Over the years, we have had the privilege to serve a wide range of professional service providers such as doctors, lawyers, and accountants. Through our work with these professionals, we’ve identified things that make their lives especially unique from a wealth management perspective.

In this article, we want to share several of those planning challenges, opportunities, and considerations. As always, we invite you to connect with our team to review any of the items discussed.

Your Biggest Asset Is Your Human Capital

If you are like most professional service providers, your biggest asset is your human capital: the ability to do your job and build wealth. To obtain this level of human capital, it is likely that you have made significant financial investments in yourself: law school, medical school, or a Ph.D. or master’s program. This investment might also include buying-in as an equity partner at your firm or starting your own practice.

Because of these large personal investments, you probably managed large cash outflows early in your career as you serviced student loans and any debt from buying-in as a partner. This is significant from a wealth management perspective because these up-front expenses during the early years of your career create a small but potent window of peak earning years as you approach retirement. And during this window, when cash flow is very healthy, it’s critical to make wise decisions as it relates to saving, investing, tax planning, and planning for retirement.

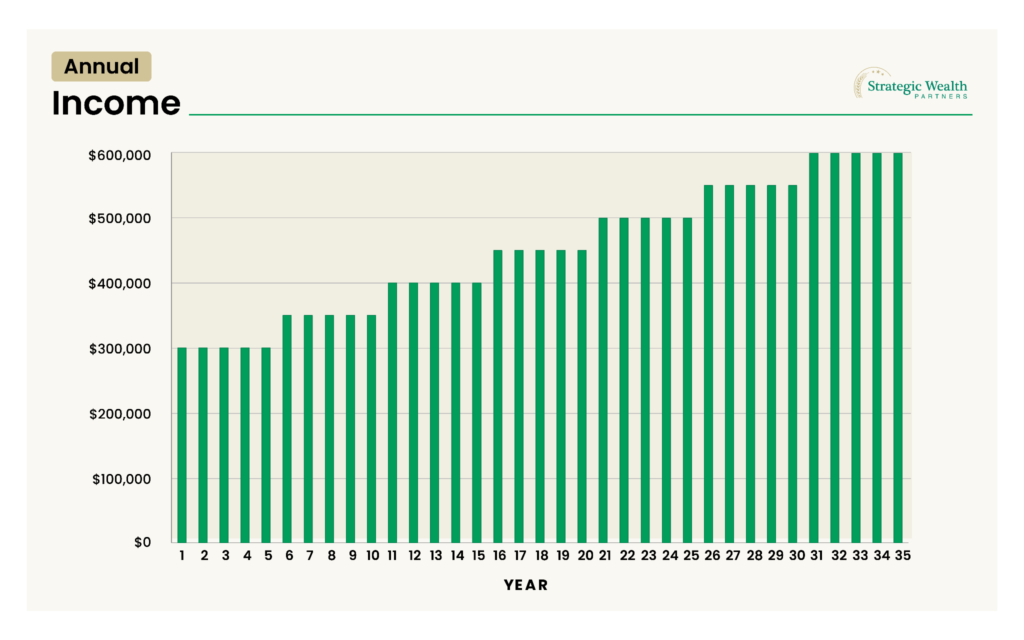

To help illustrate this, what follows are three very simplified charts showing the experience of a hypothetical lawyer with a 35-year career. Early in her career, she took out student loans to pay for law school and obtained financing to buy-in as an equity partner at her law firm.

The first chart shows her annual income. We assume she earned $300,000 per year out of graduate school and her annual income increased by $50,000 every five years until retirement. Over her 35-year career, that looks like this:

For most people, earning $300,000 out of graduate school and $600,000 per year approaching retirement feels like a lot of money on paper — and it is — until you factor in expenses.

