchanges like the New York Stock Exchange or NASDAQ.

While the majority of financial headlines are focused on what is happening in the public markets, the private markets have become a much larger component of the U.S. economy during the last 25 years: in 1998 (near the peak of the dot com bubble), there were 7,905 publicly-traded companies, but by 2019 that number had fallen to 4,266.[1] Meanwhile, between 2000 and 2019, private equity net asset value grew more than sevenfold, which is twice as fast as the growth of public market capitalization.[2]

Driving this trend is the fact that many companies are choosing to stay privately held for longer. For many companies, the decision to stay private involves a blend of factors, including the cost of going and being public and the growing availability of private funding.

- The cost of going public: taking a company public means incurring a significant amount of underwriters’ fees, which can range from 3.5% to 7% of gross IPO proceeds.[3]

- The cost of being public: public companies have significant regulatory costs that private companies do not have.

- Growing access to private funding: the key benefit of an IPO is raising capital and liquidity. But companies have more access to capital and liquidity through private investors and venture capital firms than ever before, which can make an IPO less attractive from a management perspective.[4]

This is all to say, because private companies make up a larger portion of the U.S. economy, it’s critical to consider allocating to private investments when constructing a modern, diversified investment portfolio.

Why we sometimes use private market investment in client portfolios

Private market investments may offer the potential for better returns than public markets – partially due to their illiquidity. Investments in private assets are less liquid than investments in publicly traded ones and, therefore, investors demand a higher return on their capital when investing in the private markets relative to the public markets. This higher return potential is known as the “illiquidity premium.” Private investments may also provide higher returns because they can offer access to investments that are unavailable in public markets – for example, some private markets are too small to be registered, and thus, investors cannot access them in the public markets.

Additionally, some areas of the private markets offer exposures that are unavailable or difficult to find in the public markets. For example, some areas of the private credit market can offer valuable protection against inflation. Interest rates on middle market lending typically have a floating rate which means the rate fluctuates based on Fed policy. So, when rates rise, investors may receive a higher coupon payment on private credit placements. This compares to most public debt, where rates are fixed, such as bonds or bond funds, which could provide a lower total return in rising interest rate environments.

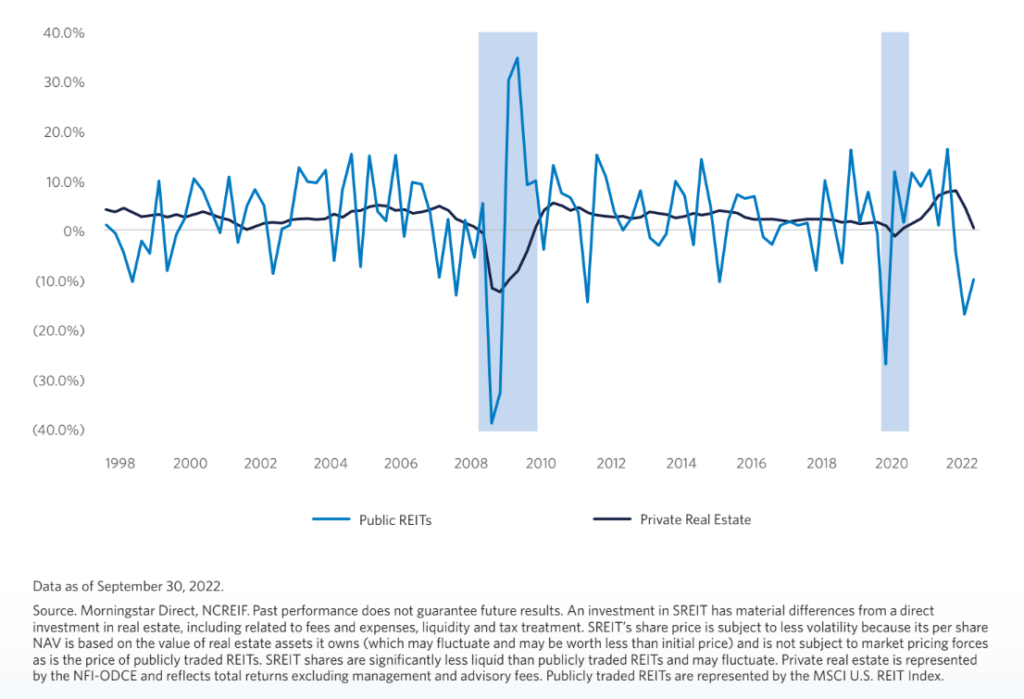

Lastly, an attribute of private market investments that we find appealing is that they can be an effective tool to reduce volatility. Private market investments are valued formulaically, so their price is less subject to the ebbs and flows of investor sentiment than their public market counterparts. Investor emotion can cause dislocations between an asset’s price and the value of the asset.

For all the above reasons, the “ride” for the investor can be significantly smoothed, as evidenced by the chart below showing the performance of a private real estate [5] relative to its public market counterparts.

Drawbacks to consider

While the private markets do have many benefits, there are potential drawbacks that should be considered. Along with it generally being more expensive to access the private markets, private companies are not bound by the same financial disclosure requirements as public companies, which can mean that investors have less transparency into the performance of the private companies in which they are invested.

Additionally, many private investments have liquidity constraints that define when capital may be redeemed from the investment. This compares to publicly traded investments which can be bought or sold daily.

Lastly, some private investments generate K-1 tax statements, which can create complexity from a tax reporting perspective. K-1s are typically not delivered by April 15th; rather, they are generated later in the year. As a result, some investors will need to file an extension with the IRS each year while they wait for their K-1s to be delivered.

At SWP, we carefully consider these factors when exploring whether private investments make sense for a client’s portfolio.

How we invest in the private markets

We typically access the private markets in two different ways for our clients. One way is through limited partnerships which are investment vehicles created to invest in private assets; another way is through interval funds: mutual funds that can be purchased daily and sold on a quarterly basis (there may be limits on how much can be sold quarterly). Interval funds offer many of the benefits of limited partnerships in an easy-to-access way.

Importantly, the way we utilize private markets varies greatly based on the unique needs of each individual client. Private market investments are sometimes part of our allocation to alternative investments, which depending on an investor’s situation, may or may not be appropriate. More about our views on alternative investments can be found in this article written by our founder, David Copeland.

The right path for you will depend on your unique investment objectives, tolerance for market risk, and liquidity needs. If you would like to learn more about private markets and the role they can play in your overall investment strategy, we invite you to connect with our team.

[1] The World Bank, Listed domestic companies, total – United States. (Link)

[2] McKinsey, Private markets come of age. (Link)

[3] PWC, Considering an IPO? First, understand the costs. (Link)

[4] NASDAQ, As Companies Stay Private Longer, Advisors Need Access to Private Markets. (Link)

[5] Starwood Real Estate Income Trust, October 2022 Update

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).