Wealth management is about more than simply choosing the right investments. It’s about optimizing assets, minimizing risks, and ensuring long-term legacy planning. Much like with one’s own health, it’s important to maintain regular financial checkups to achieve these financial objectives. These periodic check-ins provide the opportunity to fine-tune strategies and adapt to changing circumstances. Below, I outline seven financial areas that are crucial to review periodically.

1. Aligning your portfolio to match your goals

Financial goals are diverse and ever-changing. Whether it’s retirement, succession planning, or philanthropy, it’s important that investment portfolios align with your objectives. Periodic reviews are necessary to ensure that your portfolio remains tethered to these goals. They allow you to assess whether your current asset allocation meets your risk tolerance, growth expectations, and income needs. While not something we recommend often, adjusting your investment strategy to reflect market conditions or changes in your personal financial situation ensures that your portfolio continues to serve long-term objectives.

2. Tax Efficiency

Beyond alignment and risk tolerance, tax efficiency is a critical element to successful investing. Tasks like ensuring time-sensitive distributions are made, income deferral strategies are utilized effectively, and assets are titled appropriately, can all make meaningful differences when it comes to tax liability. Regular financial checkups provide opportunities to implement tax-efficient strategies as well. This might mean utilizing tax-advantaged accounts, making strategic charitable donations, or using trusts to minimize estate taxes. Staying informed about changes in tax laws and regulations allows you to proactively adjust your approach, potentially saving substantial amounts in taxes and enhancing overall wealth preservation.

3. Risk Management and Asset Protection

Portfolios often include a diverse range of assets, each carrying unique risks, including complex strategies such as real estate, private equity, and private credit. Regular financial checkups can help reassess these risks and ensure adequate diversification and liquidity. Protecting yourself by ensuring sufficient insurance coverage or implementing legal asset protection strategies can shield wealth from potential litigation or financial setbacks and is crucial in protecting assets and securing your financial future.

4. Succession and Estate Planning Updates

Estate planning is not a one-time task but a continuous process. Changes in family dynamics, financial goals, and tax laws require regular updates to your estate plan. Regular checkups ensure that wills, trusts, and other estate planning strategies remain current and effective. Revisiting this topic occasionally can also prevent imbalanced estate plans. To emphasize the importance of this concept, let’s look at a hypothetical example below using Illinois’ estate tax regulations in place as of 2025.

Married couple #1, Illinois residents, have an $8 million estate. Assets are divided evenly ($4 million each) into two revocable living trusts, one under each spouse’s name.

Married couple #2, also Illinois residents, have an $8 million estate. Assets are divided unevenly ($6 million & $2 million) into two revocable living trusts, one under each spouse’s name.

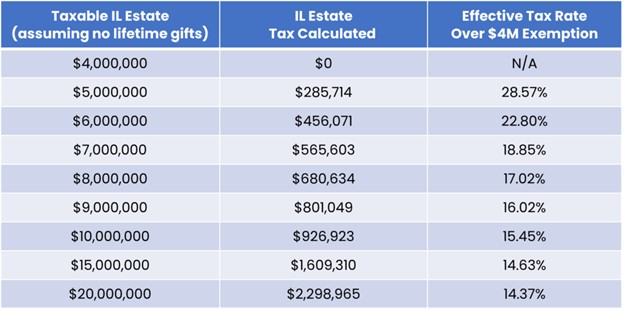

Using the chart below shared by my colleague Eric O’Brien last year in a great piece that goes deeper into this topic, you can see the tax liabilities of different size taxable estates in Illinois. Married couple #1 would have no Illinois estate tax liability because each spouse’s assets were at or below the $4 million threshold. On the other hand, couple #2 would have an estimated tax liability of $456,071. This comes from the spouse with $2 million having no tax liability and the spouse with $6 million falling into the bracket represented by the 3rd row in the chart below.

The simple act of balancing these assets can significantly impact the amount beneficiaries receive. Regular checkups help to minimize estate taxes and ensure a smooth transition of wealth to your heirs.

5. Philanthropic Planning

Philanthropy plays a significant role in financial strategy within many households. Periodic checkups allow you to evaluate and adjust your philanthropic commitments, ensuring they align with your broader financial objectives. Exploring options such as donor-advised funds, charitable trusts, or private foundations can maximize the impact of your contributions while also providing potential tax advantages. This approach helps you fulfill your charitable goals in a financially efficient manner.

6. Cash Flow Management and Liquidity

An often overlooked element of financial management is cash flow planning. This is especially true when dealing with less liquid assets such as private credit, private equity, or real estate. Regular financial reviews help ensure you have sufficient liquidity to meet ongoing obligations, whether they be traditional lifestyle expenses, taxes, or investment opportunities. Much like rebalancing a portfolio to ensure risks are weighted appropriately, liquidity needs to be reviewed and managed in a similar fashion.

A sound strategy includes replenishing liquid portfolios when they’ve been depleted or, conversely, withdrawing assets from liquid accounts once they’ve exceeded their intended purpose. Additionally, well-structured cash flow plans prevent the need for asset liquidation at inopportune times, preserving wealth and limiting tax surprises.

7. Maximizing Investment Performance

Managing an investment portfolio involves balancing differing levels of risk, complexity, asset classes, and investment vehicles. Periodic financial checkups enable you to assess the performance of these investments and make informed decisions about rebalancing, new opportunities, or changes in fundamental strategy. These adjustments are vital for maintaining a portfolio that aligns with your risk tolerance and growth expectations.

Conclusion

Regular financial checkups are more than a best practice; they’re a strategic necessity. These checkups enable you to continually optimize your financial plan, ensuring your wealth is preserved, risks are contained, and opportunities for growth are maximized. Like going to the doctor, it isn’t always the most exciting date on your calendar, but a clean bill of health provides relief. And if issues do arise, regular checkups are likely to catch them in time and allow you to adjust course early enough to limit significant damage. By dedicating time to these regular assessments, you can maintain financial agility, security, and alignment with long-term aspirations. If you’re ready for a financial checkup, please reach out to our team.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).