The Impact of Personal Investments

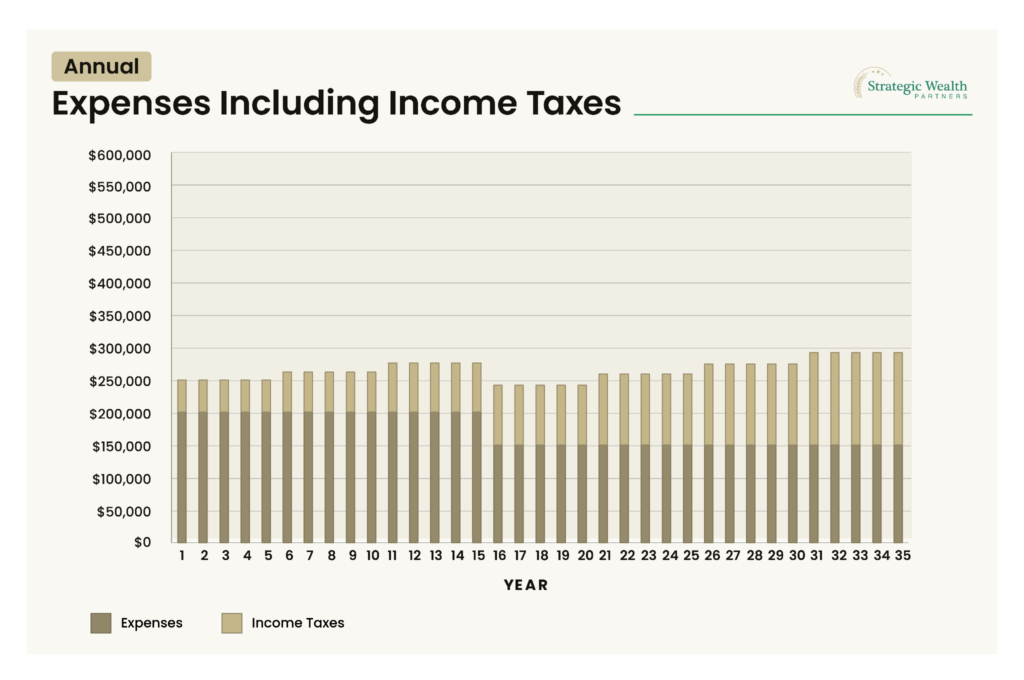

In this example, she also has expenses each year of $200,000 (including living expenses, student loans, partnership buy-in costs, mortgage, income taxes, etc.) for the first 15 years of her career. Starting in year 16, her expenses drop to $150,000 per year as she pays off student loans and the debt required to buy-in as a partner.

As it relates to taxes, we assume that she begins her career with an effective tax rate of 16.4% and that rate climbs steadily during her career as her income grows. In the final year of her career before retirement, she has an effective tax rate of 23.5%.

Over her career, those personal expenses and tax payments would look like this:

