I filled up my car with gas the other day, and it cost $91.78. Good times!

As I reflect on the first five months of 2022, expensive gas is certainly one thing that sticks out. Inflation is running at +/- 40-year highs, and we are all feeling it one way or another. Even my Starbucks Venti Cold Brew costs 25% more than a year ago!

I find the economy and financial markets so interesting because of how intertwined everything is. For example, rising inflation impacts corporate earnings, which, in turn, impacts stock prices. To be sure, some companies benefit from inflation, but many more are hurt by it.

Then there is the Federal Reserve (Fed) which has a dual mandate of price stability and maximum sustainable employment. With the current rising inflation, the price stability mandate has been compromised, and as a result, the Fed has had to enact a policy in an effort to curb inflation. Up go interest rates, and subsequently down go bond prices. And I have not even mentioned the threat of a recession yet! See, it is all connected!

When you put all these variables together, it can be quite confusing.

So how do I deal with this? I think it is always a good idea to slow down and look at things one by one. This allows me to think more clearly and rationally – which we can all benefit from after checking our portfolio returns this year.

With all that said, here are a few thoughts on where we stand today.

Inflation

Inflation seems to be the number one topic on everyone’s minds these days – just take another look at the picture above. Demand for both goods and services has been considerably outpacing supply, which has sent inflation to levels we haven’t seen in decades.

On May 27, data from the Commerce Department showed that the consumer price index (commonly referred to as CPI) was at 8.3% in April.[1] This is its highest level since the early 1980s

One component of inflation that I have been particularly intrigued with is wage growth. Many employees, especially at lower wage levels, have received meaningful raises from their employers. I think raises are long overdue (in many cases) and, in today’s economy, are really important. But we do enter this circular trap where it can feel like a hamster running on a wheel. This is because higher wages mean higher costs for businesses, which then forces businesses to raise prices to preserve profitability. In effect, these higher wages have helped strengthen the finances of consumers, who can then continue to spend and enable businesses to keep raising prices.

It certainly feels like inflation is driving everything. So how does it ultimately get tamed? Enter the Fed (insert ominous music here).

The Federal Reserve

The Fed is caught between a rock and a hard place.

It needs to walk the line of enacting strategies (rate hikes and balance sheet reductions) to curb inflation while ideally not pushing the U.S. economy into a recession. This would be that “soft landing” you may have seen blasted across your television screen over the past couple of months. Rising interest rates are stressful, but this needed to happen (I’ll get to that later in the bond section of this piece.) The Fed had to enact the policy that it did in March 2020 to keep us out of Great Depression 2.0, but life, where borrowing costs are effectively 0%, is not sustainable.

While the Fed has already made a couple of interest rate increases, the Fed minutes released in late May indicated that officials are prepared to move ahead with multiple 50 basis point interest rate increases. On top of this, the Fed has just begun the process of “quantitative tightening,” which means it will let bonds on its balance sheet mature and will not purchase new bonds. The impact of this should be higher yields because the Fed is draining liquidity from the financial system (less liquidity means higher interest rates).

Even though this Fed policy is well underway, many have criticized the central bank for being too slow to address the inflation issues we are facing. Not everyone agrees, though, especially those concerned about this Fed policy being too aggressive and pushing us into a recession (insert more ominous music here).

The Economy and a Recession

Remember, the Fed is not trying to force the economy into a recession. Rather, it’s trying to tame inflation by bringing all of the excess demand back in line with supply.

Regarding recessions, it’s important to acknowledge that not all of them are as extreme as we experienced in 2008 or 2020. Sometimes recessions are benign, and we don’t even realize that they happened until they are in our rear-view mirror.

In the last 80 years, we have had 13 recessions:

While each of these recessions occurred for different reasons and had a different magnitude of impact on our economy, the one commonality is that they all ended. Every. Single. One.

While each of these recessions occurred for different reasons and had a different magnitude of impact on our economy, the one commonality is that they all ended. Every. Single. One.

With all of that said, I’m actually pretty optimistic about the economy.

U.S. employers had 11.4 million job openings as of April, while there are currently just 5.9 million people who are unemployed. In other words, there are nearly two job openings per unemployed person. Some additional context to the numbers above: The pre-pandemic high for job openings in the U.S. was 7.5 million. We are now at more than 11 million.

These employment figures are a sign that the economy is doing well.

