Investing takes nerve. There’s always a reason to “let things calm down,” “hold off for now,” “take profits,” or any other common quip we’ve all heard.

We do know that long-term, diversified investing leads to positive outcomes in almost every circumstance. Despite that, human nature leads us to make emotional choices affected by outside influences. There are times when these emotions seem especially heightened. This year promises to be one of those years.

Election years, especially presidential ones, are fraught with emotion, angst, fear, and all the other superlatives you can think of. It’s easy to allow this thinking to impact investment decision-making. Politics tend to skew people’s outlook on the future. According to a recent Nationwide poll, “Nearly one in three (32%) investors believe the economy will plunge into a recession within 12 months if the political party with which they least align gains more power in the 2024 federal elections.”1

With a looming election hanging over markets, in addition to the usual suspects that create investor nerves, what is the best course of action? What has historically happened to markets leading up to elections? What if one political party wins instead of the other? What about a unified vs. divided government? There are countless questions that arise from the uncertainty. Let’s look through some and see what history says.

Markets During Election Years

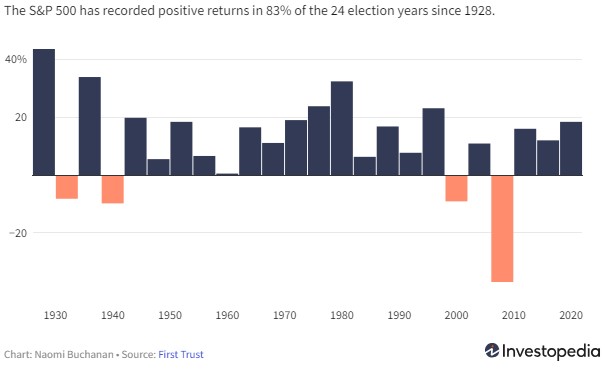

Some will adopt a wait and see approach to investing during election years. Why wade into choppy waters when you can just keep your money in cash and wait it out? This makes all the sense in the world on the surface. Unfortunately, evidence points to this strategy doing far more harm than good. As seen in the chart below, markets have provided positive returns in 83% of presidential election years since the Great Depression. Moreover, in the last 20 election years, markets have only been negative twice and those coincided with severe economic downturns in 2000 and 2008.

Chart source: Investopedia

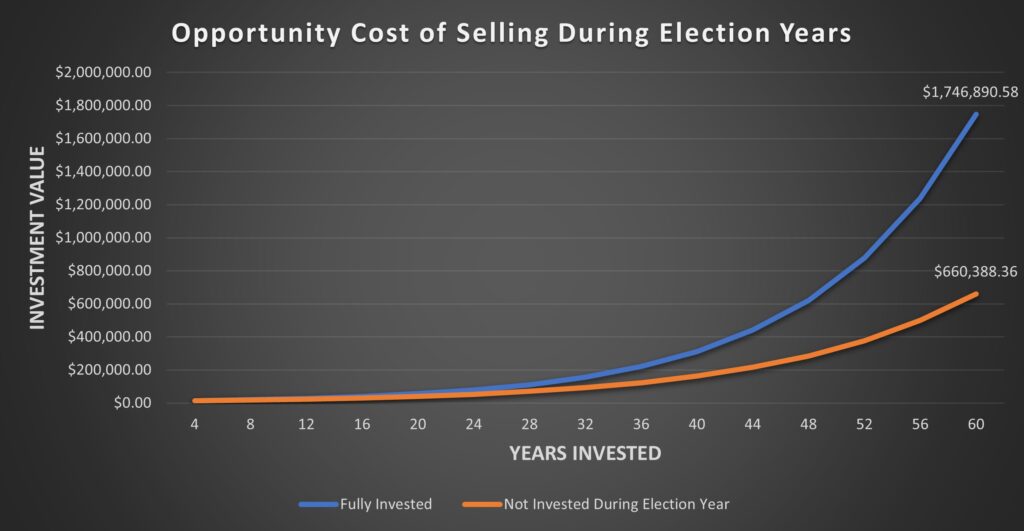

But what if this time is different? There is so much uncertainty in the air after all, so maybe sitting this one out makes sense. If an investor adopted this philosophy and “played it safe” by skipping each election year, that would have a huge negative impact over time. To quantify this, let’s look at the disparity between investing $10,000 and holding vs. selling before each presidential election year. As you can see in the chart below, the difference becomes significant. The value gap would be more than $1 million or 100x the initial investment over 15 election cycles.