Maximizing Your Peak Earning Years

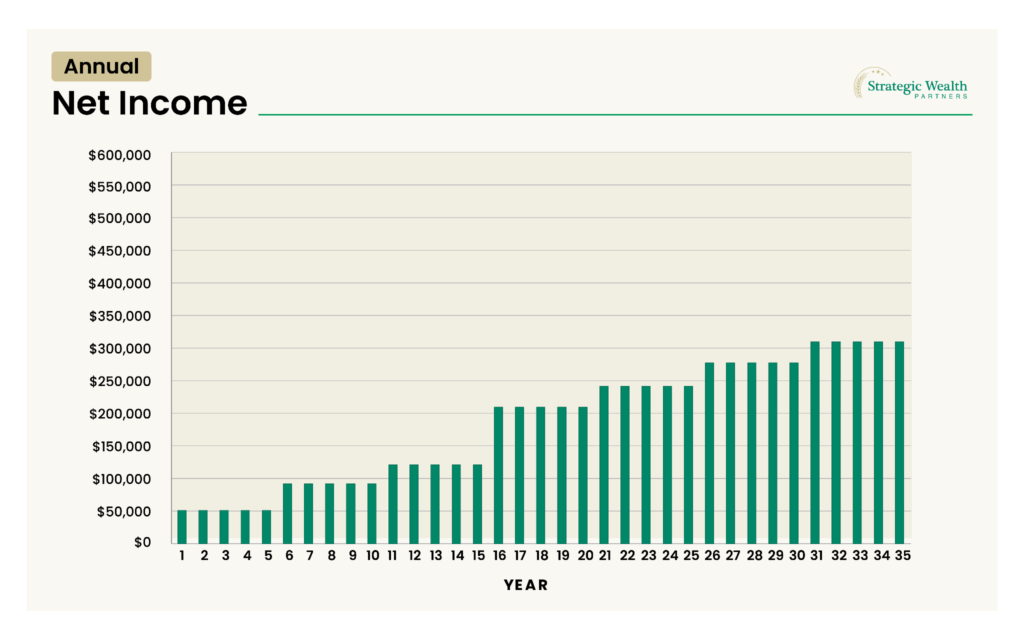

By combining these two charts, we arrive at the most important one for anyone reading this: annual net income. This final chart shows how much she has left each year after expenses for savings, retirement planning, and building a meaningful legacy.

Over the course of her career, she has significant income net of personal expenses and taxes: nearly $6.5 million. However, 79% of this net income is realized in the last 20 years of her career — and 63% of this is realized in the final 15 years of her career. The last 15 or 20 years of her career are her peak earning years, and the financial decisions made (or not made) during these years will have a significant impact on her lifetime wealth trajectory.

This chart also illustrates why it is common to feel like you are “treading water” during the early stages of your career. Expenses are high, and you are trying to get ahead in your career, buy a house, and start a family. As a result, your cash flow is more constrained than it should be, given your income level. But like in all things, managing expenses effectively and finding the right balance is key throughout your working years. If you can remain disciplined, stick to a budget, and keep your eye on the long-term, you will bear the fruits of your labor when your cash flow turns substantially positive during the second half of your career.

A Personalized Approach Is Critical

This is a hypothetical example, but it’s also very representative of the professional service providers we have worked with: these individuals have a 15 or 20-year period where they can amass significant wealth for themselves, their family, and their legacy — so it’s critical to make the most of this window through prudent financial planning and investment management. A partnership with SWP can help ensure you make the most of your peak earning years.

In doing so, we recognize that your annual income and expenses are not neat and orderly like in the example above. Many clients we serve receive monthly draws followed by a large distribution at year-end. This makes cash flow planning especially important, as we manage the peaks and troughs of annual cash flow within the larger picture of your lifetime earning potential. We also know that your priorities and lifestyle will shift as you move through life, impacting the expense side of the equation and bringing about new cash flow challenges and opportunities. On all fronts, we can help manage the complexity and deliver simplicity for you and your family.

Protecting Your Earning Potential

As the previous example highlights, most professional service providers have significant lifetime earning potential, and they have made significant personal investments to obtain this earning potential. But to realize this potential, you (and only you) are capable of doing the work.

For this reason, we advise all professionals to explore disability and life insurance. By doing so, you are protecting your future earning potential that you have worked so hard to build. And in sharing that perspective, it’s important to note that we do not sell insurance, and we don’t receive referral fees from insurance providers. We do, however, act as advocates for our clients when identifying the right policies to protect their future earning potential.

Closing Thoughts

As a professional service provider, your greatest asset is your ability to do your job and build wealth. A relationship with SWP can allow you to focus your time and energy on doing what you do best while we focus on managing the complexities of your financial life. As part of this, we take the time to educate you and talk through the various options available, knowing that in wealth management there is rarely one right answer to a planning question.

We hope this article has provided a look at how we serve the unique needs of professional service providers. If you are a professional service provider who is looking for a more comprehensive approach to wealth management, we invite you to connect with our team.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).