Humor me for a moment and try to remember accessing the internet in the early 1990s. For me, connecting went something like this: Double checking no one was on the landline, letting everyone in the home know that I was logging on, and to please stay off the phone. The unforgettable sounds of dial-up and my first AOL instant messenger screen name also come to mind.

We’ve sure come a long way since dial-up internet, and it’s impossible to imagine life without the technology of today. FaceTime has made it easy to stay close to family in Des Moines, IA and Cleveland, OH. And can anyone possibly live without their personal DJ Alexa? In our house, she’s stuck playing Wheels on the Bus for Harvey, our one and a half year old.

The wealth management industry has also undergone tremendous change over the past couple of decades. For example, early in my career, rebalancing a portfolio involved printing a trade ticket and dropping it off at the trader’s desk, where the buy or sell orders were ultimately placed. It wasn’t that long ago! Thankfully, those days are behind us.

Fast forward to 2023, I’m proud to say that Strategic Wealth Partners (SWP) is a firm that embraces change and stays ahead of the curve, ultimately for the benefit of clients. From the perspective of an advisor who started at SWP in January of this year, here are several strategies that we embrace that I believe are innovative:

- Personalized/Direct Indexing: In a nutshell, direct indexing involves investing in an underlying index (for example, the S&P 500) by way of owning shares of the company outright (instead of via a mutual fund or an ETF). Traditional index funds are opportunistic at deferring capital gains but lack the ability to pass through losses to each respective shareholder. Direct indexing solves this problem as the strategy is designed to “unlock” the benefits of regular tax loss harvesting (“TLH”). A quick reminder that TLH is important as it can significantly reduce your capital gains tax liability (and $3,000 of ordinary income too!).

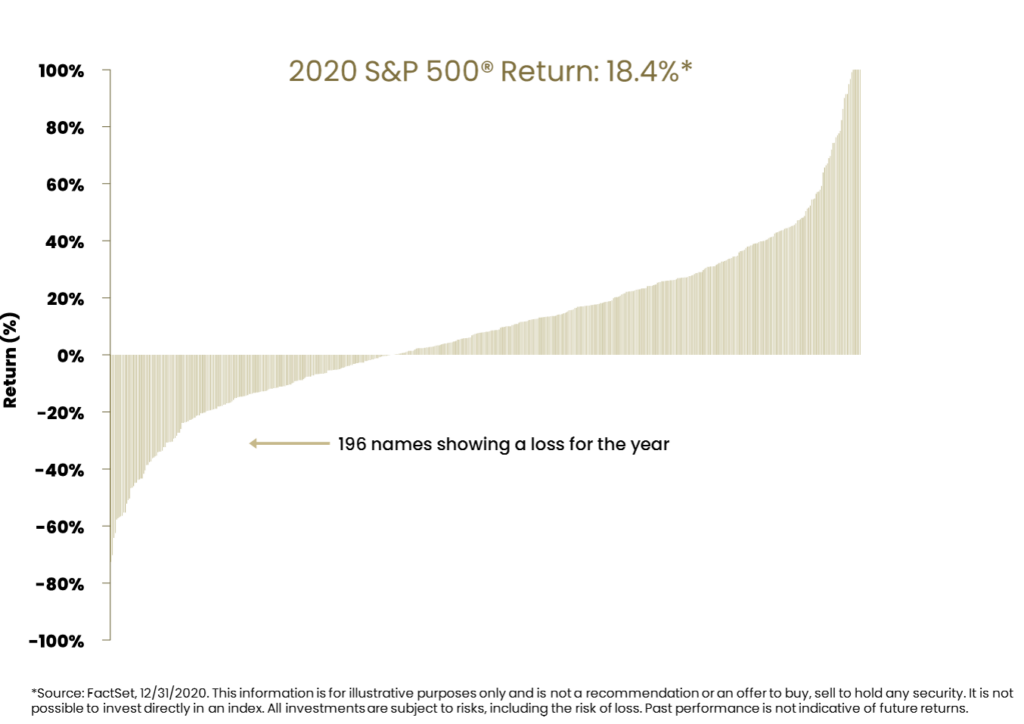

Just how large is the opportunity set for TLH? The chart below helps tell the story. Using 2020 as an example, the chart below shows the individual returns of all stocks in the S&P 500 index. The overall index returned 18.4% return on the year, BUT, as you scroll your eyes toward the bottom left of the chart, you’ll notice 196 companies within the index finished the year down! Because investors own shares of the company outright, the manager can “sell the losers” for the tax benefits.

Equally meaningful is the personalization of strategies at the client level. Imagine you’ve accumulated significant equity via your employer, or the stock you’ve owned for decades has grown too large relative to your investment portfolio. You’d love to sell some of your holdings but can’t stomach the tax consequences. Personalized indexing can solve this problem.

Working with your SWP advisor, we can further create investment solutions to exclude the holding or even the entire industry from your stock portfolio (potentially reducing risk). Plus, the tax losses mentioned in the previous paragraph can offset the gains generated from selling the concentrated holding.

