This spring I turned 34. As with most birthdays, I took some time to reflect on how the world has changed. More times than not, my mind wanders to the changing landscape of financial markets. I must have chosen the right career!

The recent rise in interest rates has sparked conversations with clients who have questions about the role of fixed income in their portfolios. When interest rates increase, prices decrease. Thus, many investors are seeing negative year-to-date fixed income returns in their portfolios.

A couple of questions I have received from clients:

- If interest rates are going to continue to rise, does it even make sense to include fixed income in my portfolio?

- In this rising rate environment, is it better to hold individual bonds rather than fixed income mutual funds?

Before you make any decisions about the fixed income in your portfolio, I want to provide some clarity on the role of fixed income in a well-diversified portfolio, as well as the different ways to invest in this asset class. But first, let’s spend a minute on the history of the bond market.

One caveat: The terms “fixed income” and “bonds” are often incorrectly used interchangeably. Fixed income is effectively an investment in which the issuer is obligated to make fixed payments on a fixed schedule. It is a broad term, and there are various securities that can be considered fixed income, but are not bonds (for example, mortgage backed securities). Bonds are a type of fixed income, and more specifically are debt obligations issued by entities, such as corporations or governments.

QUICK BACKGROUND ON FIXED INCOME

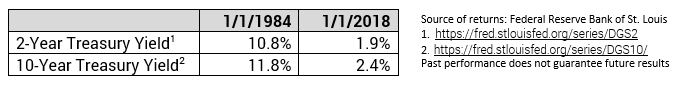

The fixed income markets have changed considerably since I was born in 1984. Consider the shifts in the 2-Year and 10-Year Treasury Yield:

In 1984, rates were high by historical standards. After keeping interest rates at historically low levels for many years, the Federal Reserve raised the Federal Funds rate by 25 bps in 2015. More recently, over the past 15 months, the Federal Reserve has raised rates 5 times, for a total of 1.25%. In 2018, investors are finally starting to feel the pain. This year, the 10-year treasury rose from 2.40% to 2.90%3. This may not seem like a large increase in absolute terms, but, in relative terms, it is over a 20% jump.

As a result, the Barclays Capital U.S. Aggregate Bond Index is down almost 2% year to date. This means negative year-to-date fixed income returns for investors.

REASONS TO REMAIN INVESTED IN FIXED INCOME

1. Fixed Income helps manage portfolio volatility.

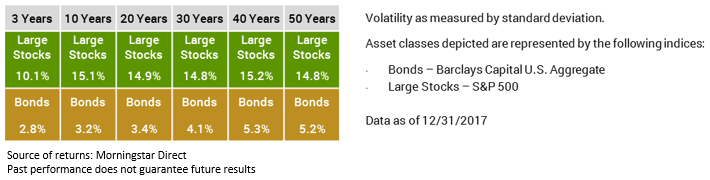

Owning fixed income is one of the best ways to manage overall risk in an investment portfolio. Over the past 50 years, bonds have been consistently less volatile than stocks. Consider the historical standard deviation of the stock market vs. bond market:

As a refresher, standard deviation measures how far an actual value deviates from its historical average. Within an investment portfolio, a lower standard deviation means the asset has been less volatile and the returns are closer to their historical average.

As such, a portfolio that includes bonds should have returns that are more stable over time. This can be especially important for investors who are uncomfortable with the more unpredictable returns of the stock market.

The last 50 years have seen periods of rising rates and falling rates. As the above chart shows, bonds have always been considerably less volatile than stocks.

2. Fixed Income may generate positive returns (even during times of rising rates).

Fixed income doesn’t just serve to protect against the swings of the stock market – it can produce positive returns even during times of rising rates.

Since the early 1980s, interest rates have generally been falling in the U.S. During this time, however, there have also been periods of rising interest rates. At times, this has caused periods of negative returns for bond investors – but not always.

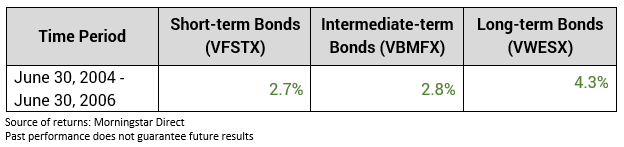

From summer 2004 through summer 2006, the Federal Reserve was concerned about rising inflation. As a result, from June 30, 2004 – June 30, 2006, they systematically increased the Federal Funds rate 17 times – from 1% all the way to 5.25%. During this time, the returns on different parts of the bond market were actually positive:

The table above shows the cumulative returns of three different Vanguard bond funds during the period of rising rates. We see that short-, intermediate- and long-term bonds (as measured by the performance of these 3 funds) all generated positive returns, despite the Federal Reserve raising the short-term Federal Funds rate.

DECIDING BETWEEN INDIVIDUAL BONDS AND BOND MUTUAL FUNDS

There are two primary ways to invest in fixed income: individual bonds or fixed income mutual funds. Seeing some losses in their funds, investors are wondering if it makes sense to hold individual bonds instead of funds. Below, I share two reasons you may consider remaining invested in funds.

1. Opportunity cost of holding individual bonds to maturity

Individual bonds pay a stated interest rate until they mature, so many investors feel comfortable knowing that they will get their principal back at maturity. But that buy-and-hold “certainty” comes with an opportunity cost: If rates rise while investors are holding the bond, they could miss out on other opportunities offered by newer bonds on the market.

Moreover, when interest rates go up, individual bonds technically fall in value just like a bond fund. Yes, an investor will get principal back by holding the bonds to maturity, but in an environment with higher interest rates and possibly inflation, that same principal amount will be worth less in nominal terms.

2. Flexibility of fixed income managers

Fixed income mutual funds hold numerous securities with a variety of maturity dates and income payments. When interest rates rise, the prices of the positions in the funds generally decline. This subsequently causes shares of the mutual funds, which price daily, to fall. The long-term impact to investors, however, may not be as bad as some think.

Fund managers do not have to hold all securities until maturity. Funds have the flexibility to buy or sell prior to maturity to try to maximize the overall coupon income their funds produce. For example, when interest rates rise, a fund can sell a bond it holds and replace it with a higher yielding bond. When this strategy is executed multiple times within a fund, it can increase the total return over the long run. Moreover, fixed income managers can own securities that many individual investors cannot. For example, a fixed income fund can own mortgage-backed securities or privately issued debt. These types of securities may have less interest rate risk and are difficult for individual investors to purchase directly. Fixed income managers can also implement unique strategies, different from a bond ladder, to generate return. For example, a manager can utilize a barbell strategy by investing in long- and short-term bonds. This can be useful in a rising interest rate environment because the short-term securities are rolled over at maturity and reinvested to receive a higher interest rate, thus raising the value of the strategy.

MAKING A THOUGHTFUL DECISION ON FIXED INCOME

When I was born, my parents’ investment portfolio was comprised exclusively of fixed income. Why? Because fixed income produced much larger returns than it does today. A lot has changed over the last 34 years. While returns on fixed income may not be as high moving forward, we believe that fixed income remains an important part of well-diversified portfolios.

We welcome the opportunity to discuss this further.

Sources:

3. Data as of 6/22/2018

https://www.betterment.com/resources/investment-strategy/portfolio-management/bonds-rising-interest-rates/

http://theirrelevantinvestor.com/2018/02/22/when-stocks-and-bonds-fall/

https://www.schwab.com/resource-center/insights/content/should-you-hold-bonds-or-bond-funds-when-interest-rates-rise

http://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart