My wife and I recently got back from a week in Disney World with our two daughters. It was the first time there for the three of them and my first time back since the early 1990s. Everyone had a great time…including me! It is truly magical. I will never forget watching my 6-year-old waiving enthusiastically at the animated Anna and Elsa characters on the Frozen Ever After ride in Epcot as if they were actual people. It was pure joy. What more can you want?!

That said, there are blurred lines between my work life and my personal life. Throughout our 4 days (and ~100,000 total steps) at the Disney parks, I couldn’t help but continually think that this place can tell us so much about the current state of the economy. More specifically, everywhere I turned, I would find rides, activities, events, or a group of people that made me think about the strength of the U.S. consumer.

Here are a few of my takeaways…

Economic surveys show that consumer sentiment is down, but it’s hard to believe that when you walk around a Disney park

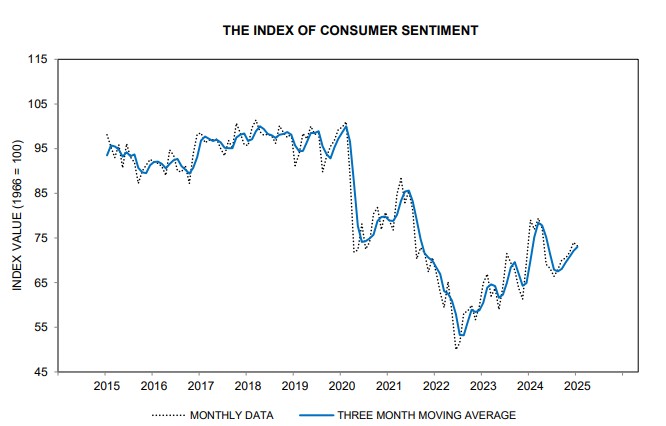

As shown in the graph below, economic surveys reveal that consumer sentiment remains relatively low, especially compared to pre-pandemic levels.

Source: University of Michigan

While the absolute numbers of the vertical Y-axis aren’t relevant to this point, the relative direction of the line graph is. Although the current sentiment level (on the far right) is higher than it was during the peak inflation/market bottom period of 2022, it is still much lower than it was in the late 2010s.

Why does this seem to be the case? A lot of it probably has to do with inflation. We consistently hear anecdotes about the lingering impact of recent inflation on people’s budgets. Additionally, there are countless stories about first-time home buyers coming up against a housing market with limited supply and elevated prices.

Well, I challenge anyone to spend a week in Disney World and then tell me that consumer vibes are down. We chose to travel two weeks after winter break ended in hopes of being there at a time when it wasn’t very crowded. Yeah….ok. The place was packed.

Every ride had wait times between 30 minutes and 90 minutes. Every. Single. Ride. Let the record state that we did lightning lane passes, so we avoided lines for the most part, but my point remains. At Epcot, the line to get a French pastry was so long that I didn’t even wait in it!

Consumer sentiment surveys say the opposite, though. It just doesn’t add up.

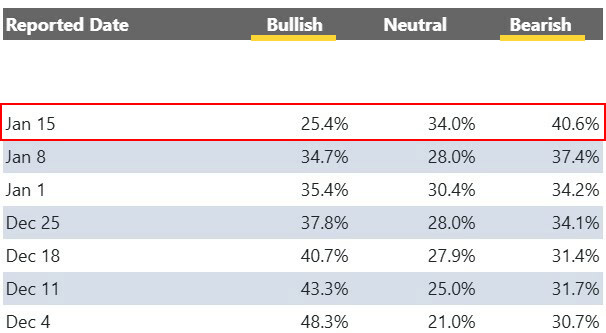

In mid-January (the exact week I was at Disney), the American Association of individual investors (AAII) published a huge decline in consumer sentiment.

Source: Sentiment Survey Past Results | AAII

Each week, the AAII asks people one question: Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral), or down (bearish)? The table above shows that only 25% of respondents felt bullish on the stock market over the next 6 months.

Only 25% of people say they feel good about the direction of the market, yet I’m forced to wait 45 minutes at Disney World for a croissant. Help me, please.

My trip to Disney World was a firsthand example of what I believe is a very strong U.S. consumer. From the continued willingness of families to spend money on travel, entertainment, and experiences, it was clear that many Americans are more than willing to put economic concerns aside.

I guess it’s one thing to be bearish on a survey, but another thing to skip a trip to Disney.

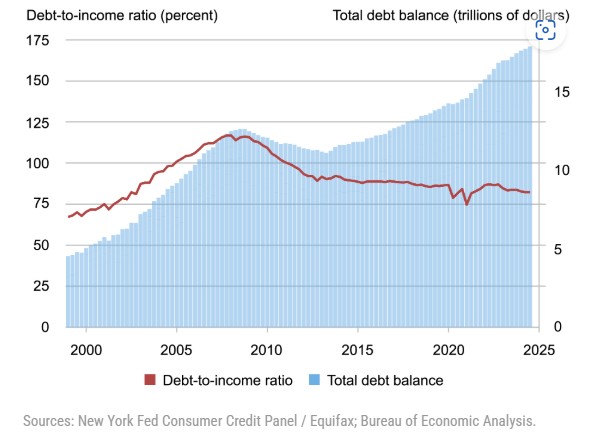

The U.S. consumer will borrow…

U.S. consumer debt levels have grown substantially this decade. The blue columns in the graph below show the total outstanding consumer debt. Note the steady increase since the early 2010s.

