As anyone can attest to lately, it certainly feels like the economy and financial markets are confounding. Browse any news source of your liking, and you’re bound to see the first few articles with titles that make your head spin. Disruption brings change, including to capital markets. While this can bring financial anxiety, it also creates opportunities for investors.

The technology, investment management, and tax planning opportunities accessible to investors today compared to just five years ago are remarkable. At Strategic Wealth Partners, we fully embrace this evolution and implement it into our way of doing business. We’re constantly aiming for comprehensive service for our clients by embracing technological advancements, offering innovative investment solutions, using time-tested strategies, and going beyond the basics. This ensures we cover a broad spectrum of options for our clients’ financial success.

Having joined the SWP team earlier this year after being in the industry for over 12 years, I speak from experience on how impactful this is to clients and how different this approach is from other firms. It’s the appropriate blend of traditional strategies that have historically driven success and forward-looking approaches that help ensure the same in the future.

Technology

At SWP, we use a robust suite of technology. Other colleagues of mine have written about this in the past, but the impact can’t be overstated in how it rounds out an efficient wealth management strategy.

A solid plan is the foundation for effective advice. We use a comprehensive financial planning software that allows us to provide broad advice such as retirement and cash flow analysis. The program is dynamic and highly customizable, which lets us adapt to virtually any scenario. Alongside standard planning tools, we utilize software to identify strategies for both mitigating taxes and optimizing the more tax-efficient areas of portfolios, creating the most opportunity for long-term growth. The software also allows us to assess income scenarios, such as social security, to select the most effective strategy possible. We also leverage state-of-the-art reporting systems that simplify performance analysis.

Investments

Some investment philosophies are tried and true. When things work, they work. We aren’t trying to reinvent the wheel. However, there are segments of the market we are certainly ahead of the curve on when it comes to innovation in both strategy and implementation.

We still believe in stocks for the growthier part of client portfolios. I realize this is as basic as it gets, but how we implement them is important. We are incredibly selective on what solutions are on our platform. We are not stock pickers. That is left to the analysts and fund managers. We believe in using mostly mutual funds and ETFs to accomplish the equity sleeve goals for clients. We complement this approach using direct indexing. This has been written about in the past as well, but it is essentially a strategy that enables us to capture market-like returns while strategically taking capital losses to alleviate the tax burden on portfolios. This ideally results in better net results for clients.

Despite recency bias, we still believe in the public fixed-income markets and feel bonds continue to play an important role for investors in dampening volatility. The rising rate environment over the last year plus has created headwinds for traditional “core” bonds. As rates have increased on newly issued bonds, existing bonds paying less interest are no longer as valuable and have dropped in price significantly since the beginning of 2022. Because of our nimble structure at SWP, we’ve been able to pivot clients into areas of the bond market that are not as sensitive to rising interest rates. Treasuries, for example, which had paid anemic rates for over a decade, have finally become attractive, and we were able to quickly adjust to take advantage of this. This has allowed us to lower the volatility of client portfolios, generate higher income, and protect principal.

Now to the less well-known and more innovative strategies that the investing public hasn’t had as much historical exposure to, alternatives. This is a broad term that is used to describe either an asset class or a particular strategy. One of our co-founders, David Copeland, has written about alternatives numerous times here, here, here (you get the picture) and has been at the forefront of this for years. Examples include private segments of the market such as credit, real estate, and equity, as well as defined outcome vehicles like hedged equity and structured notes. These strategies are essential in diversifying portfolios, as proven in 2022. While stocks and bonds were falling in tandem last year, many alternative strategies were delivering positive returns for clients.

