In the world of financial planning, the federal estate tax tends to get a lot of press, but what often surprises some clients (and will impact more of them) is that states themselves also have their own estate or inheritance taxes. For clarity, an estate tax is levied and paid by the estate of the deceased, while an inheritance tax is paid by the heirs receiving the inherited property (with spouses generally exempt).

Currently, 12 states and Washington, D.C., have an estate tax, while 6 states have an inheritance tax. Maryland is the only state that has both.[1] While we work with clients from all over the country, a good amount of our clients live and work in Illinois and as such we are going to take a closer look at the Illinois estate tax and 4 key features of how it works.

Before proceeding, please note that this article is for educational purposes only and should not be treated as legal or tax advice. The information below is not a substitute for specific legal or tax advice from your own professional advisor.

1. $4 Million Exemption Per Person with No Portability

Illinois has an estate tax exemption of $4 million per person, meaning that if you pass away with an estate valued at $4 million or less (this includes real estate, investment and retirement accounts, business interests etc.) generally speaking, you will not be subject to Illinois estate taxes. But if your estate exceeds $4 million, you are then subject to the Illinois estate tax.

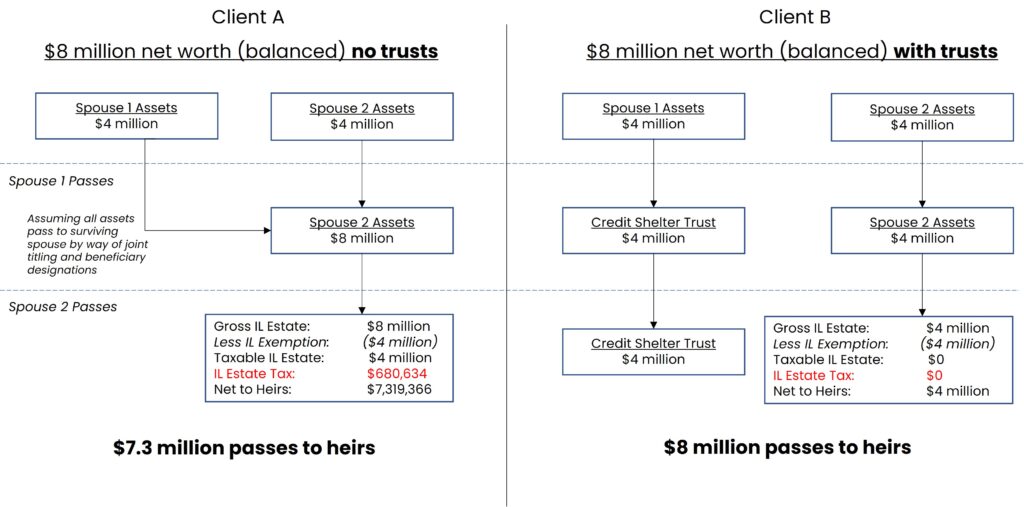

What is important to understand is that unlike the federal estate exemption, which is ‘portable’ between spouses (meaning that a surviving spouse can use a deceased spouse’s unused exemption (DSUE) in addition to their own to reduce their federal estate tax exposure), the Illinois exemption is not portable between spouses, presenting a ‘use-it or lose-it’ situation. The following flow charts will help illustrate how the lack of portability can impact a married couple with an $8 million net worth:

The main takeaway from the charts above is that clients should not only work to “equalize” their balance sheet between spouses but also look to incorporate credit shelter or “bypass” trusts as part of their estate plan. Clients A and B both have a net worth of $8 million. Client B, however, has trusts in place for both spouses so that when the first spouse passes, $4 million goes into a trust for the surviving spouse (using their Illinois estate tax exemption). This means the surviving spouse has $4 million in their own name, plus another $4 million in a credit shelter trust for their benefit. So, when the surviving spouse of Client B passes away, there’s no Illinois estate tax to pay on a total of $8 million. In contrast, Client A simply titled assets to all go directly to the surviving spouse, and on their passing, there would be a $680,634 Illinois estate tax on their respective $8 million.

There are other, more nuanced strategies to consider, so be sure to have your estate documents reviewed by your estate planning attorney to confirm they address Illinois estate taxes.

