At some point in your life, you may be faced with managing a large cash inflow. Selling a business, collecting a deferred compensation payout, and receiving an inheritance are a few of the most common reasons. Regardless of the source of this money, you will have to decide what to do with it.

It’s an age-old investing debate: should I invest the cash all at once, or stage into the market over time?

Over the last few years, I have helped dozens of retirement-age clients with these types of decisions, and there is rarely a correct answer. Emotions, performance considerations, and risk tolerance are all key factors, and none is more important than the others. It may be just as important for you to squeeze out some additional return as it would be for you to be able to sleep easier at night.

In this article, we will explore the mathematical realities of these two approaches, known as Lump Sum Investing (LSI) and Dollar Cost Averaging (DCA), and the emotional aspects of this decision.

Defining Dollar-Cost Averaging (DCA) and Lump Sum Investing (LSI)

Dollar-cost averaging (DCA) is an investment strategy where you consistently invest a fixed amount of money at regular intervals, regardless of market conditions. This approach spreads out your investments over time, potentially reducing the impact of market volatility on your portfolio. On the other hand, as the name suggests, lump sum investing (LSI) involves investing a large sum of money all at once into the market.

Which is better mathematically?

When comparing the mathematics involved in these two strategies, it’s important to recognize that timing matters. Of course, we cannot know in advance what will happen after we invest.

Intuitively, we expect someone who invests a lump sum right before the market begins a sharp upward move will do better than an investor who chooses DCA (although if uninvested cash is earning a high return, this may not be the case). Conversely, if the market drops right after the lump sum is invested, DCA will look better in hindsight.

The answer to this question also depends on who you ask — in other words, we need to know the specifics of how a given analysis of LSI vs. DCA is structured. Various studies say that lump-sum investing delivers higher returns than DCA anywhere from two-thirds to more than 75 percent of the time.[1]

But it’s important to note that these results depend on how the DCA is carried out – e.g., does it involve investing 1/12th of the total every month over a year versus every two months over two years? And after the lump sum or periodic investments occurred, were subsequent returns calculated for the next year, the next five years, or the next ten years? The historical period used in the analysis also matters. Comparing the returns that an investor would have earned using LSI versus DCA over the period from 1950 to 2022 would be different than a comparison that uses the period from 1990 to 2022.

For me, the most telling data may be a study from Vanguard which analyzed multiple 10-year periods between 1926 and 2011. In that study, lump sum investing comes out ahead during most periods. The average outperformance was 2.3% per year for the 10-year holding periods analyzed![2]

Which is better emotionally?

Because these two strategies provide inconsistent performance outcomes, the key factor, for me, is the emotional side of this equation.

Investing the entire sum in the market all at once usually feels riskier. Many people cannot (or do not want to) tolerate the risk of investing a large sum of money all at once. If it feels better to move gradually rather than jumping in, the incremental amount of return you might give up by DCA’ing may be well worth it if you sleep better following the decision.

Another benefit to DCA is that it imposes discipline and takes the emotion out of the investment decision. Investors with a large sum to invest may procrastinate or wait until it “feels” right – DCA helps us avoid that. This is especially true for investors that are investing the proceeds from a recent business sale or inheritances from their loved ones. These types of events make investors feel an innate sensitivity toward how these funds are deployed into the stock market.

What not to do

Whichever path you choose, remember these two important pieces of advice: don’t procrastinate, and don’t try to “buy the dip.”

Don’t procrastinate. Charles Schwab conducted a study that compared results for five hypothetical investors: (i) a perfect timer who always manages to buy at the market’s low for the year; (ii) a worst possible timer, who always buys at the high for the year; (iii) a lump-sum investor who invests the same amount the first day of every year; (iv) a gradual investor who uses DCA in 12 monthly installments each year, and (v) a procrastinator who keeps waiting for the market to decline and ends up keeping his money in T-bills.

