Equity markets are performing well, but many of our clients have expressed concerns about what the future might hold and what steps they can take today to prepare for what comes next. In this article, we’ll share five of the most commonly asked questions we’re hearing from our clients and our perspective on each.

As always, we invite you to connect with our team about anything that is covered.

1. I’m hearing a lot about inflation. What can we do from a portfolio standpoint to help address this?

This is perhaps the single most frequently asked question we’ve gotten from clients.

In our view, traditional equities are one of the best hedges against inflation. Growth in earnings and dividends of publicly traded companies have historically outpaced inflation, and equities have a high likelihood of long-term growth compared to other asset categories. In addition, interest rates are very low — which is often the case during inflationary periods — so the return prospects for fixed income are less desirable than in years past.

However, this does not mean it’s time to completely revamp your portfolio’s allocation, since increasing the equity portion of your portfolio can increase your portfolio’s volatility and risk. As always, it’s important to work closely with your advisor to determine the appropriate asset allocation strategy for your financial objectives, risk tolerance, and time horizon.

2. Interest rates are low right now. What does this mean for the bond part of my portfolio?

We often get this question in conjunction with the above question about inflation.

Not too long ago, investors could rely on their fixed income allocation to generate 5% or more on an annualized basis. Today, with interest rates at historic lows, the returns from traditional fixed income will likely be low compared to historical averages. With that said, we continue to feel that traditional bonds remain a valuable tool to support many people’s investment objectives due to their ability to help control a portfolio’s volatility during periods of market unrest, while generating some income along the way.

For investors looking to generate a more meaningful return than the fixed income portion of their portfolio can provide, alternative investments are worth considering. These strategies may hold private debt or real estate. Each of these types of investments are less liquid than a traditional fixed income security (like a treasury bond, municipal bond, or corporate bond), but this reduced liquidity can also mean a greater yield for the investor.

While these higher-yielding strategies can sound enticing, they are not right for everyone, and it’s always prudent to discuss the options with your advisory team in order to understand the impact on your overall portfolio from both a risk and liquidity perspective.

3. I have some extra cash that’s accumulated over the last few months. I want to invest it, but the market is so high right now. What should I do?

Invest it.

Time in the market is better than timing the market. If you think you may need some of this cash in the short term, you could set a portion aside or invest it in lower-risk assets like fixed income with daily liquidity. Anything geared towards long-term growth can be invested in traditional equities. Of course, if you’ve accumulated a significant amount relative to the current size of your portfolio, it may make sense to spread things out over time.

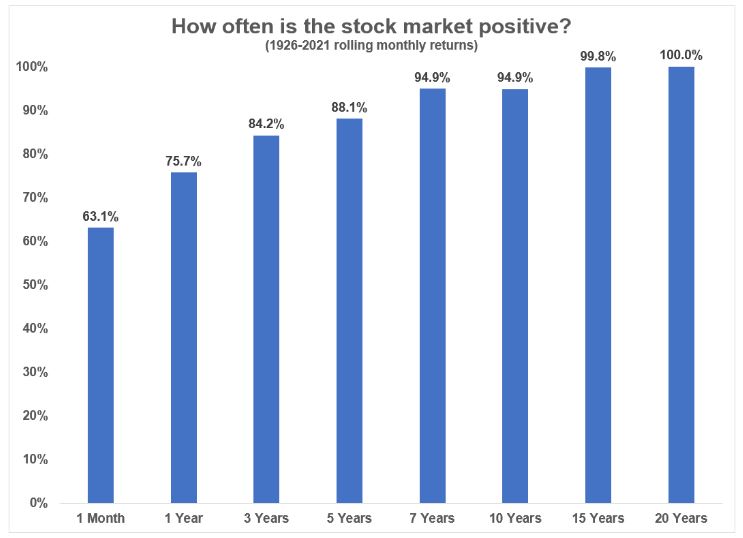

One of my favorite finance writers, Ben Carlson, just published an article called “Time Horizon Is Everything for Investors.” In this article, he shows that the longer an investor’s time horizon is, the more likely it is that they will see a positive return when investing in the stock market. Here is a great chart that he included to illustrate his point:

As the chart above illustrates, there has never been a 20-year period (dating back to 1926) where the stock market had negative returns. Yes, 20 years is a long time, but even look at the 3-year period. You’ll see that 84% of all 3-year time periods have had positive market returns!