2. Regressive (Effective) Tax Rates

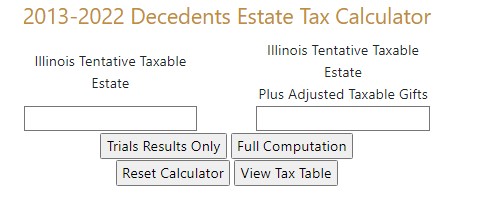

So, what is the Illinois estate tax rate? If you search online, you will likely see articles saying it is between 0.8% to 16%. This can be slightly misleading, as it can be perceived as a progressive tax rate. In reality, how the Illinois estate tax is actually calculated is through a complex, circular computation that requires the use of a calculator (available on the Illinois Attorney General website, found here) to run various trials to address the circularity.

But what is important to take away is that the Illinois estate tax is a regressive tax once calculated. Below is a table to help illustrate the regressive nature of the tax using the state’s calculator:

Table A:

Keep in mind that if your estate is sizable enough to where you are also subject to federal estate taxes, any Illinois estate tax paid can be used as a deduction for your federal taxable estate (which is taxed at 40%).

3. Prior Taxable Gifts are Added Back (up to a point)

While Illinois does not tax gifts made during your lifetime, the Illinois estate tax does take into account a certain amount of those taxable gifts that were made in excess of the annual exclusion amount ($18,000 in 2024 and filed on your federal 709 gift tax return). And this is again where the calculator is important with the second box titled, “Illinois Tentative Estate Plus Adjusted Taxable Gifts”.

Say, for example, you are single and pass away with a $2 million taxable estate, and you gave away $3 million in taxable gifts (so using the online calculator, box 1 is $2 million and box 2 is $5 million and click “Full Computation”). Your taxable estate is under $4 million; you should be fine, right? Wrong. You will actually have an Illinois estate tax of $92,910. This is, again, a unique feature in how this complex tax is calculated.

Now, for comparison, I want to draw your attention to the tax Table A above and the taxable estate of $5 million, where the tax was $285,714. What you can take away from this is that it is more beneficial to make inter vivos gifts (gifts made while alive) vs. testamentary gifts (gifts made at death) under the Illinois estate tax law.

To get specific, gifts that bring the ‘tentative taxable estate” + “adjusted taxable gifts” within the $4,000,000 to $5,360,000 range are then factored into the Illinois estate tax calculation at the donor’s death. But once the estate and gifts exceed approx. $5,360,000, any excess gifts are entirely ignored! Let’s use that same $2 million estate but assume they gave away $8 million; the result is the same $92,910 Illinois estate tax (vs. $926,923 if they kept it in their $10 million taxable estate).

4. Non-Residents with Illinois Real Estate (and vice versa)

The easiest way to avoid Illinois estate taxes entirely is to move out of the state and establish residency in a state that does not have an estate tax (Florida being a common example). But if you still have Illinois property (real and tangible property physically located in Illinois), you are still exposed to the Illinois estate tax. And it is not just on the value of the property itself, but rather the Illinois estate tax is calculated on all property, with “the apportioned tax determined by multiplying the tax by the ratio of Illinois assets to total assets.”[2]

Here is a a quick example using a single person who is a Florida resident with a $5 million estate. Part of their estate includes a $1 million home in Illinois. Upon their passing, they will have an Illinois estate tax of $57,142 (the calculation is ($285,714 (tax on a $5 million estate) * 20% ($1 million / $5 million)) even though Florida does not have an estate tax.

The same formula applies in reverse if you are an Illinois resident with out-of-state property. Assume you are a single Illinois resident with a $5 million estate which includes a $1 million home in Florida; your Illinois estate tax would be $228,571 ($285,714 (tax on a $5 million estate) * 80% ($4 million / $5 million)).

A common technique for non-residents with Illinois property to mitigate the Illinois estate tax state issue is through the use of an LLC, turning a ‘tangible’ asset into an ‘intangible’ asset. But this strategy needs to be discussed in more detail with a qualified estate planning attorney.

Although the Illinois estate tax is complicated, there are some basic planning techniques that can help alleviate its impact thus leaving more to your heirs. Be sure to reach out to your estate planning attorney if you have any questions.

[1] Tax Foundation, Does Your State Have an Estate or Inheritance Tax? (Link)

[2] Illinois Attorney General, Important Notice Regarding Illinois Estate Tax and Fact Sheet (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).