The last several trading days serve as a cruel, but important, reminder to investors – despite what has transpired over the past couple of years, investing in the stock market is not always a smooth ride. This is hardly profound, yet it is a good reminder as many investors were lulled into a false sense of security given recent highlights, including:

- January 2018 marked the 15th consecutive “up” month for the S&P 500, a historic streak achieved only one other time (March 1958 to May 1959)

- The S&P 500 posted positive returns in 22 of the last 23 months dating back to March 2016

- It has been two full years since the last “10% correction” for the S&P 500, a 13.3% drop over three months that ended February 11, 2016

- At 106 months, this is the second longest bull market in 90 years, eclipsed only by the 113 month bull market from 1990 to 2000

For historical context, consider this:

- Over the past 75 years, the S&P 500 had 28 declines of at least 10% but less than 20%, which is about once every 2.7 years

- There have been 10 declines greater than 20% over the past 90 years

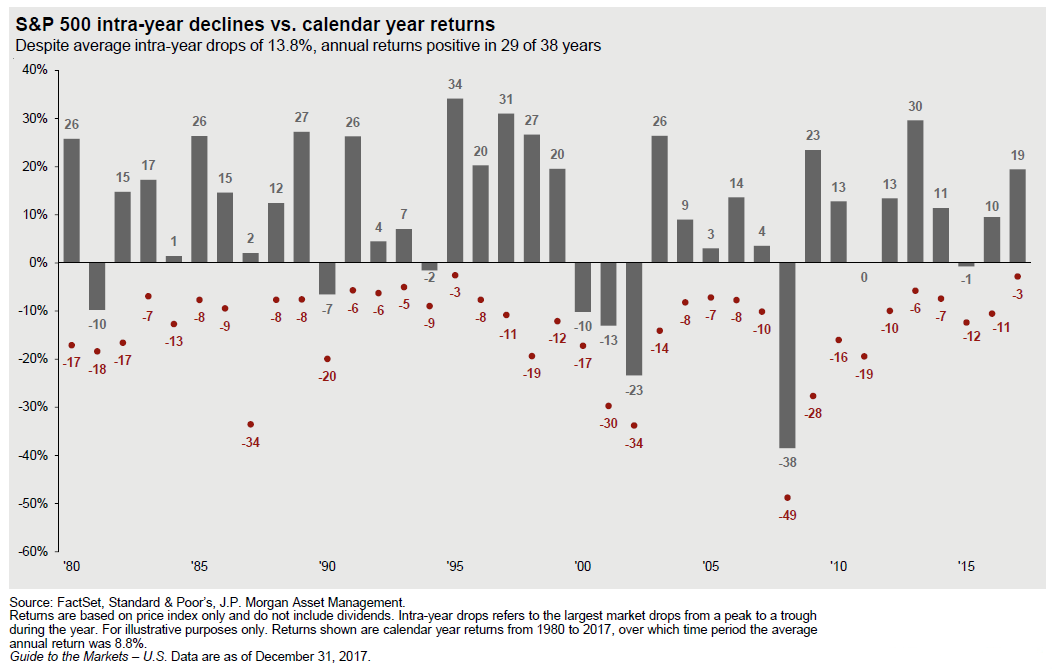

For additional perspective, the dark grey bars in the chart below represent the price return of the S&P 500 in each calendar year dating back to 1980, while the red dots show the largest intra-year drops during those same years. For example, the last year on the chart (2017) shows that the S&P 500 gained 19% (excluding dividends), and the largest decline during the year was 3%. Looking more broadly, most years yielded positive returns, but even in strong years, it is very normal to see declines of 10% or more. In short, volatility is normal, and the upward escalator of the past couple of years is not!

On the heels of a strong stock market in 2017 (S&P 500 total return of +21.8%), followed by a fantastic January, a bull market approaching its ninth birthday in early March, and then the angst of a market “selloff” thus far in February, the natural question is “Where is the market headed?”

It’s the multi-billion dollar question and one that we simply don’t have the answer to. I often hear myself and colleagues say, “We’re smart enough to know that we’re not smart enough to predict short-term results.” Admittedly, our crystal ball, even if we had one, is cloudy. That’s not an admission of guilt or lack of skill, and certainly not something to apologize for. Rather, it’s fundamental to our investment approach of creating a tailored plan for every client and staying focused on long-term results.

The truth is, no one knows where the market is headed tomorrow, next week, or the remainder of the year. Yet that doesn’t stop smart people from offering short-term predictions. While these can often be persuasive – based on seemingly good research, data, financial models, qualitative arguments, etc. – they can lead to rash decisions. A quick internet search yields countless articles and studies documenting the miserable track record of “market gurus.” As Yogi Berra once said, “It’s tough to make predictions, especially about the future.”

Basic human psychology is such that uncertainty causes anxiety, while certainty is rewarding. Uncertainty triggers an alert response; certainty evokes positive feelings and reduces fear. As a result, market predictions satisfy a human instinct but are rarely correct and seldom useful in the short-term. Ironically, the surest short-term prediction for the stock market is uncertainty. It’s the cost of entry that allows for long-term wealth creation, so the only logical choice is to embrace it.

Despite the unsettled feelings of the past several days, simply put, our advice is to stay the course. A big part of our role in serving clients lies in developing an asset allocation strategy that is designed to meet each client’s unique situation. Short-term money is not invested in inherently risky assets, such as stocks. Stay the course, and this too shall pass.

As always, we welcome your feedback and questions.