Source: Income Growth Outpaces Household Borrowing – Liberty Street Economics

I acknowledge that this isn’t necessarily a bad thing. The red line in the graph shows that debt-to-income has actually gone down, meaning consumer income is growing favorably relative to debt outstanding.

I’m convinced that U.S. consumers will stop at virtually nothing to fund their lifestyle choices, even if it means taking on additional debt. This is perfectly exemplified at Disney World.

In June 2024, LendingTree published the results of a survey of over 2,000 people that found that 45% of parents with children under 18 who have gone to Disney went into debt for the trip[1].

If you consider census data on U.S. income, this isn’t surprising. The median U.S. household income at the end of 2023 was $80,610[2]. You can attempt to be fiscally responsible at Disney, but it’s near impossible to go and not spend thousands and thousands (and thousands) of dollars. For a family of four, the cost of a one-week trip to Disney can range from $6,463 to $15,559, not including flights or souvenirs, according to an analysis by NerdWallet[3].

The main reason that so many people can get to Disney World is because of the proliferation of credit cards, loans, and financing options over the past couple of decades.

The ability to borrow money and take on debt is a fundamental aspect of American economic culture. While many Disney guests finance their vacations, it does not deter them from enjoying all that Disney World has to offer.

…and in turn, the U.S. consumer will spend

People typically borrow so that they can spend. Disney World exemplifies this phenomenon, where families can easily rack up bills by purchasing souvenirs, food, park tickets, and premium experiences.

Before exiting any ride at Disney, you are literally forced to walk through a gift shop that is themed for the ride you just went on. After we did Remy’s Ratatouille Adventure in Epcot, I entered into a hostile negotiation with my daughters over stuffed animals they wanted to purchase. I eventually caved and purchased two plush ratatouille rats that were the size of beanie babies. Total cost: $60. Cool.

U.S. consumers have consistently demonstrated their willingness to spend money, even in the face of economic uncertainty. The graph below shows how retail spending has grown over the past 30 years.

Source: fred.stlouisfed.org

Retail sales have gone up consistently over the past few decades. The above graph doesn’t adjust for inflation, but still. What I find particularly interesting in this graph is that recessions (shown in the three gray bars) barely created a short-term dent in retail sales. From my perspective, the U.S. consumer is nearly unstoppable. People will spend and find any way possible (see previous section on borrowing) to do it.

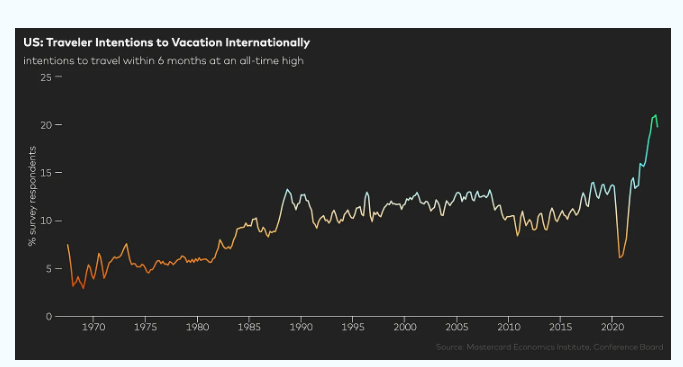

More specifically, the graph below from Mastercard shows the 50+ year upward trend in the share of U.S. consumers who plan to take international vacations.

Source: We’re taking that vacation whether we like it or not 🛫

There, of course, has been a spike coming out of Covid, but the share of people who plan to take international vacations within 6 months has been trending up for the past half-century. Keep in mind that, unlike food or rent, travel is a discretionary expense. Despite the high costs throughout the Disney parks, the lines of visitors eager to spend never seem to shrink. Yes, a trip to Disney may be a discretionary expense, but it also provides the ultimate confirmation that U.S. consumers will stop at no end to spend.

Concluding thoughts

I was able to unplug and (sort of) unwind at Disney. It’s a place where people seem to put aside their stresses and immerse themselves in magical experiences with loved ones. But these experiences don’t come cheap!

While I don’t know what’s going to happen to the stock market or the economy over the coming months or years, I do believe in the strength and resiliency of the U.S. consumer. Spending a week in Disney only reinforced this mindset.

There will be difficult economic periods and recessions, but the U.S. consumer is relentless. Go to Disney World and experience it firsthand. And buy yourself a $10 pineapple dole whip while you are there (worth it).

[1] Jessica Fu, Why Families Are Going Into Debt for Disney Vacations (Link)

[2] Median Household Income (Link)

[3] Jessica Fu, Why Families Are Going Into Debt for Disney Vacations (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).