The world has become captivated by instant gratification. Smartphone apps, TV and movie streaming on demand, same-day delivery services – the speed of obtaining immediate reward has become an obsession. While this desire for instant gratification isn’t new, research has found that our expectation of “instant” has become faster.

The need for instant gratification has skewed our ability to think about the long term. This effect has also filtered into our collective expectations of what it takes to be a successful investor.

During the pandemic, “meme stocks” grabbed headlines as a handful of investors became overnight millionaires thanks to taking concentrated positions on speculative stocks. Before that, it was cryptocurrencies, tech stocks, speculative real estate, etc. It is all too easy for investors to feel pulled towards leaping from one hot investment trend to another in pursuit of quick wins. However, as these investors who jumped into the meme stock fad learned when they lost all of their gains (and then some) the following year[1], it is important to develop a long-term investment plan.

Many investors believe that they can time the market – by knowing the perfect time to buy or sell stocks. But it is very difficult, if not impossible, to accurately predict the “perfect” time to invest. Investors who wait (and wait) to try to time the market so they can feel the instant gratification of entering the market at the ideal time will likely have sub-optimal results compared to those with a long-term plan who get and stay invested over market cycles.

The Psychology of Impatience

Humans are hardwired to seek pleasure and avoid pain. Research on the pleasure principle, as it’s known in psychology, shows that our brains inherently lean towards instant gratification and strive to prevent any form of displeasure – essentially a type of stress resulting from our unfulfilled immediate desires.

Couple those human tendencies with the allure of ‘perfect timing’ – buying low and selling high at just the right moments – that stems from hindsight bias (looking back after events have unfolded and believing we could have predicted them accurately ahead of time) you end up with a potent cocktail for investors to overcome.

Time in the Market Beats Timing the Market

As advisors, one question we often hear from clients is: “Is now a good time to invest?”

For those with a long-term time horizon, history suggests the short answer is “yes”, especially if they can put money away every year. An analysis of historical data shows that while investing a fixed amount of money at the “best” time every year (when the market is at its lowest) does lead to better results than consistently putting money away regardless of where the market is, the difference in performance is actually not that large.

Trying to time the market brings on a different challenge. Many investors believe they can pick the perfect time to enter the market; however, for a variety of reasons, they may not invest when the “perfect” moment arrives, leading them to stay in cash and lose the long-term opportunity the market may provide.

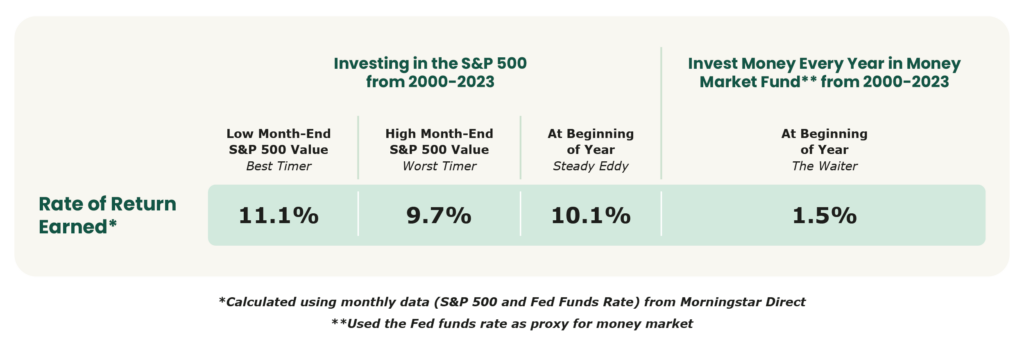

Consider four hypothetical investors who each receive the same amount of money at the beginning of the year, starting in 2000. They follow four different investing strategies based on month-end data.

- The “Best Timer” who consistently invests at the best time of the year when stocks are cheapest (more on the challenge of this in a moment).

- The “Worst Timer” who invariably always buys at market peaks before downturns occur every year.

- The “Steady Eddy” who invests consistently at the beginning of the year regardless of market conditions.

- The “Waiter” who doesn’t invest as they think an even better time to invest will come along during the year.

The chart below shows how each of our hypothetical investors would have done investing the same amount of money annually from 2000-2023. The “Best Timer,” “Worst Timer,” and “Steady Eddy” all invest in the S&P 500, while the “Waiter” invests in cash, as they are still waiting for the perfect time to invest.

As expected, our “Best Timer” outperforms all other investors with an average annual return of 11.1%. Yet not far behind, at a 10.1% average annual return, is our “Steady Eddy,” who invests at the beginning of each year.

As expected, our “Best Timer” outperforms all other investors with an average annual return of 11.1%. Yet not far behind, at a 10.1% average annual return, is our “Steady Eddy,” who invests at the beginning of each year.

The investor who is the “Worst Timer,” and only invests when things are going well (at the market top every year), still ends up with a 9.7% return! Not bad, especially when compared to the 1.5% return earned by the “Waiter” investor who decides to continue to wait for the perfect time and ends up not putting the money to work at all.

