The modern financial landscape is complex and constantly evolving. However, managing complexity and delivering simplicity can come from consolidating these elements under the stewardship of a knowledgeable professional. A professional can help keep track of all the different accounts and investments you may have while optimizing your portfolio for better risk-adjusted performance and a higher level of focus on achieving your overall goals.

The Pitfalls of an Uncoordinated Approach

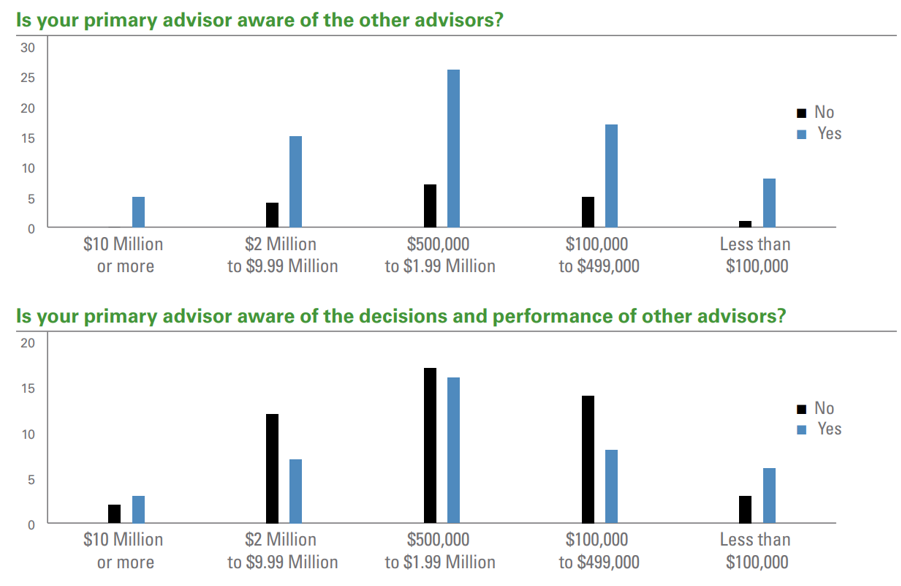

Just as any organized endeavor suffers when the parts of the whole aren’t working in coordination, so too can your investments when they are scattered among several disconnected portfolios. While there is an allure to seeking out different perspectives and management philosophies, all too often, this path can lead to conflicting guidance and strategies that may be duplicative or at cross purposes. A recent report found that investors who use multiple advisors to handle disconnected accounts said their primary advisors were unaware of the decisions and performance of the other advisors. The charts below show that most primary advisors are aware their clients may have other advisors but are unaware of the decisions and performance of these advisors.

Source: State Street and Knowledge@Wharton Survey

The Benefits of Consolidating Your Investment Accounts

The solution lies in adopting a more consolidated model. Consolidating your financial holdings with one wealth manager enables you to utilize a comprehensive approach more effectively.

Asset Allocation

Consolidating your investment accounts provides a more straightforward path to an optimal asset allocation strategy. With all assets visible in one place, it becomes more straightforward to rebalance when necessary and ensures that your risk exposure aligns with your tolerance and goals. A diverse portfolio is a fundamental building block of successful investing, and a consolidated approach guarantees that diversification is not just commonly spouted industry jargon but a consistently applied disciplined practice.

Tax Efficiency

Tax optimization is an often overlooked component of effective wealth management. However, with consolidated accounts and a single advisor overseeing all your investments, potential tax advantages become more apparent and actionable. From capital gains harvesting to strategic distributions, the coordination brought about by consolidation enables you to minimize tax obligations and retain a more significant portion of your investment gains.

Potential Fee Reduction

The administrative burden of managing multiple accounts is not just a matter of coordination but also one of cost. Each separate account accrues its set of fees and expenses that, when aggregated, can represent a significant drain on investment returns. By consolidating accounts, you can potentially reduce these overhead costs, allowing a greater portion of your capital to work for you rather than being siphoned off by unnecessary fees.

A Unified Financial Plan

When it comes to wealth management, the most affluent families often see the benefit of consolidation. A ‘Family Office’ is a singular entity that helps ensure alignment between financial intentions and the tactics utilized to reach them. This mindset applies to all investors wishing to consolidate accounts and effectively ensures that all the moving pieces of a portfolio are carefully reviewed to ensure that they are working together efficiently to achieve optimal results.

Taking the First Step

Consolidating investment accounts under the stewardship of one primary advisor is a decisive move that can redefine the trajectory of your financial future. It’s about unlocking the full potential of your wealth through a streamlined, focused, and strategic relationship. However, like any transformational endeavor, it begins with the first step—a decision to streamline, simplify, and amplify your financial resources. If you are ready to explore consolidation, we encourage you to contact our team to discuss the prospects of streamlining your investment accounts.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).