I come from a long line of family members who were financial professionals. There are generations of Karmins before me who were either traders, stockbrokers, or asset managers. No doctors, no lawyers, and not even an accountant in our family.

So, I feel like I was destined for a career in finance. I graduated from what is now the Gies College of Business at the University of Illinois, started my career as a portfolio manager at Northern Trust Bank, and ultimately found my passion in wealth management here at SWP.

Being surrounded by many in finance, our dinner table conversations frequently revolve around the markets. Recently, during one of these conversations, my dad commented, “It seems like a really volatile time in the markets.” My first reaction was to agree, as we were in the midst of a potential run on regional banks. But after some reflection, I turned to him and said, “Dad, this is normal. I actually don’t think the dust ever settles.”

In the weeks since this conversation, I’ve been thinking a lot about market volatility and have been asking myself a few questions.

Why have the past few years felt like such a volatile period?

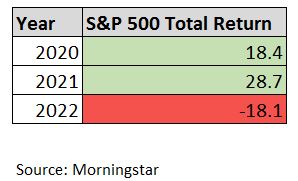

In a relatively short amount of time, there have been many seemingly out-of-the-ordinary events that have led to stock market volatility. There was the start of Covid, the war in Ukraine, supply chain issues, rapidly accelerating inflation, some of the most dramatic Federal Reserve moves ever, and most recently a regional banking crisis. The stock market over the past 3+ years has swung violently in both directions. So far in this decade, we haven’t had a calendar year where the stock market performance was in the single digits, positive or negative. Here are the S&P 500 returns since 2020:

On top of these significant stock market fluctuations, interest rate movements have also been pretty extreme. At the end of 2021, the yield on the 2-Year Treasury was under 0.75%. Just last month, the two-year treasury yield touched 5%. This is a 567% increase! Since then, in the past month, the yield on the same 2-Year Treasury is all the way back down to 4%, or a 20% drop![1]

Interest-bearing investments, specifically fixed income, are supposed to be a portfolio stabilizer, but over the past 15 months, this has been anything but the case.

And it’s not just stocks and bonds that have been volatile. Gas prices have been on a roller coaster, mortgage rates have more than doubled in the past year, and even egg prices were at one point up 70%![2]

But hasn’t it always been like this?

So, it sure feels like we are living through a volatile period. But I’d argue there have always been reasons to worry and that these past few years are just one in a laundry list of challenging periods we have been through.

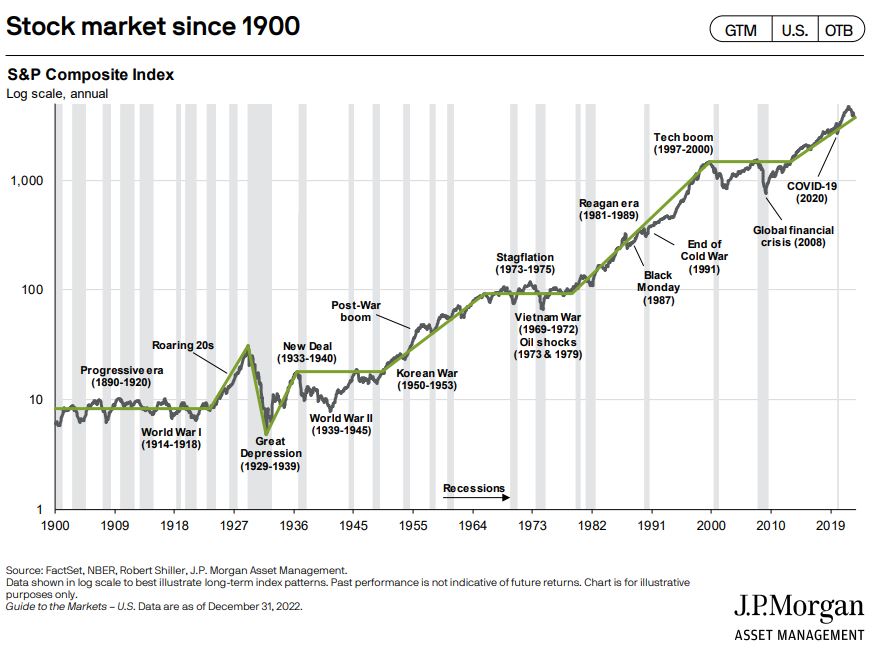

The graph below shows cumulative stock market returns (from left to right) from 1900-2020. Additionally, the vertical light grey bars are recessions, and the data labels show some of the more important geopolitical events and financial crises.

Look at the sheer number of recessions and tumultuous events shown in this graph. It’s hard to find a 5-year period without one. And if we zoomed in on any decade, there are plenty more alarming situations that we could add to this graph.

