I have many pet peeves. I don’t like it when pillows in our house are lying on the floor. It irritates me when people talk on speaker phone in public. It drives me crazy when people rush to stand up in the aisle of an airplane once it lands (I’m really not as angry as it might seem).

However, one of my biggest pet peeves is related to financial markets. I find it absolutely maddening when financial pundits claim that investing is like gambling. Take these two article titles as examples:

- From Yahoo Finance: Warren Buffett says the stock market is increasingly ‘casino-like’—and young investors need to remember this ‘one fact of financial life’ to avoid the mess (yahoo.com)

- From the Financial Times: Investing vs gambling: a fine line to tread

While these headlines may garner attention and get clicks, I find them to be quite misleading. In fact, there is a world of difference between investing and gambling.

But first, the similarities

For the sake of discussion, let me address what makes investing and gambling similar. Both activities are commonly associated with risk and uncertainty. When a stock is purchased, or a blackjack bet is made, we don’t know the ultimate outcome. In the short-term, money could be made or lost in either case.

Moreover, there are variables that are out of our control that will lead to these uncertain outcomes. When it comes to investing, there are seemingly unlimited factors that we cannot account for which cause a security to change in value. For example, there could be a surprise in a company’s earnings, an exogenous shock like a global pandemic, or there may just be more buyers than sellers (or visa-versa).

With gambling, there are numerous outside factors that could lead to a surprising result. In the case of a sporting event, a player could be injured in the middle of the game, or a team may perform below expectations. For a card game, we can’t control what other participants do around us (please don’t hit on 13 when a dealer is showing a 4!).

Introducing a longer time horizon

Despite these surface-level similarities, it doesn’t take long before we begin to see that investing and gambling are quite different. This is especially apparent as we consider a longer time horizon.

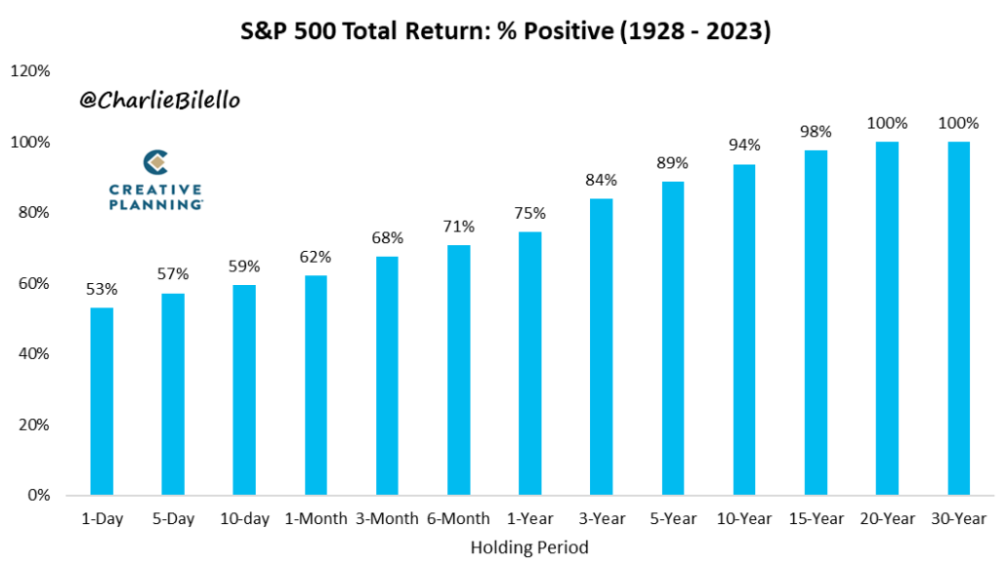

One of the most surprising stock market statistics I’ve encountered is that since 1928, only 53% of trading days have shown positive returns. That’s way less than I would have expected! Although the odds of the stock market going up in a single day are just slightly above 50%, increasing the time horizon improves the likelihood of positive results significantly, as shown in the chart below.

This chart shows that the S&P 500 had positive total returns (returns including dividends) 75% of the time over a trailing 1-year period. And the “odds” improve as the time horizon extends. Look further to the right on the graph, and you’ll see that the S&P 500 has had positive total returns 98% of the time over trailing 15-year periods and 100% of the time over trailing 20-year and 30-year periods. We don’t get a lot of “100% of the time” in finance!

Now, compare this to your odds of winning at a casino. On a one-time basis, your odds of winning different table games aren’t that different than being invested for one day in the stock market. For example, in blackjack, the player has a 42.22% chance of winning any one hand, an 8.48% chance of a push, and a 49.1% chance of losing [1]. Said differently, if you play 60 blackjack hands, you will likely win 26 hands, lose 29 hands, and tie 5 times.

While the chance of winning or pushing a single hand is similar to the historical likelihood of having a positive day in the stock market, the expected long-term results couldn’t be more different.