Party Affiliation Impact

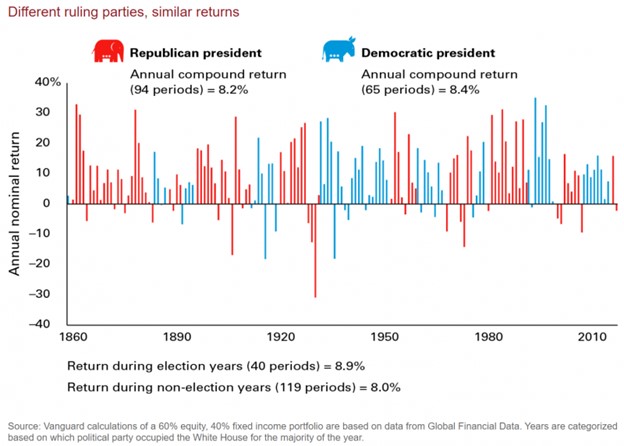

We’ve established that election years have been historically positive. But what about Democrat vs. Republican? There certainly must be some sort of variance by party. After all, the differences in fiscal strategy, foreign policy, and government spending must impact markets. While policy may differ, history again seems to say there’s little to no impact on performance. As seen in the chart below, going all the way back to 1862, the average annual returns of a balanced portfolio have been almost identical regardless of party.

Chart source: Best Path Forward

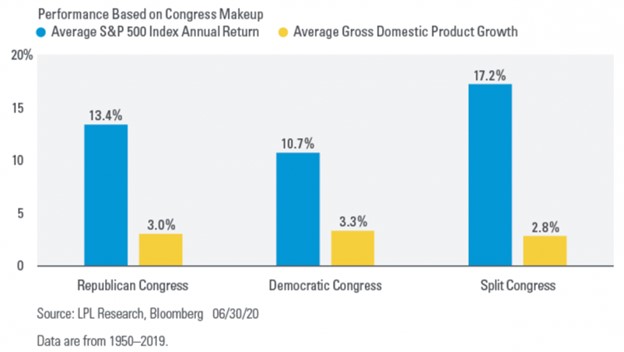

If the president’s political party has little impact on the markets, what about Congress? While the data shows slightly more deviation here, it is still not as much as one might think. As seen below, markets have done well regardless of party control. A republican controlled Congress has historically provided better investment returns, but weaker economic performance compared to a democratically controlled Congress. The best investment results have come from a divided Congress.