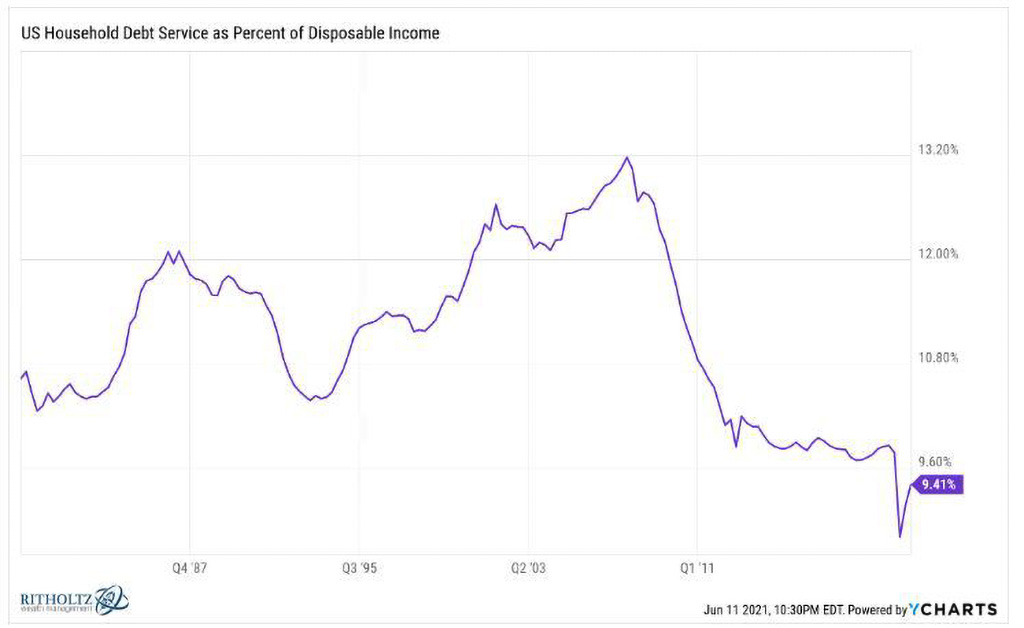

In general, households and businesses are much more cash-rich than they were before the pandemic. Just look at the U.S. Household Debt Service as a Percent of Disposable income.

Household debt is basically at its lowest point relative to disposable income in the last 40 years. This is especially important because the consumer represents 70% of U.S. GDP.

There are certainly headwinds, but a soft landing for the economy is not off the table. Stay positive!

Stock Market

Peter Lynch, a famous American investor and portfolio manager with Fidelity, once said, “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

This quote is especially poignant today as investors consider how the stock market will be impacted by inflation, Fed policy, and a possible recession.

One thing is for certain, though, it’s been a quite challenging year for stocks.

If the year ended today, this would be the 8th worst year for the S&P 500 (large-cap stocks) since 1926.

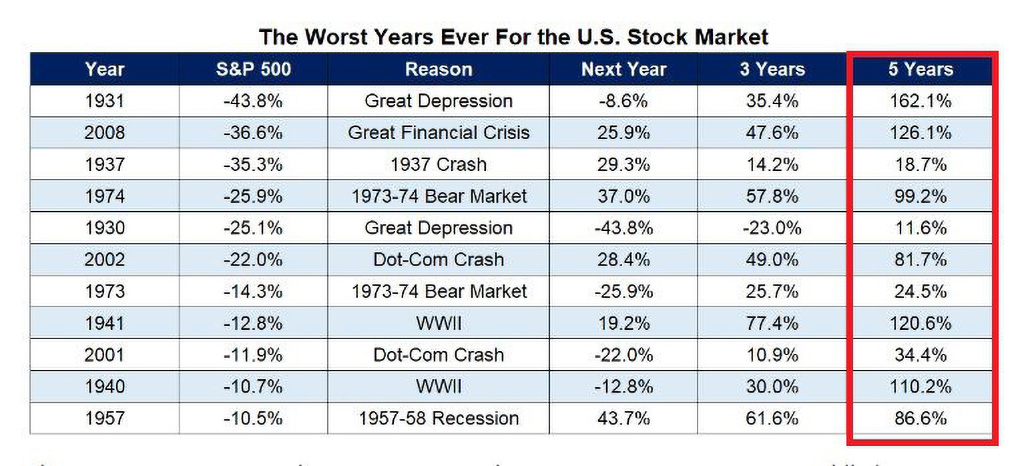

But here is some good news, lower prices mean higher expected returns. And as history shows us, the total returns after bad years have been really good, especially when looking out over a 5-year period. This table shows the forward 1, 3, and 5 year total returns following the previous 11 worst years in the stock market. Notice that there has been no negative 5-year return (red box) following one of these bad years. If you exclude the Great Depression years (which I believe is acceptable to exclude because the Fed was in its infancy), the worst cumulative 5-year return was 34.4%. It could be worse if you ask me.

This table shows the forward 1, 3, and 5 year total returns following the previous 11 worst years in the stock market. Notice that there has been no negative 5-year return (red box) following one of these bad years. If you exclude the Great Depression years (which I believe is acceptable to exclude because the Fed was in its infancy), the worst cumulative 5-year return was 34.4%. It could be worse if you ask me.

