In the ever-changing landscape of the global economy, investors will be navigating potentially unfamiliar waters during the last month of 2023. Uncertainty seems to be the only constant, with markets fluctuating as geopolitical tensions are rising.

Despite all the question marks on what will happen in the short term, there are some things that can be done to help keep investors at ease.

Embracing the Reality of Uncertainty

In the world of investing, uncertainty is a natural part of the process. Markets go through cycles, and change is inevitable. Instead of fearing the unknown, I look at it as a chance to learn, adapt, and evolve. By understanding that uncertainty is a fundamental aspect of any investment strategy, one can approach decision-making with a clearer perspective.

This can be applied in many ways. One example is how SWP views equity style boxes, meaning growth stocks versus value stocks, and how we don’t profess to know which is going to outperform the other month-to-month or year-to-year. For that reason, we take a neutral approach, often equal weighting the two for our clients.

Diversification: Portfolio Protection in Turbulent Times

Diversification in portfolios is like building a winning sports team. Just as a successful team comprises players with different strengths and abilities, a diversified portfolio can benefit from the same mentality. By spreading investments across different types of assets, you reduce the impact of a single event on your overall portfolio. Diversification provides a sense of security, allowing investors to find comfort in the knowledge that their risks are spread out, minimizing the potential fallout from any single market disturbance. Specifically, for SWP clients, we think the use of alternative investments is the most significant diversifier from traditional capital markets that we have for our clients. Our Co-Founder and CIO, David Copeland, put out this piece last summer detailing how we define and why we use alternative investments.

Adaptability: Thriving in Changing Environments

The world is constantly evolving. Industries rise and fall, technologies emerge, and consumer preferences shift. Being open to new opportunities and willing to adjust your investment strategy in response to changing trends can combat uncertainty and provide benefits to investors. The example that jumps to mind for our clients is the introduction or addition to alternative credit strategies. When we saw interest rates rising, we foresaw the pain that was to come in traditional fixed income since they follow the basics – interest rates go up, and existing bonds held by investors go down in value. Whereas private credit has been the bright spot for opportunity as interest rates have risen since most of these strategies, we utilize floating rate securities.

The Power of Long-Term Vision

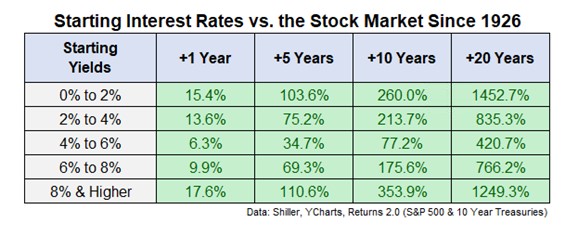

In times of uncertainty, it’s easy to get caught up in short-term market fluctuations. However, successful investors understand the power of a long-term vision. History has shown that markets tend to bounce back over time, and a patient approach can yield significant rewards. By focusing on long-term goals and staying committed to your investment strategy, you can find comfort in knowing that temporary setbacks are just that – temporary. The stock market has felt like an endless elevator ride going up and down this year, and many people blame interest rates. The chart below shows the starting yield based on the 10-year Treasury bond along with the forward average returns for the U.S. stock market going all the way back to 1926[1].

My takeaway? Things will get better with time, regardless of where interest rates currently reside.

Conclusion

While the uncertainty investors are experiencing in 2023 may be daunting, it also presents an opportunity. By embracing diversification, remaining adaptable, and taking a long-term perspective, investors can find comfort amid uncertainty.

If the uncertainty of the economy and financial markets are making you uncomfortable, our team is well-equipped to help. Please reach out, and we will be ready to help you navigate any concerns.

[1] Higher For Longer vs. the Stock Market (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).