I will admit that I am a little bit of a news junkie. In the age of the internet, we are constantly bombarded with stories about anything and everything vying for our limited time and attention, from the “Most Exciting Football Play of the Week” to the “Best Places to Retire.” Even more so, money controls many of our basic human emotions, such as personal security, fear, and greed. With the constant deluge of information coming at us from all directions, how are we supposed to stay up-to-date with what’s going on in the world AND maintain our long-term investment strategy?

For the first few years of my career, I felt compelled to keep current with the market, checking in near hourly. As time went on, I realized that those day-to-day movements were just a blip when trying to achieve long-term results. In my discussion to follow, we will take a look at some common types of headlines and how we can insulate our portfolios from our emotions and focus on the long-term objectives that matter. To continue my sports metaphor (and anyone who knows me knows that they are few and far between), it’s fun to see the game or play of the week, but when building a long-term investment strategy, we are trying to win championships (like I hope my Michigan Wolverines can pull off this year).

The Market Did What?

The Dow on track for biggest monthly gain since 1976 – Yahoo! Finance

Dow, S&P 500 on Track to End Week Lower – Barron’s

Stocks are tanking today because of fears the Fed is nowhere near winding up its inflation fight – Financial Post

U.S. stocks finish higher as S&P 500, Nasdaq climb for 5th straight month – Morningstar

Dow on track for first gain in four sessions, up around 400 points in Monday’s final hour of trading – MarketWatch

Without heading to your preferred search engine, could you identify when those headlines ran? It’s natural for us to think about our own portfolios when we see news like that, but at the end of the day, unless we’re day trading (which I strongly urge against), what happened in the past is likely to be completely dwarfed by what happens in following weeks to come. Stories like these tell you what happened, but knowing what happened on a single day, week, or month doesn’t help us understand the progress toward our personally important goals. When I invest for the long-term, I release myself from the stress of day-to-day movements in the markets and focus on a longer future.

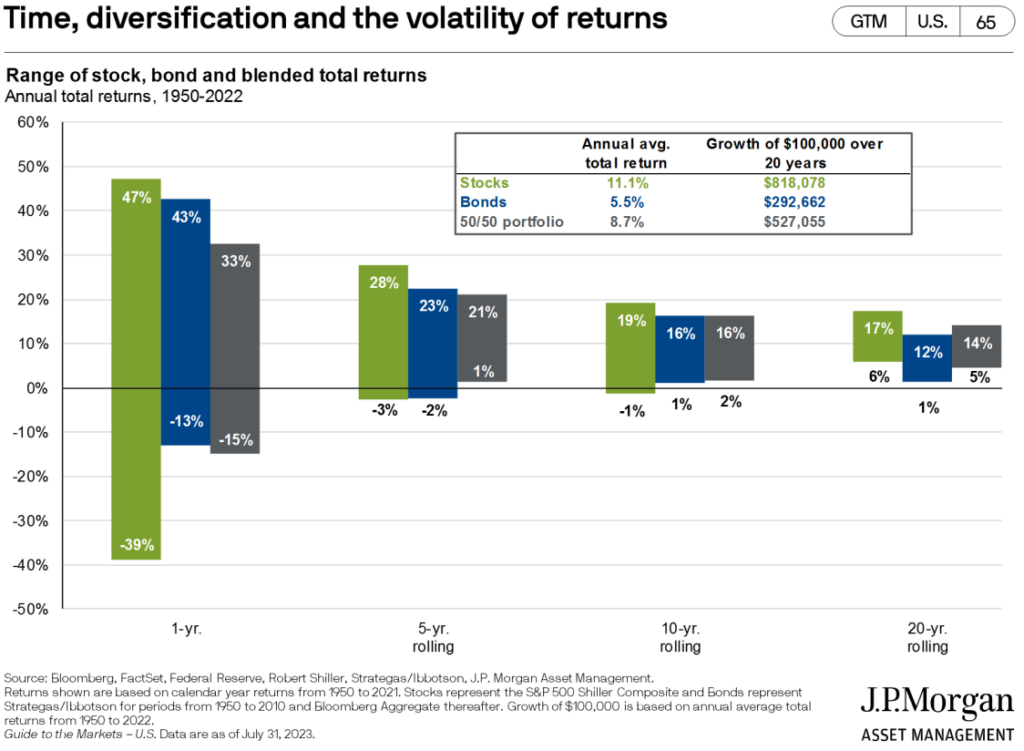

Data helps me look beyond day-to-day market movements. The exhibit above shows the potential return of various asset classes over different holding periods. As we move from the left to the right, increasing from one year to twenty years, we see the range of returns get tighter and tighter. For example, for any one-year time period between 1950 and 2022, the return of stocks ranges from down 39% all the way to up 47%. How could anyone make financial planning decisions knowing this? However, when you invest for the long-term and look at 20-year periods, that range diminishes to up 6% to up 17%. Knowing this, I can invest with confidence for the future and reduce the emotional impact of a single volatile year.

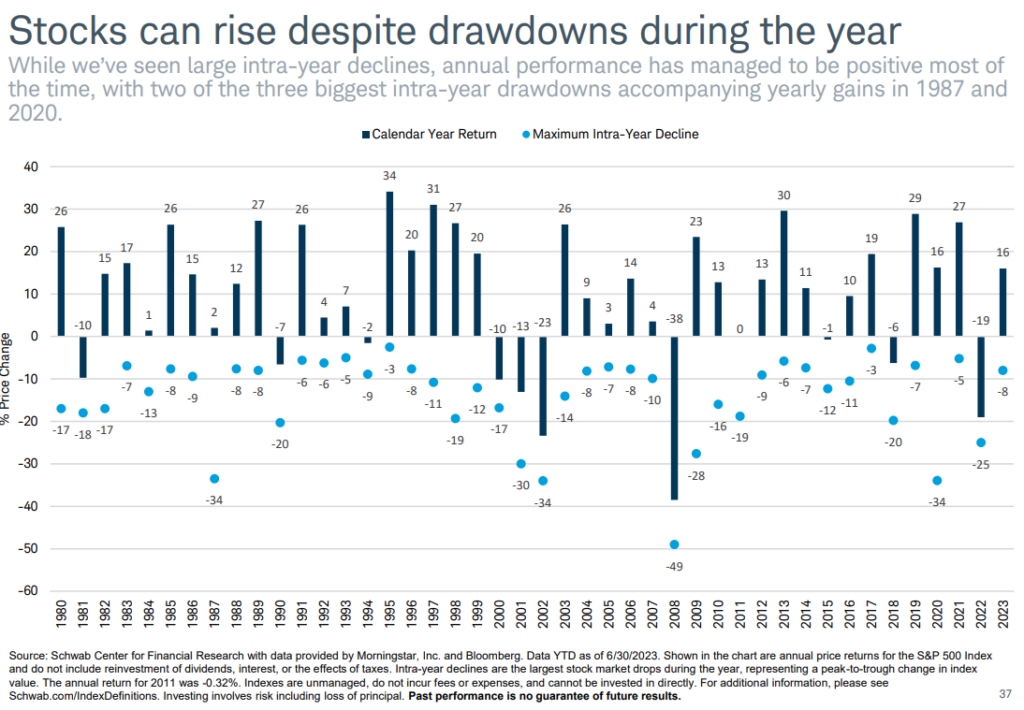

When I look at the chart above, I can contextualize day-to-day and even month-to-month market movements into the bigger picture. Every single year, you can see a drawdown in the S&P 500 intra-year with better performance for the whole year. Let’s take a look at the year 2009: If we had sold our stocks because of the fear of being down 28%, we would have missed the positive return of 23% for the year. By allowing our emotions to seep into our investment decision making, we would really miss out on some great returns!

