In today’s fast-paced world, it’s easy to get caught up in the noise of predictions, forecasts, and market speculation. Turn on the TV, and you’ll likely hear from pundits offering their take on where markets are headed next or which investments are poised to soar. My guilty pleasure is the Stock app on the iPhone which provides me with market updates and weblinks to ‘helpful’ financial news. It’s tempting to listen and react to predictions, but successful investing and sound financial planning involve tuning out the noise and taking a more disciplined, strategic approach.

The Problem with Predictions

Predictions are simply educated guesses. The truth is, no one has a crystal ball that can accurately forecast the future of the stock market, interest rates, or economic conditions with 100% accuracy. Wall Street and even the most seasoned investors all have poor track records of predicting the economy and short-term moves in the stock market.

To help prove the point about the dangers of acting on headlines, here’s a collection of my favorite articles from the last two or so years:

Prediction: 2023 S&P 500 Price Targets

Source of Prediction: Wall Street Banks & Strategists

Out of all the pundits, Wall Streeters’ forecasts should be accurate, right? Large financial institutions have the quantity and quality of date in which to form an accurate opinion.

Outcome: Wall Street has a lousy track record. Below is a collection of Wall Street’s 2023 forecast for the S&P 500. For context, the S&P 500 was around 4,000 in early December 2022, and since then, it has appreciated roughly 25% to 5,000. Making portfolio decisions based on these predictions would have been detrimental to most financial plans.

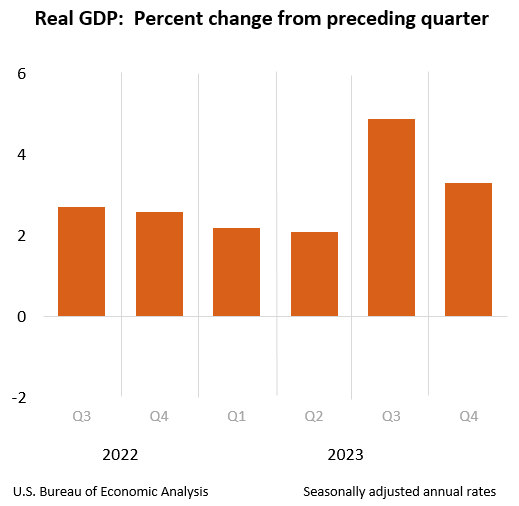

Prediction: 100% certainty of a recession.

Source of Prediction: Bloomberg

The rational reaction of an individual reading this article might be, “Better change my portfolio before it’s too late!”

Outcome: Instead of a recession, economic growth accelerated and grew faster in 2023 than in late 2022. The chart below shows the change in Gross Domestic Product (GDP) from Q3 2022 through Q4 2023.

Prediction: Economic hurricane

Source of Prediction: CEO of JP Morgan (the largest U.S. Bank by assets, according to Bankrate.com), Jamie Dimon

I’m not sure how to define an economic hurricane, but it sounds scary!

Outcome: We have seen continued economic growth, an unemployment rate below 4%, and the stock market near all-time highs.

Prediction: AI Bubble to burst and brace for a recession

Source of Prediction: Jeremy Grantham: Founder of GMO Asset Management which is an investment management company with approximately $60 billion of assets under management. Jeremy is known for accurately forecasting and avoiding several bubbles, including the Internet bubble of the 1990s.

Outcome: Jeremy has been predicting an economic crash just about every year since the financial crisis. None of this has materialized, and more importantly, stock market investors have benefitted from the returns of AI-related companies. For example, The Magnificent 7 (technology companies such as Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) returned on average more than 100% in 2023.

In the moment, it’s easy to see why a rational person might act in reaction to these headlines. I didn’t even mention other global and economic events such as the rapid increase in interest rates, the first ground war in Europe since WWII, or the Debt Ceiling Debate of 2023. The list goes on.

So, how does someone turn down and tune out the noise? Enter Behavioral Finance – which I believe can help you identify and avoid the pitfalls that ultimately sabotage financial success.