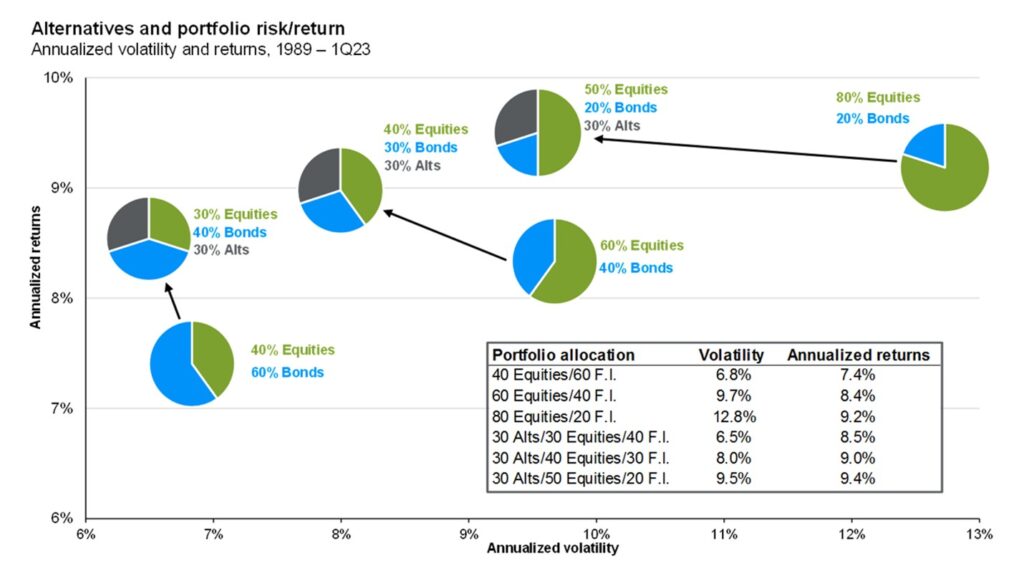

The chart below shows the comparison between different portfolio mixes and their historical risk and return. As seen in the table on the bottom right of the graph, a more aggressive 80% stock and 20% bond portfolio (third row down) has returned 9.2% annually over the past 35 years, whereas one consisting of 50% stocks, 30% alternatives, and 20% bonds (bottom row) has outperformed over that same stretch, returning 9.4% per year. All this while experiencing roughly 25% less volatility. Seems like a good risk/reward to me!

(Citation: Source: Bloomberg, Burgiss, FactSet, HRFI, NCREIF, Standard & Poor’s, J.P. Morgan Asset Management. Alts include hedge funds, real estate and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. This slide comes from our Guide to Alternatives.

Guide to the Markets – U.S. Data are as of September 30, 2023.)

Tax Optimization

The ever-changing global landscape will continue to bring debate on how and what to invest in. This uncertainty leads to a wide array of opinions and market forecasts. For every bullish outlook on a financial news network, there’s an equally bearish perspective in the next segment. Making heads or tails of it can be disorienting. While I’d love to opine on how this shows the value of having a good advisory team (selfless plug), I’ll digress and simply say that making objectively solid financial choices, irrelevant of markets, is essential.

At SWP, we are hyper-focused on doing this for our clients. One of the most effective ways is to be tax efficient where possible. This could be as basic as opting for ETFs or passive mutual funds. These strategies tend to produce smaller capital gain distributions compared to active mutual funds, which can be forced to pay hefty distributions even in downturns (see 2015, 2018, 2022). It also goes beyond efficiency by proactively harvesting losses. I described this briefly earlier regarding direct indexing, but we will actively sell tax losses to “lock them in” and prevent the tax cost that can come from gains.