I mentioned earlier that the stock market has experienced positive returns just over half of trading days dating back almost a century. Just having 53% odds on a one-time basis creates transformational long-term results. To be specific, over the same 96-year time period, when the market was positive for 53% of individual days, the stock market (as measured by the S&P 500) has returned 9.9% annually[2]. If you invested $100,000 and held for 30 years at a 9.9% compounded rate of return, you’d have nearly $1.7 million[3]. That’s not too bad, given you’d make money just over 50% of the time on any given day.

Conversely, if you go to a blackjack table with $100,000 (DO NOT DO THIS! JUST AN EXAMPLE!) and play 1,000 hands at $100 per hand (AGAIN, DO NOT DO THIS!) your expected remaining dollar amount given the above odds is approximately $99,500. This is a net loss after all that time spent at the table! While investing is truly a long game, gambling is anything but.

Investing isn’t supposed to be easy

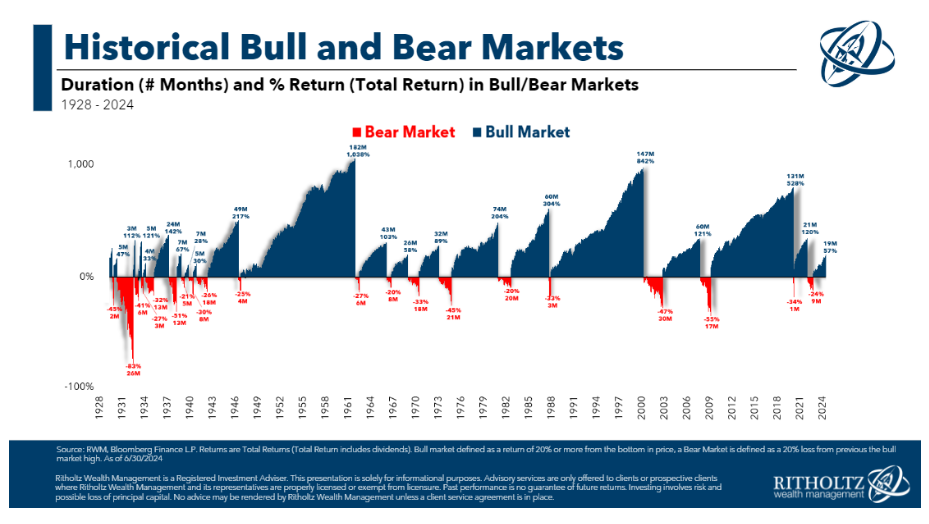

It should be noted that investing isn’t always a walk in the park. There are always sustained bear market periods that can be frightening. However, the bull markets tend to be longer and more than make up for the challenging times. See the chart below.

This chart shows the duration and magnitude of bull markets (the dark blue shaded areas) compared to the duration and magnitude of bear markets (the red shaded areas). Successful investing is time-tested. Sure, it can be a long game, but the “odds” certainly tilt in your favor the longer you stick with a plan.

Investing is not a game of chance

Also, let’s not forget what investing is. It is predicated on often owning cash-flow-producing assets, for example, stocks or bonds, with the expectation that they will generate over time.

The expectation of growth is not by chance or luck. In fact, it is driven by a myriad of factors like economic expansion, company earnings, and improvements in productivity. We, as investors, can attempt to increase returns by holding these assets for extended periods and benefiting from reinvestment and compound interest. Moreover, owning stocks (like Apple, Google, etc.) is owning a small piece of a company and its earnings. Although an investor may only see a monthly statement with a ticker and number of shares, they actually own something.

This could not be more different from the speculative nature of being a gambler. Gambling is mostly a game of chance. The “house” (such as a casino or betting organization) has a statistical advantage, which in turn leads to likely profitability for them over a longer time horizon.

Closing Thoughts

Here’s a saying I really do not like, “I play the market.”

This is not the mindset of a true investor. On the October 25, 2024 episode of The Compound and Friends podcast, Wall Street Journal writer Jason Zweig said, “A casino, if you are a customer, is a place where you go to lose money. A casino if you own it, is a place where you mint money.”

Zweig goes on to ask the question, “Do you want to play in the casino or own the casino?” He then wisely states that “[You can own a casino] by buying a handful of index funds and owning them your whole life.”

This is really the perfect perspective. Sure, there is risk in investing, just like there is risk in gambling, but investors have odds on their side! And, if an investor can endure some difficult periods, history has shown that good results will come.

So, if you are looking for gambling advice, our team is most certainly not the right group to talk to. Alternatively, if you would like to see the power of shifting the odds to your side through a thoughtful long-term investment plan, then please reach out to us. We are here to help.

[1] Best US Casinos, Blackjack Probability of Winning: Odds for Each Hand (Link)

[2] Investopedia, S&P 500 Average Return and Historical Performance (Link)

[3] GIGA Calculator, Time Value of Money Calculator (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).