The simple answer to that question is “yes.” The full answer is “yes, but you may need to tweak how you give to charity.”

As you have likely heard, the Tax Cuts and Jobs Act (TCJA) President Trump signed into law on December 22, 2017, raised the standard deduction to $24,000 for taxpayers filing a joint return. You may ask, what does that have to do with getting a tax deduction for a charitable contribution? Under the new law, the IRS says that you can only take a deduction for a charitable contribution IF you itemize your deductions when you file. Since the standard deduction has significantly increased, many taxpayers will not have enough deductions to exceed the higher standard deduction, and consequently, they will not itemize. If a taxpayer does not itemize, he or she will not receive the deduction for their charitable gifts.

The new tax law does not change the fact that we want to give, but it does require us to rethink our giving strategies.

Some people may stop contributing to charity because they don’t receive a tax benefit, but most will still contribute and not care about the tax deduction. According to Ted Hart, President and CEO, Charities Aid Foundation America, in 2017 “over half (62%) of Americans engaged in charitable activities within the last year” and “58% of Americans gave not because of any personal benefit, but because they care about the cause.”

The good news…there is still great opportunity to give and save.

While the press is predicting doom and gloom for the outlook of charitable giving in the United States, it does not have to be that way for you. With smart planning, such as combining the three strategies below, you can continue to give to the causes you care about and receive tax breaks along the way.

- Charitable Clumping: Charitable clumping is a strategy that concentrates charitable donations in certain tax years to surpass the standard deduction amount.

- Donor-Advised Funds: A donor-advised fund is a common charitable investment account that allows donors to contribute cash and securities with long term capital gains, take the tax deduction (assuming the donor’s total deductions exceed the standard deduction) and then direct the funds to any IRS-qualified public charity. A donor-advised fund can be thought of as a holding spot for future charitable contributions. Additionally, the money in donor-advised funds grows tax-free. Many donor-advised funds have start-up minimums as low as $5,000.

- Donating Appreciated Securities: You may have appreciated securities in your taxable accounts. Consider donating those securities to a charity or donor-advised fund. Donating appreciated securities not only produces the opportunity for a tax deduction for the amount of the donated securities, but also allows the donor to avoid paying tax on capital gains.

Here is an example of charitable clumping using a donor-advised fund and appreciated securities.

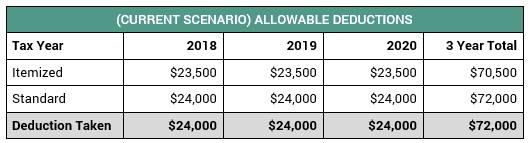

Current Scenario

- Bob and Sue are married, have an adjusted gross income of $300,000/year and own their single family home with a mortgage of $175,000 and regularly give $8,000 annually to charity.

- Under the new tax law, they will be able to deduct $15,500 for their property tax, state tax and mortgage interest combined. When we add $8,000 in charitable contributions, their total deduction will be $23,500.

- Since an itemized deduction of $23,500 is just short of the standard deduction of $24,000 for married couples in 2018, Bob and Sue will take the standard deduction and they will not receive any tax benefit for their $8,000 charitable contribution.

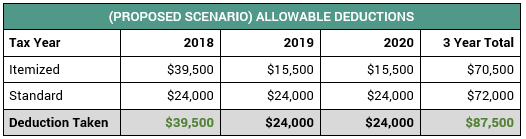

Proposed Scenario Using Charitable Clumping with a Donor-advised Fund

- Continuing with the above scenario, Bob and Sue open a donor-advised fund and transfer from their joint investment account a $16,000 mutual fund that has a long-term gain of $7,000 (appreciated security).

- Adding the $16,000 donor-advised fund contribution to the $23,500 of deductions in the current scenario, Bob and Sue now have $39,500 ($24,000 standard and $15,500 excess itemized) in deductions and thus exceed the $24,000 standard deduction. This allows them to take a $15,500 deduction for their $16,000 charitable contribution versus not being able to take any charitable deduction for their $8,000 contribution in the current scenario.

- The following two years, they will take the standard deduction of $24,000 while continuing to contribute to charity from the donor-advised fund.

Bottom Line

- They avoid the 15% capital gain tax of $1,050 ($7,000 of capital gain X 15%) because they donated the mutual fund to the donor-advised fund.

- They pick up $15,500 of charitable deduction in 2018 they would not have had in the current scenario. At a 25% tax bracket, that is a savings of $3,875.

While the TCJA bill may impact the way taxpayers give to charity, it has not eliminated the desire to give, nor the tax benefit for doing so.