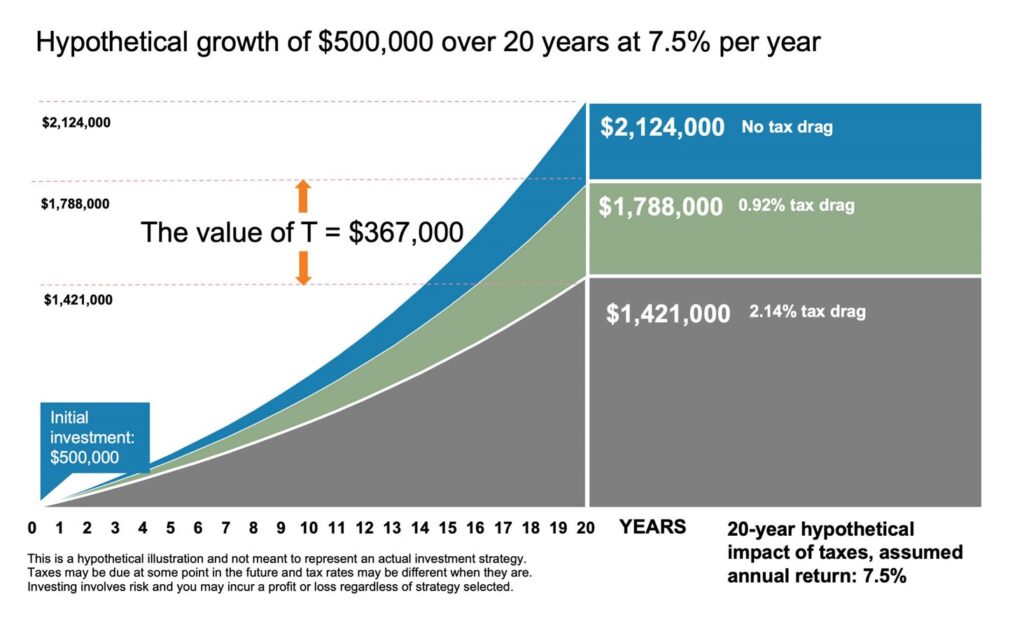

The chart below shows the difference that taxes can make on a $500,000 portfolio over time. The blue section represents 20 years of 7.5% annualized growth with no taxes impacting the portfolio value, and the gray section shows that same growth but accounts for roughly 2% in annual tax drag. The difference between the two is more than $700,000 over 20 years. That’s more than the initial amount invested by simply limiting taxes by 2% annually.

(Citation URL: https://russellinvestments.com/us/blog/tax-smart-planning-value-of-advisor)

In addition to selling losses, we also look at ways to limit taxation by maximizing eligible contributions into vehicles such as retirement plans, college education plans, or health savings plans. These strategies effectively reduce current or future tax burdens independent of market performance.

For our more philanthropically inclined clients, we involve charitable giving as part of our comprehensive approach. One strategy is to utilize Qualified Charitable Distributions (QCDs). This allows clients who are required to take annual distributions from their retirement plans to use these funds to gift up to $100,000 annually to the charities of their choice. This makes what would have been a taxable distribution become a non-taxable event. Another popular method is to utilize a Donor Advised Fund (DAF). DAFs allow funding with cash or, ideally with securities that may have substantial appreciation. This not only prevents realizing capital gains but, in most instances, results in a tax deduction. There are intricacies to this strategy, but it can be an excellent way to minimize taxes and sustain a philanthropic focus, so it’s a win-win!

Managing Complexity, Delivering Simplicity

At SWP, we pride ourselves on doing more than just giving investment advice to our clients. Our mantra ‘managing complexity, delivering simplicity’ isn’t just a saying; it’s our operational philosophy. Whether it’s providing tax documents to accountants or being the liaison between clients and estate attorneys, we aim to alleviate client burdens.

Aligning with this approach, our recent partnership with My Personal Bookkeeper (MPB) represents an exciting step toward realizing our vision. Through this collaboration, we can now offer services like budgeting assistance, organization, and bill payment for clients. This marks a significant milestone in achieving the comprehensive service we strive for, and we are thrilled about the new venture.

Conclusion

Change rarely comes without turbulence along the way, but it also fosters innovation. At SWP, we make a conscious effort to welcome and integrate change into how we assist our clients and structure our platform. This is what makes impactful relationships, and we will continue to strive for that goal, even when the world is frantic. After all, smooth seas don’t make skilled sailors.

If you’d like to discuss any of these concepts in more detail or how they can be impactful for you and your family, please don’t hesitate to reach out to the team at SWP.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).