After calling Suite 270 in 520 Lake Cook Road home since SWP’s founding in 2008, we started a new chapter on July 12 by moving up a few floors to Suite 520. Our new office features state-of-the-art conference rooms and space for the firm’s continuous growth.

Come check it out during our open house for our clients, partners, and friends on Tuesday, July 30. If you are unable to attend, your advisor would be happy to give you a tour of our new space at any time.

Below are some photos of our moving process.

Touring the new space before our first day of business in Suite 520.

Suite 520 is fully unpacked and up and running.

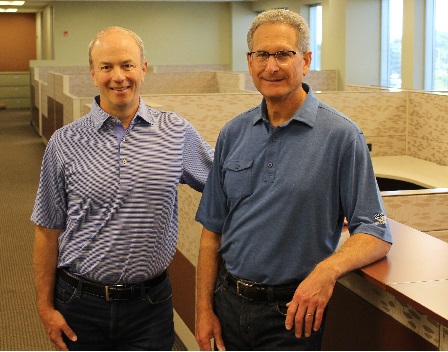

Founding Principals Neal Price and David Copeland pose for one last picture in Suite 270 on July 12.