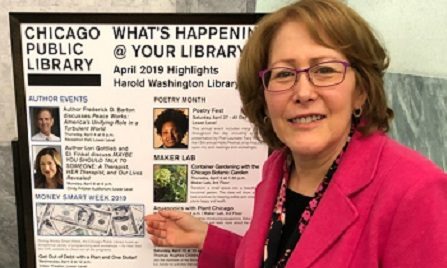

In honor of financial literacy month, Marcie Nach, CFP®, volunteered to meet with attendees at the Financial Planning Association’s annual Money Smart event at the Harold Washington Library in Chicago. “I enjoy addressing the questions raised by people who are working hard to understand their situation and help them determine the best path to move forward. I think this is an important resource for the public,” Nach said. “It was a meaningful experience for me and hopefully for all of the participants.”

Money Smart Week is a coordinated effort among a diverse group of 40+ Chicago-area organizations working together to promote personal financial literacy. Free events and presentations take place over six days in April to help consumers better manage their finances. To learn more about Money Smart Week, visit www.moneysmartweek.org.