In August 2020, my colleague Kathy Klein and I hosted a webinar for our clients and friends called “Retirement Readiness.” The crux of the discussion was that while 2020 was a really challenging time to be a retiree, there were certain planning strategies that we incorporated along the way to help ease the emotional and financial stress for those going through this phase of life.

It’s been a year since we had this discussion, and spoiler alert – it’s still a tough time to be a retiree. With that said, I thought it would be helpful to revisit a few of the more important takeaways from our dialogue, all of which still apply today.

One of the Biggest Risks in Retirement is Longevity

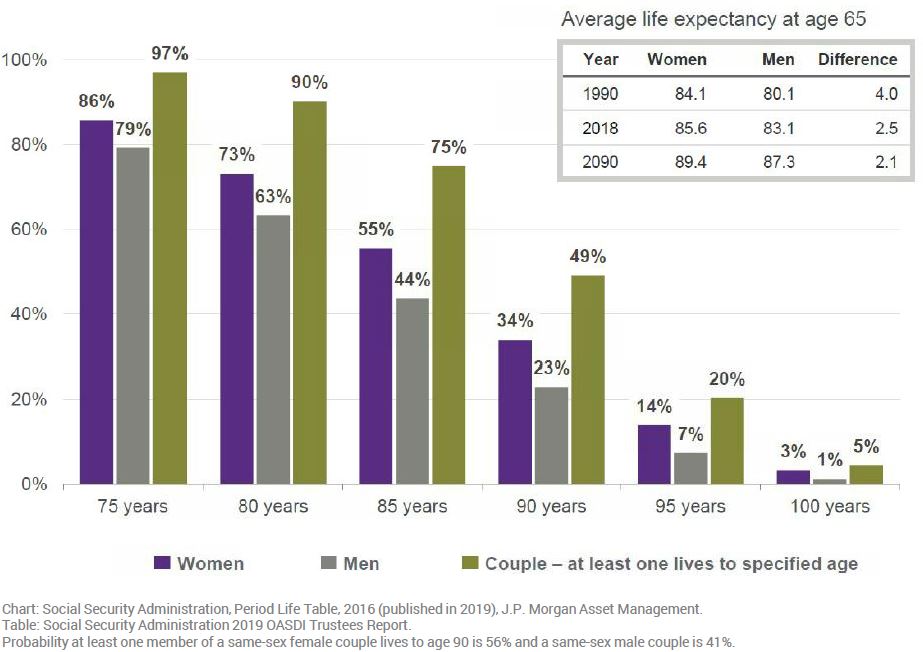

Longevity presents a real retirement challenge, as it is a complete unknown and out of our control. The chart below displays the likelihood of a 65 year old living to a certain age:

For example, this shows that the probability of at least one member of a 65 year old couple living to age 90 is 49%!

On top of this, many people are living a more active retirement. We have clients exploring new professional endeavors, sitting on boards, or volunteering with local charities. And just about everyone nowadays is excited to be traveling again.

This is all wonderful, but a longer and more active retirement comes with additional costs. Clearly, the portfolio needed to support a retiree to age 90 or beyond is larger than one that doesn’t need to last as long.

Clarity about What We Own is a Great Place to Start

A commonality among many families we meet, especially soon-to-be retirees, is that they do not have a solid grasp of the financial assets they own, including how they own the assets, or why they even own them. If you find yourself nodding as you read this, don’t worry, you are not alone! We see this often because in the accumulation phase (during our working years), there is a tendency for investors to have numerous accounts in multiple places.

For example, there could be brokerage accounts opened decades ago, retirement accounts from previous employers, and inherited accounts from family members, not to mention cash and CDs spread across a few different banks. It can be overwhelming just thinking about it.

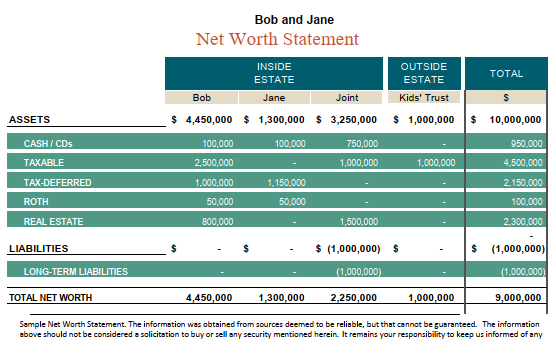

As retirement nears, however, it makes sense to get organized. And a great first step to do this is through building out a net worth statement. For example, something like this:

This table classifies all financial assets (the rows) owned by a family and is organized by the family member who owns it (the columns). It can be built out to show a different level of detail based on family circumstance.

Spending the time gathering data to populate a net worth statement is important as it can help a retiree take stock of where they are right now launching the retirement planning process!

Clarity on Our Goals is Just as Critical

In retirement, we feel that it is critical to move the conversation from focusing on the “what” to focusing on the “why” and “how.” We must consider questions like:

- Why is now the right time for you to retire?

