I’ve been in ongoing “negotiations” with my 10-year-old daughter about whether she can have an Apple Watch, iPad, or iPhone. There is no quit in this child. When my wife and I say no to the watch, she pivots to the iPad. When we say no to the iPad, she asks for the phone. Around and around, we go.

Recently, after yet another Apple Watch request, I decided to have a little fun. I said, “We’re not buying you a watch, but how about some Apple stock instead?” Her reaction was about what you’d expect: arms crossed, eyes rolled. She asked, “What even is stock anyway?”

I explained that owning stock means owning a piece of the actual company. She told me that made no sense, reminded me it wouldn’t help her text her friends, and stomped off to her room.

But the exchange got me thinking. Too often, people see stocks as just ticker symbols or names on a statement. The idea of stock as an investment can feel abstract. In reality, stock ownership is not abstract at all. It is one of the most powerful ways to participate in the growth and innovation of corporate America, and the world.

What a Share Really Is

A share of stock is not just a digital entry in a brokerage account. It is a fractional ownership stake in a business. That ownership comes with rights, like voting on corporate decisions or collecting dividends, but more importantly, it means you are tied to the company’s earnings.

Think about it this way: if you owned a local bakery in your town, you would not see it as a line on a financial statement. You would see ovens, staff, customers, recipes, and Saturday morning lines out the door (my kind of bakery!).

Publicly traded stocks are the same, just on a much larger scale. When you hold Apple, you own a slice of the teams designing the next iPhone and the profits those phones will generate. When you hold Costco, you own a piece of the items in every shopping cart being pushed down the aisle.

Investing = Participating in Innovation

One of the most exciting aspects of investing is that it lets you participate in innovation without being the one in the lab coat or behind the drafting table. Most of us are not going to code the next AI breakthrough, besides perhaps one of my exceptional daughters. But by owning stocks, we get to stand alongside and participate in the earnings of the companies doing these things.

Consider Apple in 2007. The iPhone did not just appear. It required years of R&D, global supply chains, and marketing. Shareholders provided the capital and stayed invested through uncertainty. They participated in reshaping how the world communicates and the growth in share price reflects this.

That is the magic of stocks. You do not just watch innovation from the sidelines. You get to own a piece of it.

The Long-Term Growth Story

The U.S. economy is a growth machine, but it does not move in a straight line. Recessions happen, the financial media stirs the pot, and markets stumble. But over time, productivity improves and businesses grow. This is because, in good times and bad, humans innovate and businesses adapt.

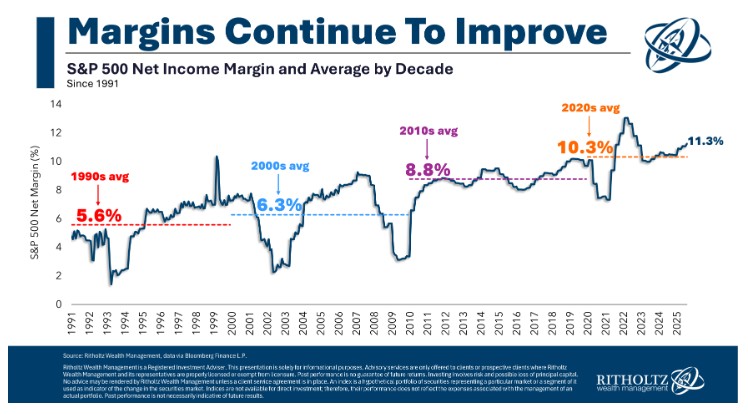

One of the clearest demonstrations of this story is the resiliency of corporate profit margins. Not only have companies been able to grow their revenues, but they have also become more efficient at turning those revenues into profits.

This graph below shows that in the 1990s, S&P 500 net margins averaged about 5.6%. In the 2000s, they rose to 6.3%. In the 2010s, they averaged 8.8%. And in the current decade, margins are averaging above 10%, with recent levels near 11%. That means companies are keeping nearly twice as much of every sales dollar as profit today compared to a generation ago.

That margin improvement is part of why earnings have grown so steadily, and why stock prices have followed. And earnings are the most important driver of stock prices.

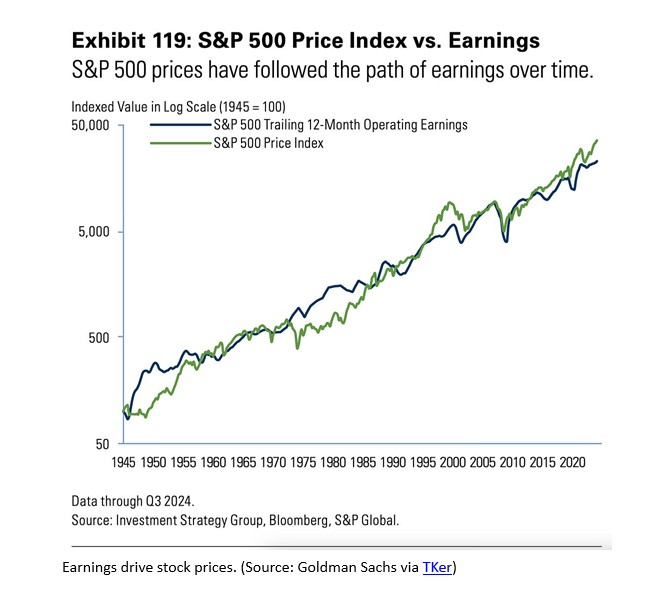

The simplest explanation for the stock market’s strength over time has been that company earnings have steadily grown. The graph below shows the strong correlation between corporate earnings and stock prices:

Going back to 1945, stock prices, as measured by the S&P 500 (green line) have almost perfectly tracked trailing 12-month corporate earnings (blue line). When companies generate earnings, stock prices go up. This is what matters the most.

The Democratization of Ownership

What is powerful is that this ownership is not reserved for the Rockefellers of the world anymore. A century, the idea of an average person being a co-owner in the country’s largest corporations was unthinkable. It is estimated that less than 3% of American households invested in the stock market heading into the Great Depression. Today, that number is over 60%[1], as the barriers to entry are remarkably low. Through 401k retirement accounts, brokerage apps, and ETFs for example, millions of ordinary investors own pieces of Apple, Amazon, Microsoft, Disney, and more.

That accessibility matters. It means wealth creation is not just something that happens “out there.” It is something you can take part in, whether through your 401(k) or your kids’ 529 plan.

Every time you walk into Starbucks, place an Amazon order, or watch a Disney movie, you are also interacting with companies you might own. You are both a customer and an owner, and that is a powerful connection.

Conclusion

I should have made a disclosure in the introduction: this was never about suggesting Apple stock as an investment. It is true that I admire the company, use its products, and that the stock has done well over time. But two things remain true: I do not recommend individual stocks, and I am not buying my daughter an Apple Watch.

What I am an advocate for is broad stock market investing, assuming it fits your goals and plan. Being able to invest in stocks is a privilege. It is something I do. It is something my parents do. It is something my grandparents started doing 70 years ago. And it is something my kids will do when they are older.

Stocks are far more than symbols on a statement or headlines in the financial press. At the micro level, stock ownership is participating in company earnings. At the macro level, it is an investment in the future of the world.

If you are interested in discussing your exposure to stocks, or more broadly, how investing fits into your financial plan, I am always happy to have that conversation.

[1]Stock Market & Home Ownership Rates

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).