If you have cash on the sidelines and don’t need it anytime soon, it’s ok to invest.

4. Is there anything that I can do right now to prepare for proposed tax changes?

There are a lot of potential changes to the tax code, which in turn means a significant number of potential planning opportunities. Two areas of focus for our team have been proposed legislation that may impact retirement accounts and estate planning.

Please note that the tax proposals are still just that – proposals. We do not know what the tax code will ultimately look like as we enter 2022. Additionally, the strategies discussed below are not appropriate for everyone, as the implementation depends on the individual’s financial circumstances.

Retirement Accounts

One proposed change that seems likely to pass is the elimination of the “Backdoor Roth IRA.” As it stands today, if your income is over a certain threshold ($125,000 for single filers or $198,000 for married couples filing jointly), you cannot contribute directly to a Roth IRA. However, it is possible to contribute to a Roth IRA by way of a traditional IRA.

This strategy involves making an after-tax contribution to a traditional IRA (which is more typically funded with pre–tax dollars and has no income limit), then immediately converting it to a Roth IRA. Since you’ve already paid tax on this money, you can avoid paying a tax on the conversion. However, it’s important to note that this strategy won’t work for everyone, especially those with large traditional IRA account balances. If a Backdoor Roth IRA is a strategy that makes sense for you, it is worth considering in 2021 because you may not be able to do so again moving forward.

Estate Planning

Under current estate tax laws, the first $11.7 million of your estate is exempt from gift/estate taxes. However, there is a “sunset provision” for this law, and unless a new law is passed, the threshold will be reduced to an inflation-adjusted $5 million in 2026. Part of the proposed tax changes calls for lowering the threshold effective January 1, 2022. If the law is changed now it will be reduced to an inflation adjusted $5M which is $6.02 in 2022. So if your estate value is between $6.02 million and $11.7 million, you may be able to exclude up to an additional $5.68 million from your estate by making gifts prior to year-end.

Our team is happy to work alongside your tax preparers and estate attorneys in facilitating any planning that best suits your needs.

5. I want to make a charitable donation. What is the best way for me to do this?

The short answer is “it depends.”

The good news is that you have a few different options.

If you are 70.5 or older, you can direct funds from your IRA toward the charity(ies) of your choice. Charitable donations made directly from an IRA do not count towards your annual income, but will still count towards your Required Minimum Distribution (RMD) at age 72 and later. Alternatively, if you take your annual RMD, deposit it in your bank account, then write a check to the charity of your choice, the distribution amount would be fully taxable, and you would take a charitable deduction (but only if you itemize).

If you are under 70.5, a great way to contribute to charity is by donating highly appreciated securities that you’ve owned for more than one year. Doing so not only allows you to avoid paying capital gains tax on these securities, but the charity can immediately sell the securities without incurring a capital gains tax burden because of their tax status. If you really like the investment, you can always repurchase more shares for your portfolio.

For our clients that make charitable donations on an annual basis, we often recommend they open a Donor Advised Fund (DAF). Assuming you itemize your deductions, you will receive a tax deduction for the year you donate to the fund, and you can invest the fund so that it grows over time. Assets in the fund can be easily distributed to any number of charities, and these charitable gifts can occur over as many years as you’d like. DAFs also help simplify the record-keeping process for charitable donations, as you only need to keep track of what you have contributed to the fund when calculating how much you can deduct from your income taxes. Note that you cannot donate a portion of your required minimum distribution to a Donor Advised Fund. As a result, we often recommend funding DAFs with appreciated securities, as discussed above.

Closing Thoughts

The list above is just an example of some of the great questions are clients and friends have been asking us. One of the best parts of our business is that there is very rarely one answer that suits everyone. These questions are no different, and the concepts shared in this piece are meant to illustrate our thought process. In doing so, hopefully it gave you some things to consider, as well.

If you have any questions about the information discussed in this article, questions about a topic not covered here, or you simply want to review your wealth management strategy, please don’t hesitate to get in touch with our team at Strategic Wealth Partners.