- Why was saving so important to you during your working years?

- How do you want to spend your time (and money) in retirement?

- How engaged would you like your loved ones to be in your financial plan?

- How do you want to be remembered?

Spending time on questions like these can lead to the development of meaningful goals. Having clarity on our goals is crucial because it allow us to create an achievable financial plan, prioritize, track progress, and maintain accountability.

Arguably the most significant reason to have goals, though, is that they give you a reason to celebrate. Retirement is a journey, and it’s critical to have some celebrations along the way!

Try to Focus on What We Can Control

I am passionate about this next sentence.

Trying to predict how financial markets act – or thinking you have some control them – is a fruitless exercise.

Variables are always in a state of flux. The problem with managing a portfolio against macroeconomic risk factors, like inflation or unemployment, is that we never know what’s already been priced in. I feel very strongly that the short and intermediate-term direction of financial markets is out of our control. And if markets don’t go up over the long, long-term, well that would be a first.

So rather than focus on the day-to-day gyrations of the markets, it’s best for a retiree to focus only on factors they can control, like spending. This can be hard for retirees because spending wasn’t always a big consideration when they were working and having constant income. However, it has to be a factor for all levels of wealth in retirement.

My colleague, Cory Rappaport, just wrote an article on the topic of cash flow. Cory wrote, “Focusing on our cash flow opens our eyes to where our money is going and helps us evaluate whether our spending aligns with our financial goals.”

I love this. Focusing on spending and cash flow allows us to better track our progress towards our goals. Moreover, outcomes can be improved by looking at variables that we can control.

Downside Protection Takes on Even Greater Importance in Retirement

Moving from an asset accumulation phase to an asset consumption phase can be stressful. Many people reach retirement age without having to use much, if any, of their portfolio along the way. This usually changes in retirement.

When it comes to the portfolio, downside protection takes on greater importance for retirees. Markets have historically trended upwards over time, but they certainly don’t always go up.

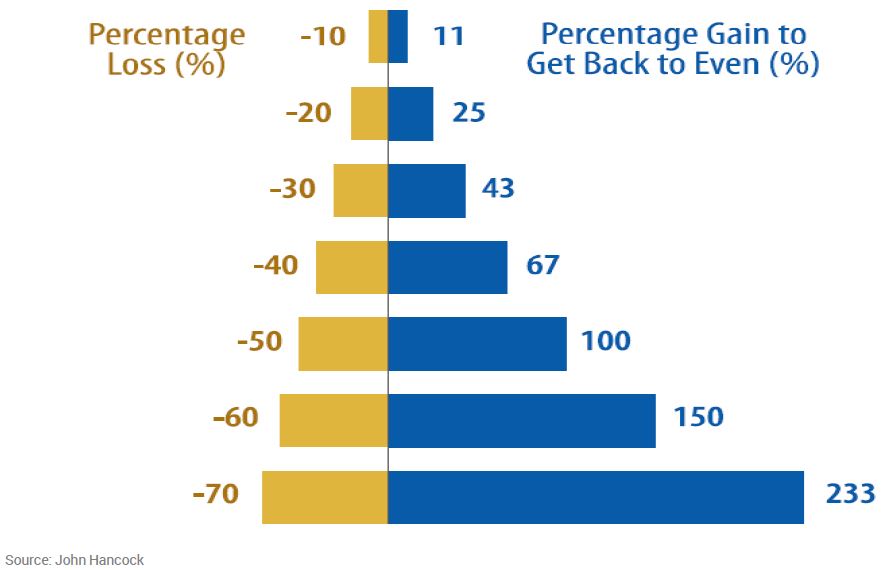

This graph shows the percentage gains required to offset portfolio losses.

Take the second row of the graphic, for example. If a portfolio experiences a 20% loss (and goes from $1M to $800K), it will take a 25% gain to get back to even (or the original $1M). This issue is exacerbated at more significant loss levels. Looking at the fourth row, if a portfolio experiences a 40% loss (and goes from $1M to $600K), it will take a 75% gain to get back to even (or the original $1M)!

This is an important concept for retirees because typically, they can’t replace lost portfolio value with new cash flow, nor do they have the opportunity to average into the market. As a result, a portfolio needs to be constructed with the potential for a market decline downside protection in mind.

While we can’t control market returns (as I alluded to before), we can control how we build portfolios, what asset classes we allocate to, and how much we hold in each of these asset classes. This can create a level of downside protection in line with a retiree’s goals.

Conclusion

During our webinar, Kathy stated that entering into the most exciting chapter of your life without a plan is akin to building your dream house without a blueprint. This is a perfect analogy, as much of what I have revisited in this piece is part of the financial planning process. Change can be stressful, but being prepared for it can positively impact your experience.

If retirement is on the mind of you or a loved one, please reach out to our team to discuss your goals and work together to implement a plan.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Past performance is no guarantee of future results. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).