Which investor had the best results? Understandably, the perfect timer had the highest (but unachievable in real life) return. But, the LSI and DCA approaches delivered roughly similar results. The procrastinator did the worst by far, worse even than the one who always invested at the worst possible time.[3]

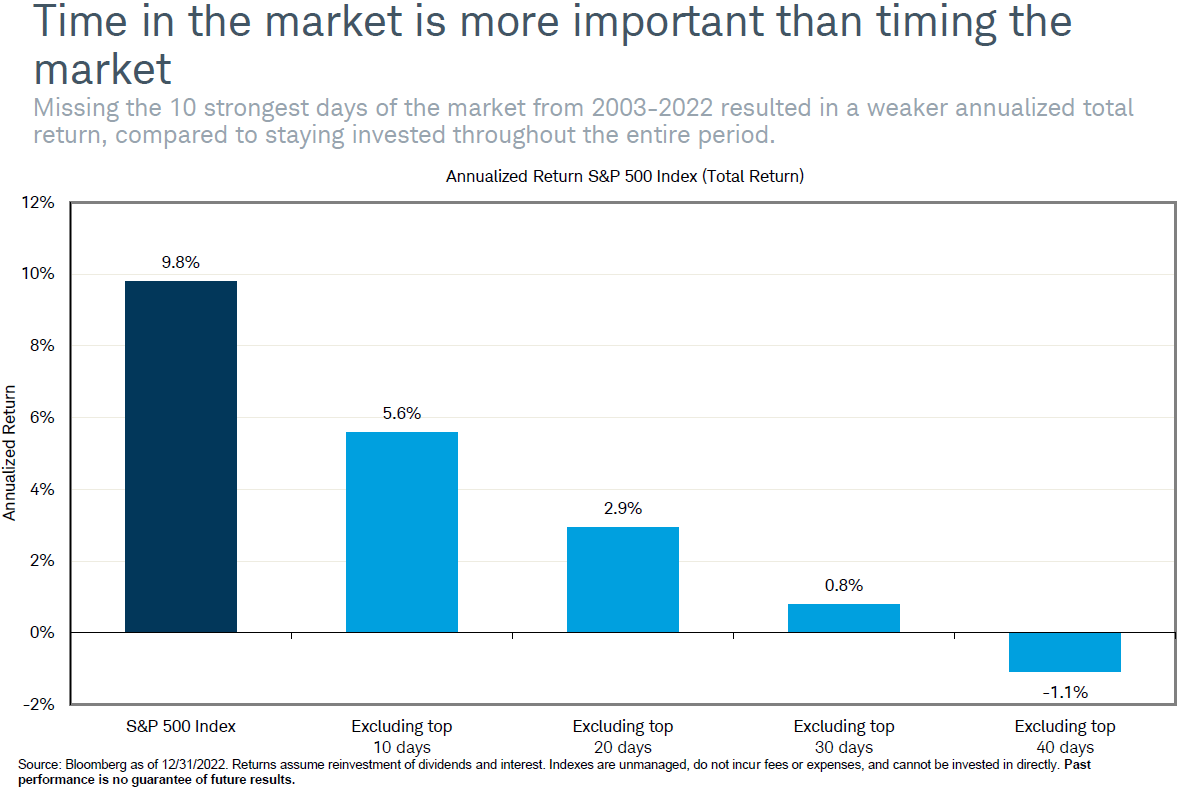

The second “don’t” is: don’t try to “buy the dip”. One form of procrastination we see often is the result of trying to “buy the dip,” which means putting money into the market only when it has declined below some threshold (e.g., down 3%) or when the timing “feels right.” When we attempt to “buy the dip” we run the risk of missing the markets best days, and as shown below, missing just the 10 best days of market performance over a 20-year period can dramatically reduce portfolio performance.[4]

The “right” choice is what’s best for you

There are advantages to both strategies. When you LSI, money is invested for a longer period of time (this gets back to the importance of “time in the market, not timing the market”) and may deliver better performance, although the difference is often small over long time horizons. When you DCA, you may find it is more comfortable, especially for more risk-averse investors. And, when short-term interest rates are fairly high (as they are now), uninvested cash is still earning a decent rate of return and is not subject to market volatility.

The bottom line: what matters most is investing and staying invested, not trying to time the market, and making sure your asset allocation (your mix of stock, bonds, cash, and alternatives) is consistent with your risk tolerance.

How we can help

At SWP, our focus is on helping you to invest wisely and thoughtfully, in a way that incorporates both objective information and subjective factors such as your risk tolerance. If you are either on the cusp of retirement and looking to invest your hard-earned cash, on the brink of selling a business, or looking to invest any other influx of cash, we invite you to connect with our team.

[1] Northwestern Mutual, Dollar-Cost Averaging vs. Lump-Sum Investing (link), among others.

[2] Vanguard, Dollar Cost Averaging Just Means Taking Risk Later (link)

[3] Charles Schwab, Does Market Timing Work? (link)

[4] Putnam Investments, Time, not timing, is the best way to capitalize on stock market gains (link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).