Software with the tools and algorithms required to monitor the strategy and facilitate the trading is mind-boggling (innovation!). Even more surprising is that only 14% of financial advisors are aware of and recommend direct indexing to clients!

2. Defined Outcome Investments/Structured Notes: A structured note, also known as a defined outcome investment, often includes a defined level of downside protection in exchange for limiting the upside. With these strategies, clients are potentially able to reduce the magnitude of large stock market losses. As such, these can be great investments for clients who have significant cash in the bank and want protection against investing the cash right before the market drops.

In my opinion, these investments can be a game changer for clients who aren’t comfortable with frequent stock market swings, but still want more return than they can get from bonds. SWP’s commitment to finding solutions like this are another example of embracing innovation on behalf of clients.

3. Middle Market Direct Lending Fund (Private Credit): How about investing a dollar (on any day the market is open) and immediately gaining exposure to a portfolio of over 3,000 loans to private, middle market companies? Hard to imagine accessing this type of investment before modern day technology. Private credit has historically been a market reserved for only those willing to invest $5+ million in a dedicated strategy. David Copeland has written extensively about private credit and why the current environment is favorable for these strategies. I encourage you to check out David’s articles Opportunities in Alternative Credit and Our View on Alternative Investments!

4. Ultra Short-Term Treasury Bill Ladder: Clearly, bonds are anything but boring these days. The last two years have been a real eye-opener for fixed-income investors. Historically a more stable asset class, traditional bonds have been quite volatile since the end of 2021.

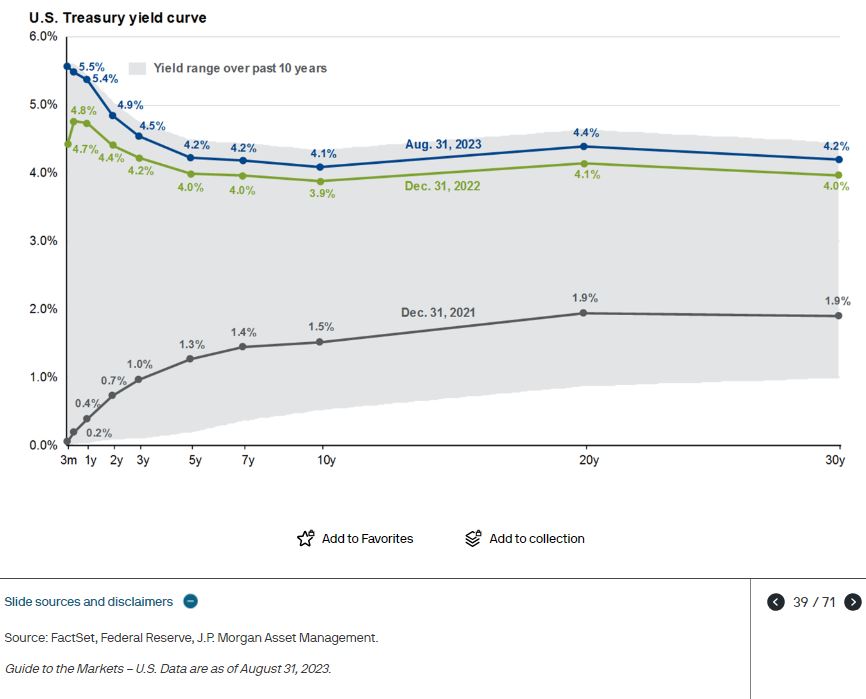

Below is the yield curve for the last several years. Don’t worry; I’m not about to dive into what an inverted yield curve means. Instead, the below graph is intended to show how much interest rates have changed since December 2021 (the gray line towards the bottom of the chart). When comparing December 2021 rates to the Green Line (December 2022 rates) and the Blue Line (8/31/23 rates), the magnitude of the increase in interest rates is clear. Additionally, the chart shows interest rates during most time periods (ranging from 3 months out to 30 years). Interest rates have moved higher across the entire time horizon, but the change has been most pronounced on the shortest part (bonds maturing within 10 years). Changes in interest have a direct impact on bond returns, and increasing interest rates usually negatively impacts existing bond holdings.

How SWP clients’ core fixed-income positions are allocated (one year or less) and why are the two most relevant point for this article. The “why” is the punchline as we’ve removed interest rate risk (protected from higher interest rates) via longer bonds and buying individual treasuries with maturities with less than one year.

SWP was able to execute these trades (and continues to do so) by leveraging technology (no paper trade tickets required!) To boot, all of this is executed internally at no extra cost to clients.

5. Addepar (bonus mention): Addepar is our performance and allocation reporting software. Addepar is the fourth such system I’ve used during my career and my favorite so far. The tool allows us to analyze client portfolios in countless ways as we strive to deliver as much value as possible to our clients. The client portal was built to be a straightforward and useful way for clients to track their accounts, and we’re now able to track outside assets/investments in certain situations. Check it out!

Market opportunities, investment strategies, and reporting software have come a long way since the days of bond and stock only portfolios. Rest assured that SWP is staying ahead of the curve by embracing technology and strategies that are likely to improve client outcomes. As always, reach out to your SWP advisor if you’d like to discuss or learn more!

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).