Chart source: Best Path Forward

Markets Impact on Elections

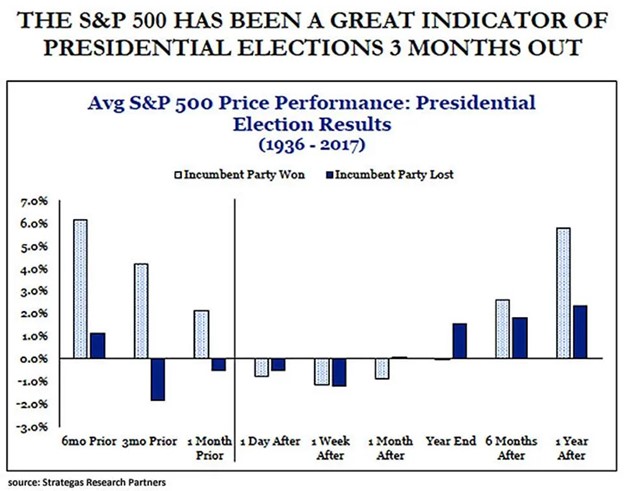

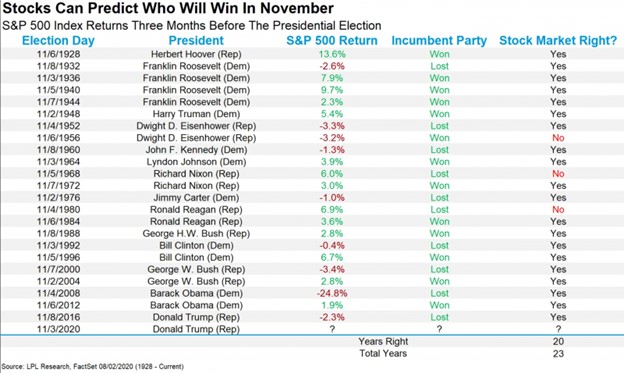

The data strongly suggests that elections have minimal impact on markets. But, what if it’s the other way around? Maybe markets influence elections. Unlike some of the other data, which seems to imply there is little to no correlation, there is strong evidence that says the opposite. As seen in the chart below, markets rising heading into an election have been positive for the incumbent party (light blue bars), whereas markets falling heading into an election have been negative (dark blue bars).

Chart source: Forbes

Taking this a step further, the performance of the market for the 3 months leading to an election has correctly predicted the winner with 83% accuracy over the last 24 elections. Data isn’t perfect though. Most recently, the 2020 election bucked the trend as the market was up in the three months leading to election day, but the incumbent party lost.

Chart source: Best Path Forward

Volatility in Election Years

We’ve established a few things so far:

- Markets tend to trend up in election years.

- The party of the president and Congress has little, if any, impact.

- Markets tend to be better predictors of elections than vice versa.

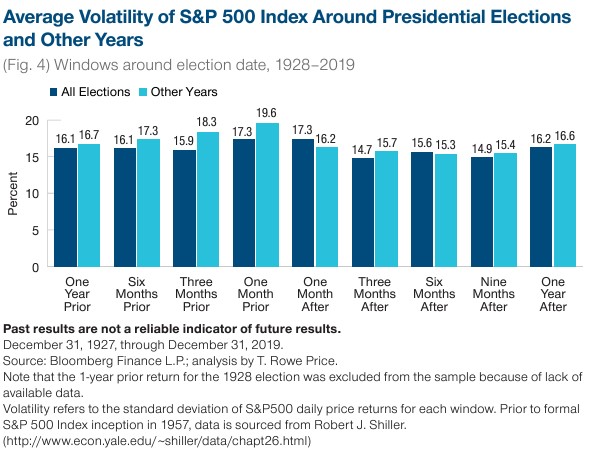

But even if markets are up, they must be choppier than a typical year, right? After all, with uncertainty comes volatility. You’re probably sensing a theme at this point, but again that has not been the case historically. As with all averages, there are outliers such as the Great Depression, Tech Bubble collapse, the Great Financial Crisis, etc. Even accounting for those extreme events, election years have experienced lower volatility than other years.

The graph below compares volatility during election years (dark blue bars) compared to all other years (light blue bars) going back to 1928. Over multiple time periods in the year leading up to an election, the volatility during election years was lower than average.

Chart source: T. Rowe Price

Conclusion

So, what should we make of all of this? Despite how politics and elections make us feel, there is very little to suggest they impact markets. In fact, markets tend to perform better and have less volatility in election years than in a typical year. There are always exceptions to the rule, but in almost every circumstance, those have been tied to other events occurring in tandem with the election as opposed to the election itself. Only time will tell if this election year is like the averages or an outlier. The data suggests one thing is clear. Deviating from sound strategy is more likely to cause problems for investors than the elections themselves.

If you’d like to discuss this or how it can impact you and your family, please don’t hesitate to reach out to the team at SWP.

[1] PR News Wire, Nearly Half of Investors Believe the 2024 Election Will Have a Bigger Impact on Portfolios Than Market Performance, (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).