All those financial headlines about how the market did last week or what speculators think might happen in the future aren’t important when evaluating your success.

The Danger of Politics In Investing

Here’s What Happens To The Stock Market If Republicans Take Congress In November – Forbes

Why it looks like the stock market wants the Democrats to keep control of the U.S. Senate – MarketWatch

What the Midterms Mean for Stocks – Kiplinger

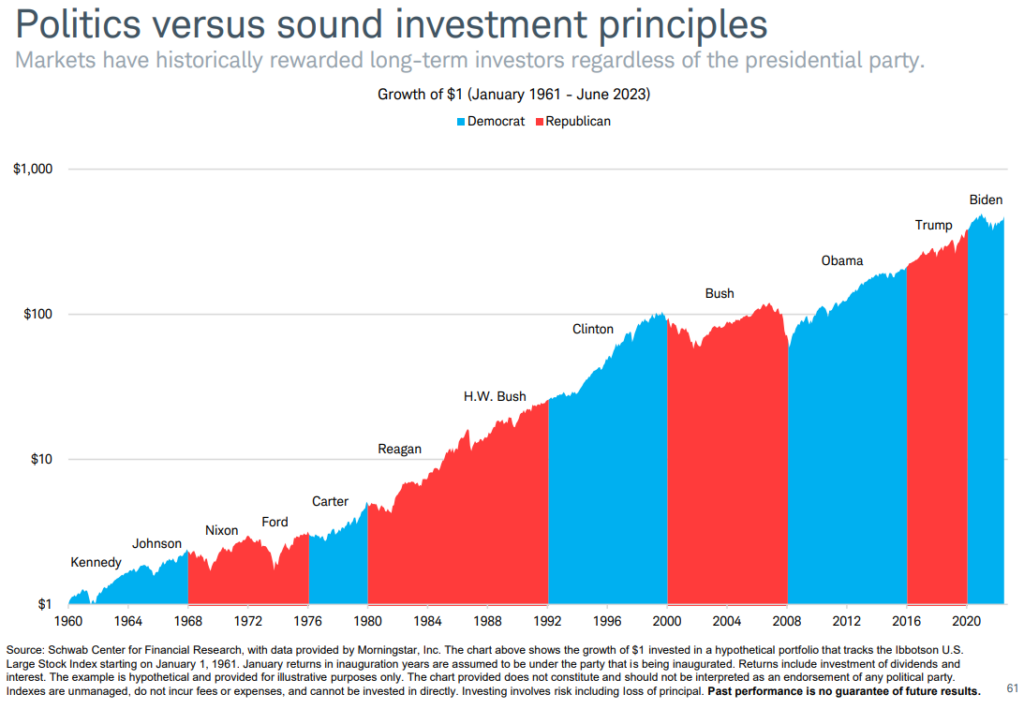

The political climate has seeped into all areas of American life, and it’s no wonder that headlines like above draw us in. While we may have our own policy preferences, the reality is that we cannot control what happens in Washington, D.C. But despite the charged political headlines of the day, we can control our investment strategy and be guided by real risk statistics and market results.

What is the most important thing I take away from the graph above? Red or blue, the market continues its uphill climb over time. I don’t use who is in political office as a cause to change my long-term investment strategy.

How Can I Ignore the Noise and Stay Focused On My Personal Goals?

My colleagues and I believe that the best investment strategy is one informed by the financial planning process in which we define and quantify your personal goals. Instead of chasing returns and feeling the woes of the stock market, when we define your actual financial goals and objectives, we can insulate ourselves from the fear and greed of everyday market movements and focus on how our unique strategy fits your needs and risk tolerance.

If you or anyone you care about is struggling to stay invested during markets, good or bad, please contact the SWP team to see how we can reduce some of the stress of being an investor.

(Alright, maybe just one more headline: “Michigan Wolverines Win College Football National Championship”)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).