As the above scenario shows, having the fortitude to consistently invest, regardless of where the market currently is, can pay benefits for investors. We chose this 24-year period because it captured 3 significant large drawdown events (drawdowns of over 35%) – the tech crash, the Great Financial Crisis (GFC), and Covid. Even with these 3 drawdown periods, the “Worst Timer” still did well, especially compared to the “Waiter.”[2]

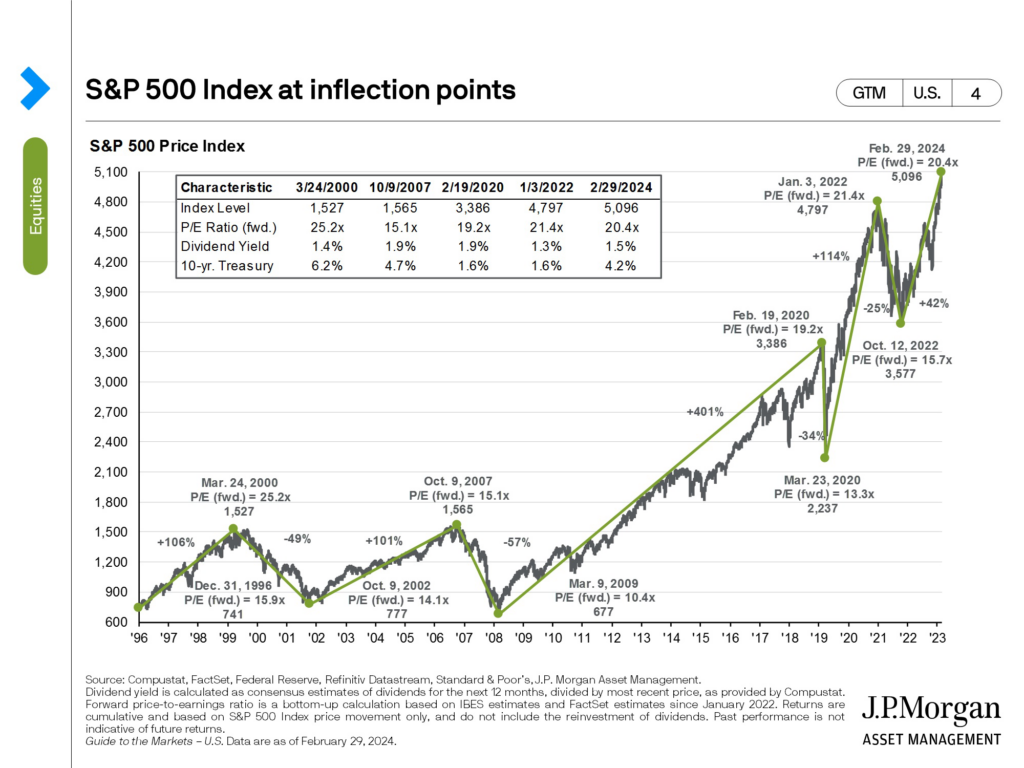

Some investors will always think about the large drawdown events that have happened over their lifetimes. What if a drawdown occurs right when they finally decide to invest for the first time? Wouldn’t it be better to wait until after a large drawdown happens? This approach requires absolutely perfect clairvoyance and the iron will to invest the money as the market is falling – at times, seemingly off a cliff. No one has a crystal ball, and very few have the constitution it takes to invest when the market is plummeting over 40%.

The chart below shows that while recessions can (and will!) happen, the market has historically recovered. Just look at all of the events and crises that the markets have overcome in the past century.

While times of large drawdowns (the Great Financial Crisis, the tech bubble) can cause anxiety among investors, an investor who is able to commit to investing for the long-term, is often rewarded for their decision to invest, regardless of their timing.

Conclusion

It’s easy to get swept up in the pursuit of perfect timing to receive immediate gratification while avoiding pain. However, as we’ve explored, when it comes to investing, the real magic lies in embracing the power of time.

As we better understand the psychology of impatience and the illusion of perfect timing, it becomes evident that patience is not just a virtue; it’s a strategy. One that can be easier with the assistance of a skilled wealth advisor who can help build a resilient, time-tested investment strategy that aligns with your aspirations, guides you through market uncertainties, and helps you stay focused on your long-term goals.

As always, please reach out to the SWP team with any questions. We’re happy to discuss any of these concepts and specific investment strategies in more detail.

[1] Wang, Lu (2022, May 8). Day Trader Army Loses All the Money It Made in Meme-Stock Era. Bloomberg. (Link)

[2] While we recognize we are only showing one 24-year time-period, other research we have seen (e.g. by Schwab (Link)) using rolling 20 year periods has found similar results – this research has also shown it is better to be invested than to wait for the perfect time to invest in the long-term.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).