As savers and investors, there are several elements we can control and many others we cannot. Certainly market returns cannot be controlled, although their results matter a great deal. On the other hand, we can control our ability to save and how much portfolio risk we take; these are two areas that are very impactful in determining the long-term likelihood of a successful financial plan.

The focus of this article will be on integrating two previous SWP blog topics:

- The intersection of things that matter and things you can control was discussed in the article Especially Now, Let’s Focus on What Matters Most written by Tom Buhrmann.

- The impact of sequence risk (aka sequence of return risk) on portfolio outcomes was the topic of the article The Risk You May Not Have Considered, co-authored by David Copeland and Cory Rappaport.

In the sections ahead, we’ll profile two individuals confronted by different but similar issues pertaining to saving and investing.

Let’s begin by visiting with Blake and Taylor. Here is some background:

- Both are in their early thirties.

- Each has the same initial time horizon of 21 years for saving and investing. At the end of this period, they will re-evaluate their pre- and post-retirement plans.

- Both individuals earn the same annual gross salary of $125,000 and work for companies that provide a 401(k) retirement plan match.

- Blake spends more than Taylor, so Taylor can save more in the 401(k) plan.

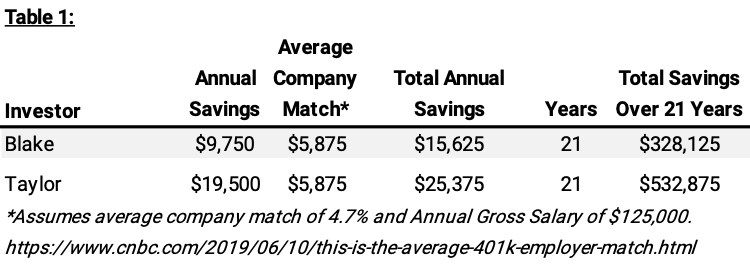

Table 1 below provides an overview of their respective savings, including projected totals over 21 years (note that Table 1 shows savings only; earnings are considered in the following section).

With a review of their savings plans complete, Blake and Taylor turn their focus to investing their hard-earned money. Given their age and time horizon, they feel they are willing and able to take more risk by investing aggressively in stocks within their respective 401(k) accounts. They’ve talked to some of their friends, and many have advised them to “just buy stock funds.” However, they remembered a recent 401(k) information session that highlighted the importance of diversification and managing risk. With access to an advisor through their 401(k) provider, they scheduled a meeting to review how risk and return may influence their long-term savings plans.

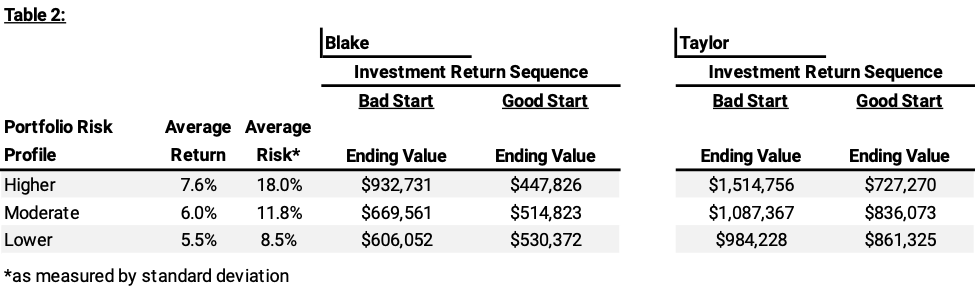

Table 2 below shows the output of three different hypothetical portfolios:

- Higher risk profile – Invested exclusively in a U.S. large-cap stock fund.

- Moderate risk profile – Invested 50%-70% in stock funds with the remainder in bond funds.

- Lower risk profile – Invested 30%-50% in stock funds with the remainder in bond funds.

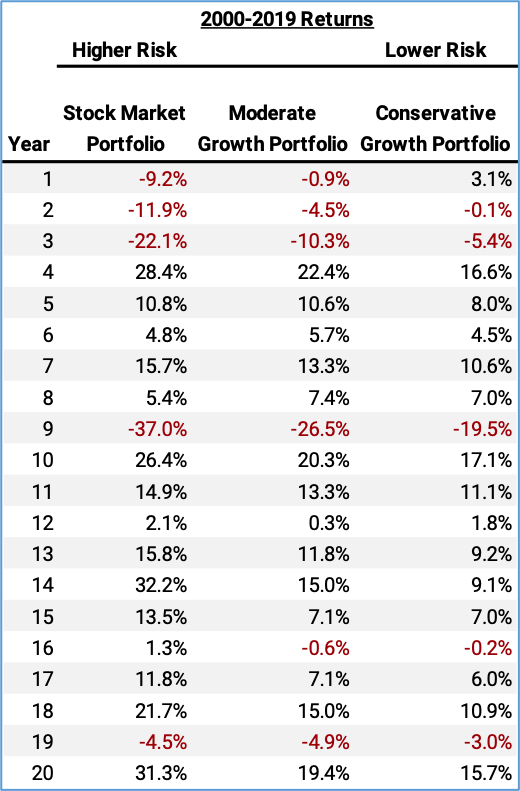

Table 2 below includes two investment returns sequences: “Bad Start” and “Good Start.” The investment return sequence titled “Bad Start” is the actual return outcomes from 2000 to 2019, while the sequence titled “Good Start” is the same annual returns but in reverse order. During the early 2000’s the market performed very poorly, while in the last several years of that period, equity markets performed very well and generated above average historical returns.

The advisor explains that in the early years, losses on the smaller investment balance are far less impactful in dollar terms than the losses occurring later, on the much larger investment balance. She follows with, “losses are actually welcomed during the early period because it allows a saver to invest more at lower prices!”

Blake says, “So, it’s sort of like buying an investment when it is on sale?”

The advisor responds enthusiastically, “YES! Exactly…but unlike many online sale purchases, this one doesn’t follow with a load of junk e-mail after your purchase!”

The advisor then highlighted that this is the opposite of what happens in retirement when investors draw on their portfolios for income needs; when portfolio returns are worse to start, the withdrawals could have a distressing effect on the portfolio value versus if portfolio returns are better to start. That’s because there’s a compounding effect of withdrawing funds from a declining balance – exactly the opposite of buying during a sale.

After reviewing the analysis and talking with the advisor, Blake and Taylor recognize an opportunity to do more ‘fine-tuning’ for their own respective portfolios before deciding on the best path forward. It is clear to each of them now how risk can work against them and their well-intentioned savings plans.

Blake and Taylor’s story is not intended to suggest, or recommend, what the right level of savings or portfolio risk is; we understand everyone has different goals, objectives, and preferences. Rather, our goal is to highlight several key elements of the wealth-building process that play an important role in determining the likelihood of long-term success.

As illustrated in our story, saving and risk exposure have a meaningful impact on long-term outcomes. Notably, it may be the case that a relatively better savings plan allows an investor to assume considerably less risk without compromising the ability to meet their goals. Therefore, the elements Blake and Taylor can control end up creating real outcomes that matter later in life.

If you’re reaching a period in your career where you’re accumulating higher levels of savings, please reach out to your SWP advisor to review how these concepts may apply to you. We are always here to help.

Appendix: