At Strategic Wealth Partners, we believe in constructing portfolios that are diversified among different asset classes, including stocks, bonds and, in some cases, alternatives. We typically utilize liquid investments, that is, securities that can be sold and converted to cash within a short period of time, often daily and at readily ascertainable prices.

But what about illiquid investments? Can it be advantageous for you to invest in assets that can’t be sold on demand? For some investors, the idea of not being able to liquidate an investment whenever they choose may create an uneasy feeling.

Our role, as your objective advocate, is to make recommendations we believe to be in your best interest and to educate you about options so you are comfortable with the strategies selected. With that in mind, the following is a brief introduction to the basics of illiquid investments and why they may make sense in a portfolio.

Types of Illiquid Investments

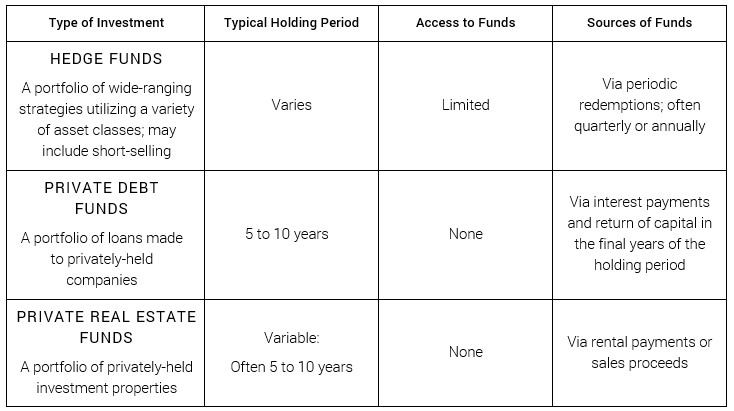

The types and characteristics of illiquid investments are virtually limitless, including commodities like gold, artwork and other collectibles, and even buying a three-flat with your brother-in-law. However, we have generally limited our clients’ investments to professionally managed, diversified strategies that in some ways mirror more liquid investments. Some of these are described below, and include hedge funds, private debt funds and private real estate funds. Each of these has unique illiquidity characteristics:

Potential Advantages of Illiquid Investments

Illiquid investments may help manage overall portfolio volatility, while striving to achieve higher returns. Some of the advantages they offer include:

1. Potential protection against overreacting to short-term market movements.

Individual investors are prone to react to market movements and make irrational decisions. But some investments are designed to exploit longer-term strategies that might take extended periods to generate a favorable return. Restricting liquidity to pre-defined times, as many hedge funds do, may protect a strategy from investors who may have a short-term perspective and who may be quick to punish poor short-term underperformance. In such cases, restricting liquidity may be a blessing in disguise and may offer potential protection to investors from prematurely exiting at the wrong time.

2. Access to certain types of investments.

Some investment assets, such as private debt or private real estate, are, by their nature, illiquid. Investors can only access them through a limited partnership or other illiquid investment vehicle. In certain cases, this trade-off between access and liquidity is worthwhile as these strategies can complement a more traditional asset mix.

3. Reduce investment risk through diversification.

Diversifying the types of investments in a portfolio may help reduce the investment risk that comes with holding just liquid strategies that invest traditional assets, such as in stocks and bonds. Historically, the stock market is known to be very volatile and the bond market to offer limited opportunities beyond capital preservation. Completing a portfolio with some illiquid strategies can provide useful diversification benefits.

Is an Illiquid Investment Right For You?

We often tell clients that planning should drive investment decisions. That is why we construct portfolios from the top down, always keeping the overall objectives in mind, and with each individual investment playing a role. So even clients who have current cash flow requirements can sometimes invest a portion of their overall portfolio in illiquid strategies. For these investors, some strategies generate cash, others growth, still others diversification.

While illiquid investments do sometimes add a bit of complexity, they can be a valuable component of the portfolio. If used appropriately, these strategies can help clients make progress towards their financial goals.

As always, please feel free to reach out to your advisor to discuss if these strategies may be right for you.