In a nutshell, behavioral finance focuses on the importance of discipline and patience in achieving financial success. Instead of reacting impulsively to market volatility, news headlines, or chasing the latest investment fad, successful investors adhere to a well-defined investment strategy based on their own financial objectives.

Seven Strategies for Ignoring the Noise:

- Communicate frequently with your advisor: I’d argue partnering with a trusted financial advisor that you feel comfortable calling (especially during periods of heightened uncertainty) is the best strategy of all. A skilled advisor and advisory firm can help you navigate the most challenging times.

- Set Clear Goals: Define your financial objectives and create a comprehensive plan to achieve them. Having a clear roadmap will help you stay focused and avoid getting sidetracked by short-term distractions.

- Limit Information Overload: Be selective about the sources of financial information you consume and avoid excessive exposure to sensationalized news or market speculation. Focus on reputable sources and filter out noise that isn’t relevant to your investment strategy.

- Practice Mindfulness: Be aware of your emotions and cognitive biases when making financial decisions. Take a step back, assess the situation objectively, and avoid acting impulsively based on fear or greed.

- Stay Disciplined: Stick to your investment plan and resist the urge to deviate from it in response to short-term market movements. Regularly review and rebalance your portfolio as needed but avoid making knee-jerk reactions based on noise or speculation.

- Don’t be your own worst enemy: “The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham (Warrant Buffet was Graham’s student).

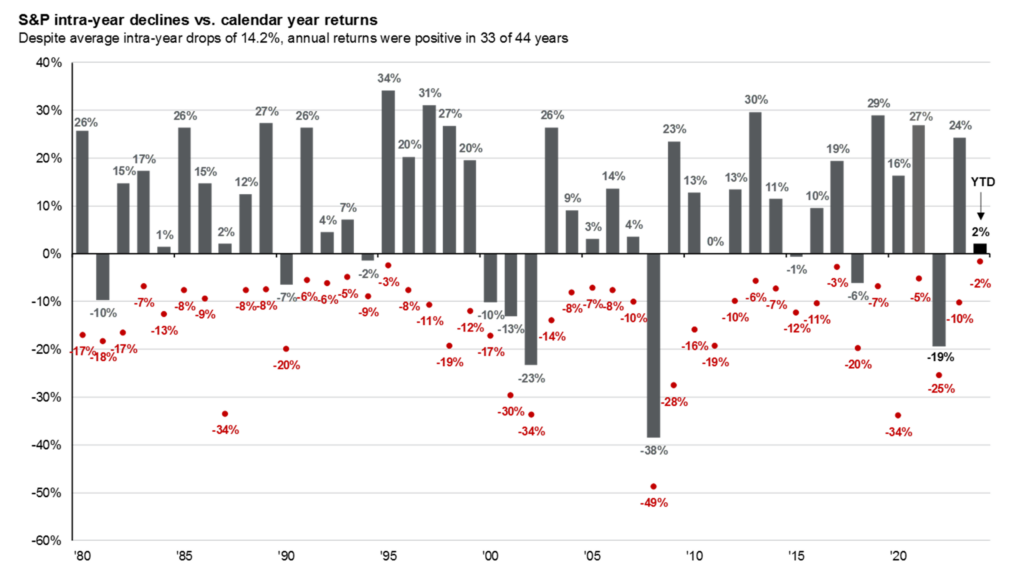

- Remember, volatility is normal. The chart below shows the prior 44 years’ worth of S&P 500 returns and the maximum intra-year decline (the red dot). Each vertical bar shows a different calendar year, chronological from left right. On average, the S&P 500 declines by roughly 14% intra-year but still finishes positive three out of every four years.

Conclusion:

We’re all human and reacting to headlines is in our DNA! One thing we should count on is that nothing will change with headlines, and they may get even worse. However, remembering how our emotions can affect financial decisions (via behavioral finance) should help improve outcomes. As always, your SWP Advisor is only a phone call away and ready to help you navigate whatever comes next.

Disclosure:

This information herein was obtained from third party resources that Strategic Wealth Partners (“SWP”) deems to be reliable as of the original date of publication. SWP does not provide legal or tax services. The information provided is for general informational purposes only.

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).