Background: How We Got Here

- In late 2008, the Federal Reserve (the Fed) cut the Fed funds rate – the target interest rate at which commercial banks borrow and lend their excess reserves to each other overnight – to 0% for the first time in history in response to the Global Financial Crisis.

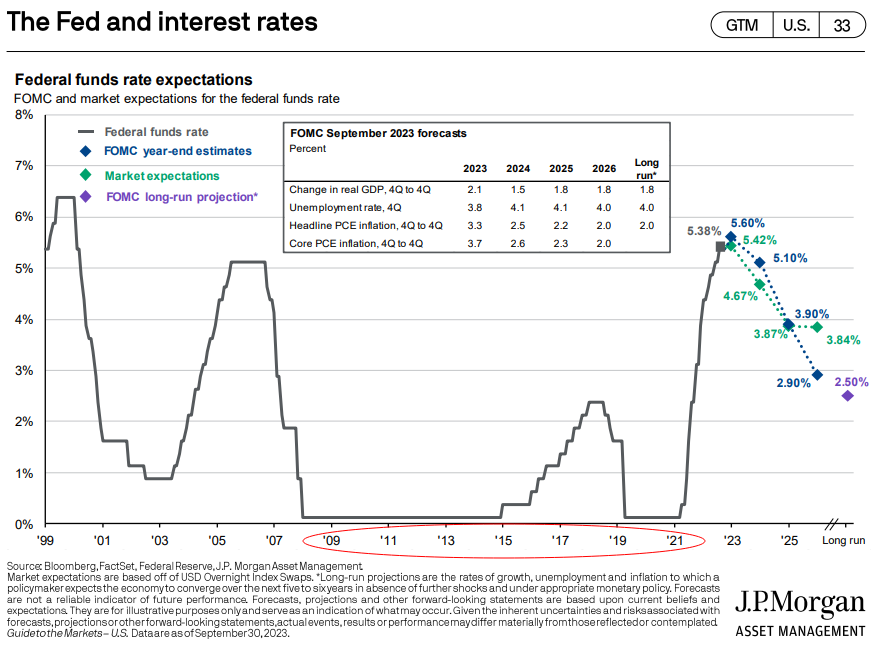

- Since cutting the Fed funds rate to 0% didn’t cause inflation to surpass the Fed’s 2% target (one of their dual mandates is price stability), the Fed maintained this accommodative policy (along with quantitative easing) for the next decade-plus as shown in the chart below.

- Ultra-low interest rates from 2009 to 2021 paved the way for one of the longest economic recoveries in history; during this period, borrowing was cheap and therefore prevalent, and because credit investments offered meager returns, investors were encouraged to pursue higher-return (and higher-risk) investments such as stocks.

- From 2009 to 2021, the S&P 500 (excluding dividends) averaged 14.2% per year, which is about 4% per year, more than its 100-year average; furthermore, there were only two negative calendar years (-1% in 2015 and -6% in 2018). In other words, cheap money created “easy times.”[1]

- Then, in 2020, COVID-19 shocked the world and led to more than $6T of economic relief measures in the U.S. Money printing, along with supply-chain disruptions, created textbook conditions for rising inflation: too much money chasing too few goods.[2]

- Rising inflation started in 2021 (it was initially deemed “transitory”) and continued more aggressively into 2022, which forced the Fed to radically change policy by raising the Fed funds rate to 5.5% as of this writing – the fastest and sharpest hike in history.[3]

Unintended Consequences and Prevailing Narratives

By now, you probably sense a theme with numerous “historic” events and corresponding actions. Unfortunately, we’re now dealing with the unintended consequences. A 0% Fed funds rate is an emergency measure, and surely, we didn’t have a continuous emergency from 2009 to 2015. Ultimately, I believe the Fed now realizes this “loose” monetary policy for nearly 13 years (2009 to 2021) was a mistake and likely explains their determination to keep rates at or near current levels, a.k.a the “higher-for-longer” mantra.

This leads us to the current day and two prevailing narratives, both with potentially profound implications.

The first narrative is that the last two years of aggressive rate hiking and higher rates are an aberration. This was a pointed policy to tame inflation, and sooner than later, we’ll revert to ultra-low rates. (As an aside, there was an accepted notion in 2020 that deficits and national debt could be disregarded in countries with “control of their currencies.” Unfortunately, that is not the case.)

The second narrative is that the last two years are the norm for where rates should be, and the 13 years prior to that were the exception.

Of course, nobody knows for sure, and predicting interest rates, just like markets or economies, is extraordinarily difficult. Even the Fed, with all its resources, has been woefully wrong with its “dot plot,” where they attempt to forecast future interest rates.

If the first narrative plays out and we find ourselves back in an ultra-low-rate world, we have a playbook for what works and how to invest. But, for argument’s sake, let’s assume the second narrative comes to fruition. What does it mean? Who benefits? How should we invest?

What does it mean?

There are several implications of higher interest rates. Businesses and consumers could encounter more challenges trying to obtain financing. The higher cost of capital could reduce profit margins, which could lead to slower economic growth and higher unemployment. Higher rates will likely lead to an increase in default rates. All these factors influence business and consumer economic sentiment and activity. For a simple example, think of a first-time homebuyer in 2023 (7% rate) vs. 2021 (3% rate). The monthly payment for the same property value is about 60% more today![4]

Who benefits?

It’s a role reversal from the last decade-plus: savers benefit and borrows now face headwinds. In the short run, while rates are rising, bond funds perform poorly, given the inverse relationship between interest rates and bond prices. Eventually, as rates stabilize, bond funds weather the storm and reinvest at higher rates for a more attractive return. Interest rates also affect the stock market for many of the reasons above – lower profitability, lower economic output, lower sentiment, etc.

How should we invest?

Credit investments are more attractive. Various public and private credit strategies now offer pre-tax yields that are in line with historical stock market returns. This hasn’t occurred in decades! And there’s an important distinction between equity and credit investments – credit investments are contractual. In an oversimplified example, the lion’s share of the return comes from the interest paid from the borrower to the lender. That interest is contractual, as is the principal repayment. Often, the collateral for the loan is company assets or the company itself, so if the borrower doesn’t pay as promised, the lender (and other creditors) take ownership. This provides the borrower with a significant incentive to repay the loan and fulfill their contractual obligation. This return stream has nothing to do with the stock market’s behavior and inevitable ups and downs. As such, it is generally viewed as a less volatile and more predictable (due to cash flows) investment. The difference between investing in equity and credit is stark but likely underappreciated, and for the first time in a long time, credit investments are appealing and offer comparable prospective returns to equities. SWP’s Co-Founder and Chief Investment Officer, David Copeland, recently issued an article about alternative credit.

While we can’t possibly know what’s ahead, it’s clear the environment has changed, and like any good game plan, there are adjustments to be made and new opportunities to capitalize. I came across a good quote recently in Morgan Housel’s newest book, Same as Ever: “Humans are actually very good at predicting the future – except for the surprises, which tend to be all that matter.”

As always, please contact your SWP team with any questions. We’re happy to discuss any of these concepts and specific investments in more detail.

[1] YCharts, S&P 500 Annual Return, (Link)

[2] Washington Post, The U.S. has thrown more than $6 trillion at the coronavirus crisis. That number could grow., (Link)

[3] Visual Capitalist, Comparing the Speed of U.S. Interest Rate Hikes (1988-2022), (Link)

[4] MReport, Average New Mortgage Payments up 60% in Last Two Years, (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).