In the long run, holding stocks has always worked out because things eventually get better. This shows itself through growing corporate earnings which filter through to equity owners. But in the short run, anything can happen.

Those stock investors who are patient enough to sit through some short-term losses are rewarded in the long run.

Bond Market

Getting back to the interconnectedness of everything. Inflation is bad for bond holders that collect fixed interest payments. This is because those interest payments cannot grow and keep up with the rising costs of goods and services.

So far this year, the bond market is down around 9%. Prior to this year, the worst year for the bond market index was down 3% in 1994. We are already 3x below that!

Let’s focus on the positives. I do not believe that there are any systemic issues in the credit markets. Bonds have lost value because interest rates have gone up. While this is painful in the short-term, over the long-term, that means higher returns for fixed-income investors. This is because the best predictor of future bond returns is current bond interest rates.

The past is the past, and all that matters is the path forward. Today, the yield on the 10-year treasury is almost twice as high as it was at the start of the year. While year-to-date returns are negative, expected returns are higher. Additionally, I believe that at a certain point, demand for bonds will go up as investors can generate more interest income than before. It might be when rates are 3%, might be when rates are at 4%, or even higher. But rates will not rise forever.

Closing Thoughts

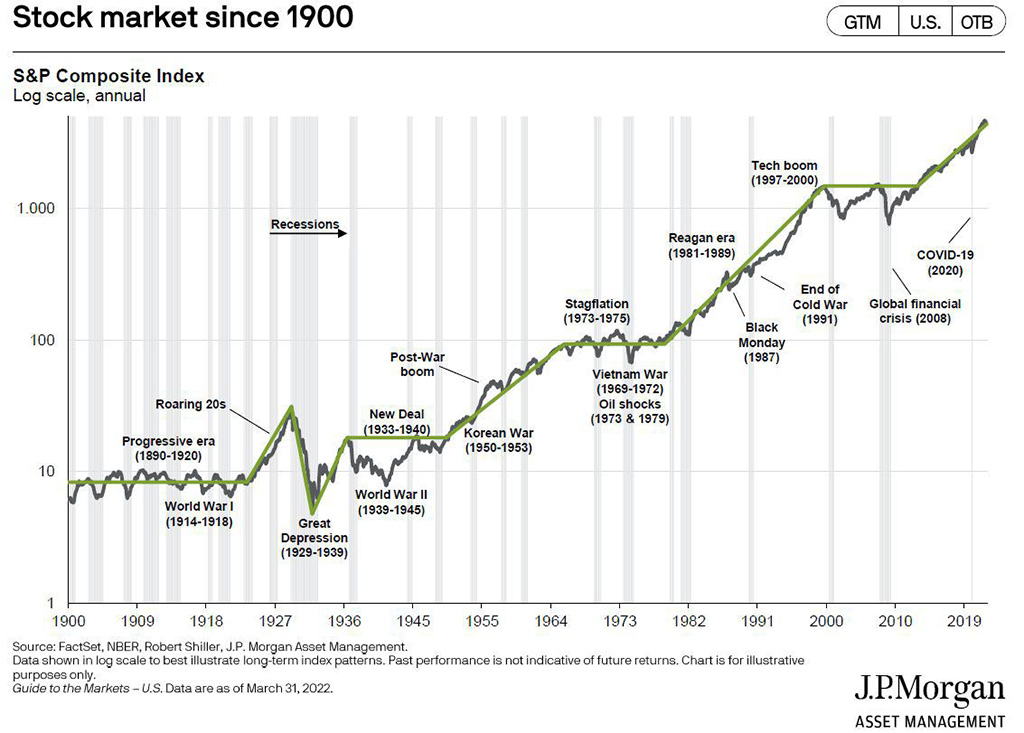

Outside of more expensive gas and coffee, what does all of this mean for you and your portfolio? First and foremost, remember, that your financial plan isn’t based on timing the market perfectly. You simply can’t expect everything to go up all the time, and you have to be ready for some uncomfortable economic and market conditions. But this isn’t the first time we’ve experienced tough conditions. Just look at this “wall of worry.”

This graph shows that there have been a lot of scary times over the past 100+ years, but stocks trend up. I don’t mean to minimize the current issues, but there will always be concerns, and the markets will persevere.

This graph shows that there have been a lot of scary times over the past 100+ years, but stocks trend up. I don’t mean to minimize the current issues, but there will always be concerns, and the markets will persevere.

Investing is not supposed to be easy. When factoring in current events and the relationship between economic principles and the financial markets, everything can feel overwhelming. That’s why I like to slow down and consider everything one at a time.

If you are looking for some guidance through this difficult period, please do not hesitate to contact our team.

[1] CNBC, The Fed’s favorite inflation measure rose 4.9% in April in a sign that price increases could be slowing (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).