All of that said, while each of these events were scary at the time and caused some market volatility, the stock market has persevered and generated positive long-term returns.

Will there be more volatility ahead?

When I look at the above graph, I can’t help but think about what’s to come next. While we don’t know the next financial crisis or global geopolitical event, it would be naïve to think that we’ll experience a prolonged period of calmness.

Financial markets are forward-looking, and the “known” risks are mostly baked into prices. For example, many forecasters believe that banks are beginning to tighten their lending standards, thus making it harder for some companies to have access to working capital or funds for growth initiatives. This could, in turn, lead to a recession. While a recession would be bad for many businesses and consumers, the market is aware of the risks, and those risks are theoretically factored into the current prices of securities.

But that doesn’t mean we are approaching a period of calm in the markets. One of my favorite financial writers, Sam Ro, recently stated, “The most destabilizing risks are the ones people aren’t talking about.”[3]

Think about the events that occurred with Silicon Valley Bank (SVB) last month. Did anyone see this coming? In retrospect, SVB had poor risk controls, but in the weeks leading up to the bank run, there was no mention of any of its issues across financial media or by so-called market experts.

I’m not sure what’s coming next, but I can assure you, there will be an event or circumstance that spooks the markets. And once that next risk is behind us, yet another new risk will pop up that will lead to market volatility. Rinse and repeat.

If the dust really doesn’t settle, what does it mean for our clients?

If you’ve read any of my previous pieces (here or here), you can probably pick up on an investment principle that I feel very strongly about: stay invested. Investing is supposed to be long-term. It is important to be disciplined and to ignore the madness of the masses. The volatility you experience along the way is implicit in the contract you enter when you invest in ‘risky’ assets. It’s part of the deal.

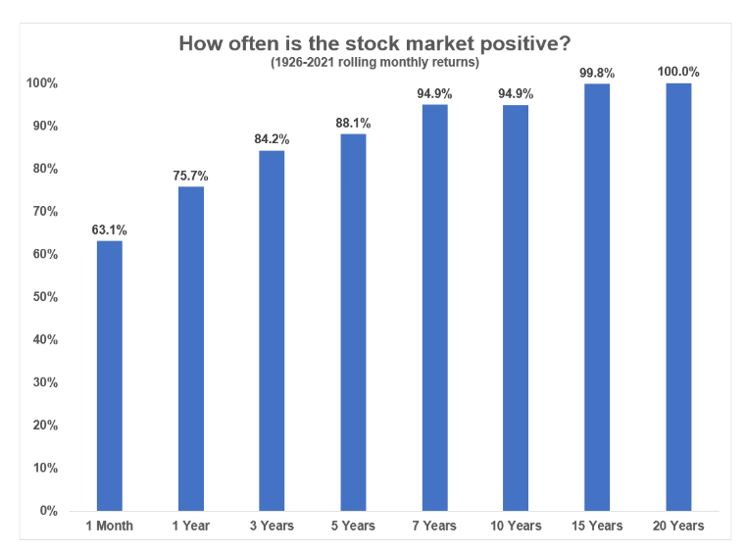

Historical data supports investors who can be patient and stay invested. The graph below shows the percentage of the time the stock market is positive over different periods. The further right you go on the graph, the longer the time period.

Source: Time Horizon is Everything For Investors[4]

While the stock market has had positive returns more than 50% of the time throughout all periods shown, the longer your time horizon, the better chance you have of experiencing gains.

I often like to compare, well actually, “contrast,” investing and gambling. More specifically, I like to think about the impact that time horizon has on each.

With gambling, the odds are stacked against you – even if it’s by just a small amount. So, the longer you gamble, the more likely that you lose money.

One of the greatest things about investing is that the odds are in your favor! The longer you do it, the more likely you will have a successful outcome. The chart above proves this.

So, while I think there are plenty of challenging periods ahead of us, by simply staying invested, we are setting ourselves up for success.

Closing Thoughts:

Waiting for the dust to settle isn’t a good strategy because the dust isn’t going to settle. History has shown us that we don’t know what will happen next, and moreover, we don’t know how the market will react.

I’m excited for more dinner conversations with my family about the financial markets. While I don’t know what we’ll be talking about in the coming months or years, I’m pretty sure that my dad won’t turn to me and say, “it seems like nothing is really going on in the markets.”

If you are looking for help investing through whatever comes next, come by for a Karmin family dinner! Just kidding – that would be fun, but I also invite you to reach out to the Strategic Wealth Partners team. We are ready to help.

[1] United States 2-Year Bond Yield (Link)

[2] Why Are Eggs So Expensive Right Now? (Link)

[3] 10 truths about the stock market (Link)

[4] Time Horizon is Everything For Investors (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).