When we look back at 2020, it will likely be viewed as one of the most volatile years in memory: a once-a-century global pandemic, civil unrest across our country, and one of the most contentious and divided elections we’ve ever seen.

The world feels a bit on its head right now. And uncertainty is around every corner.

We expect that this sentiment will only intensify leading up to the elections on November 3rd and will likely continue until the COVID-19 pandemic is behind us.

With so much happening, it can be easy to get lost in the sheer amount of news, data, and decision-points that this pandemic has brought into our lives. And when that happens, it can make clear thinking and strategic planning feel impossible.

The goal, and the challenge, is defining what tangible things we should be focusing on today, tomorrow, and the next day.

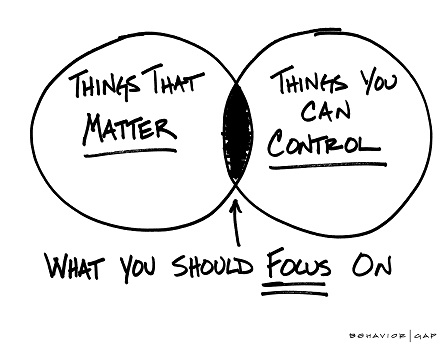

The question is: with so much happening, what should we focus on?

We like to follow the drawings of Carl Richards, who has a way of elegantly depicting investing and planning topics. The sketch at the top of this post does a great job explaining the concept that is the subject of this piece. We encourage you to focus on the small intersection of “things that matter” and “things you can control.”

The team at SWP is here to support you and your financial well-being, whatever 2020 brings next. If you need additional support or guidance during the coming weeks and months, please connect with our team.