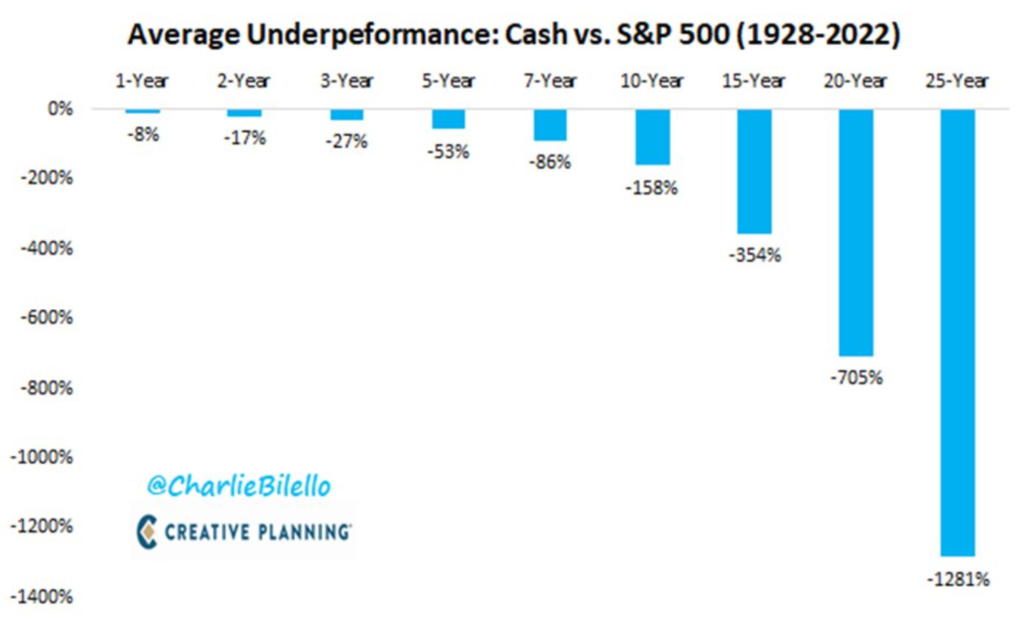

When I first saw this chart below from our industry peer, Charlie Bilello, I thought, “well of course, stocks would outperform cash long-term.” However, after my initial hasty reaction, I realized there were some meaningful lessons here.

The chart shows that the longer you sit on the sidelines in cash, the worse off your portfolio will be. But, does this hold true even in a higher interest rate environment?

Cash and cash equivalents, like Certificates of Deposit (CDs), are relatively attractive right now. I use the term relatively because things were much different a year ago. In January 2022, the average one-year CD yielded a meager 0.13%. As of February 15, 2023, that same CD is yielding closer to 4%[1]. It’s one of the few positives of the dramatic rise in interest rates over the past 15 months. But despite how rosy the picture looks today, if you go back to August 1981, the average one-year CD was yielding close to 18%![2] My point is that “attractive” is subjective to the time period you’re taking into account.

But even with today’s interest rates, I believe that investing in the stock market or other securities for the long-term will always be a good choice relative to holding cash-like investments:

- Meeting your goals may mean that you need to earn more than 4% per year. For our clients, financial planning drives investment decision making. Specifically, the financial planning process often begins with detailed cash flow projections. This helps us determine what estimated rate of return we need to strive for within portfolios to ensure our client’s goals are met. For example, if a client has a long-term goal of 6% or 7%, we know that in today’s current world, we cannot hold cash alone and meet the required return to help our clients accomplish their objectives.

- Keeping up with inflation. Stocks have historically been the best investment vehicle to outpace inflation. It’s hard to read any financial news lately without reading about persistent inflation levels. When looking at any investment return, it’s important to consider real returns (return after considering inflation). So, although today there are many high yield savings accounts that are yielding close to 4%, your real return in these types of accounts could actually be negative. The S&P 500, on the other hand, has earned about 11.5% per year since 1980[3], which handily outpaced inflation and resulted in meaningful real returns. Stocks and their growth potential provide a much better option to meet or outpace inflation than cash and cash equivalents.

- We can’t control interest rate levels. I’m a big believer in focusing on what we can control regarding wealth management. Things like asset allocation, asset location (being mindful of which assets go in which types of account), taxes, and expenses carry much more weight long-term than tactically trying to play the short-term interest rate game. It’s similar to trying to time the stock market, and the hardest part is that you have to be right twice, once on the way in and once on the way out.

- Investing doesn’t just mean the stock market. We have made many additions to our alternative investment platform over the past couple of years, such as structured notes and private credit. Many of our clients like incorporating alternative investments in their portfolio because they may provide attractive returns while being subject to lower risk (as measured by volatility) than the stock market. Expected returns on alternative strategies may be lower than stocks, but still surpass cash and cash equivalents. In other words, there are many investment options available to investors that can generate positive real returns with less volatility than the stock market. Whether it’s stocks, alternatives, certain bond strategies or a combination of them all (like many of our client portfolios have), there are attractive solutions to generate greater returns on a long-term basis than cash equivalents.

Whether it’s rising interest rates, high inflation, general stock market uncertainty, or some mixture, there will always be a reason to say, “this time is different”. Cash can provide comfort in tumultuous times, but it is not the sole long-term solution for an investment portfolio.

If you are interested in learning more about potential solutions specific to your situation, we invite you to connect with our team.

[1] https://www.forbes.com/advisor/banking/cds/cd-rate-forecast/. (Link)

[2] https://www.forbes.com/advisor/banking/cds/historical-cd-rates/. (Link)

[3] https://www.officialdata.org/us/stocks/s-p-500/1980?amount=100&endYear=2023. (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).