When it comes to executive compensation, company stock can be incredibly appealing. For top-level executives, it often makes up a significant portion of their compensation packages, offering financial rewards and a stake in the organization’s success. These packages can be potentially lucrative for the executive receiving them. However, by nature, there is a certain amount of risk associated with any asset, and relying too heavily on one company stock in your investment portfolio can bring significant levels of financial risk (consider the plight of executives at Enron, Worldcom, or Lehman, for example, who lost it all when their respective companies suddenly declared bankruptcy). Whether you’re an experienced executive or an emerging leader, understanding and managing these risks is crucial for your financial future. In this article, we explore risks associated with concentrated stock positions stemming from executive compensation and provide insights, strategies, and solutions to help successfully mitigate them.

What are the risks of concentrated stock positions?

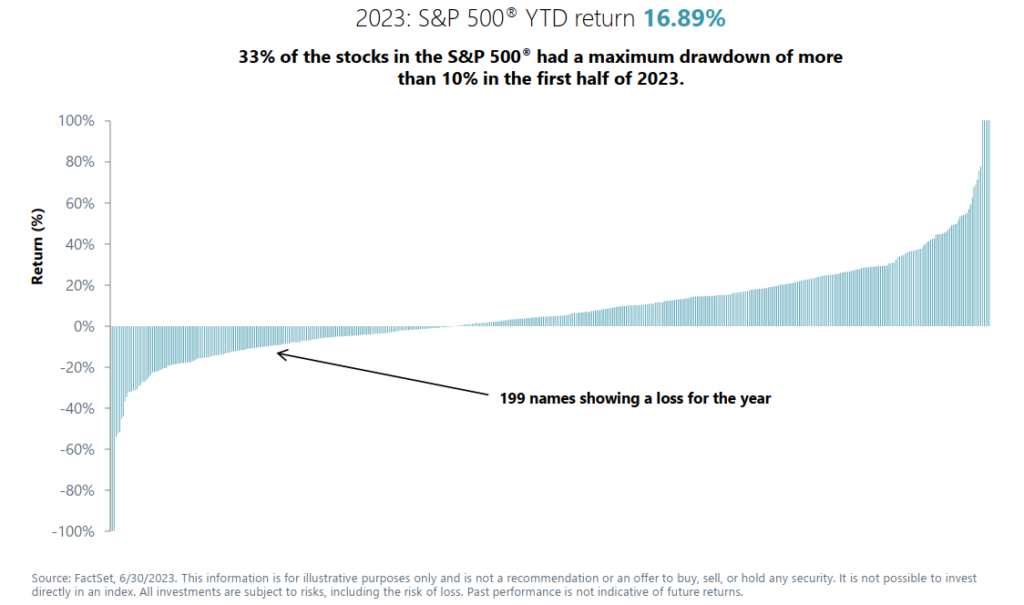

Concentration risk is the potential loss from having a significant portion of your investments in a single asset, asset class, industry, or geographic region. While there is a lot of potential upside in having large exposure to a single company’s stock, there’s also the possibility of substantial financial loss. As an executive at a company, you already have significant exposure to the enterprise’s success through ongoing compensation and potential bonuses. Compounding that risk by maintaining a concentrated stock position as a core part of your wealth can lead to a range of potentially adverse outcomes, such as experiencing long-term investment performance that lags the overall market to outright catastrophic loss. Take the chart below, for example. Through the first half of 2023, a period when equities markets were up significantly, 199 stocks in the S&P 500 (33%) were showing a loss for the year.  Further, consider recent research[1], which identified the percentage of companies in the Russell 3000 (a broad measure of the US stock market) from 1980 to 2014 where a concentrated stockholder would have experienced a “catastrophic loss”. In this case, a “catastrophic loss” is defined as a decline of 70% or more in the price of a stock from its peak, and an ultimate loss (after a minor recovery) was 60% or more. Over half the companies in some sectors experienced levels of catastrophic loss. The chart below breaks down the “catastrophic loss” by sector and shows that 40% of companies across all sectors have experienced a catastrophic loss. In other words, 40% of companies in the Russell 3000 had a permanent loss of 60% or more of stock value during this period.

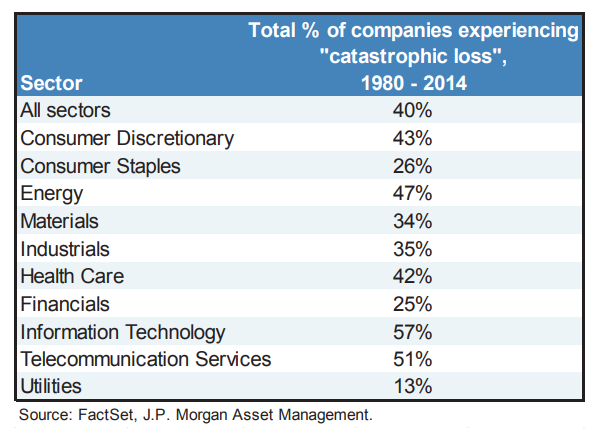

Further, consider recent research[1], which identified the percentage of companies in the Russell 3000 (a broad measure of the US stock market) from 1980 to 2014 where a concentrated stockholder would have experienced a “catastrophic loss”. In this case, a “catastrophic loss” is defined as a decline of 70% or more in the price of a stock from its peak, and an ultimate loss (after a minor recovery) was 60% or more. Over half the companies in some sectors experienced levels of catastrophic loss. The chart below breaks down the “catastrophic loss” by sector and shows that 40% of companies across all sectors have experienced a catastrophic loss. In other words, 40% of companies in the Russell 3000 had a permanent loss of 60% or more of stock value during this period.

Risk Management Strategies

There are plenty of reasons you may not want to exit a concentrated stock position due to executive compensation. You may have an emotional connection (“I put my blood, sweat, and tears into this company!”), or you may feel pressure from colleagues to remain invested and be perceived as a team player who believes in the entity. While each is understandable, it may not be prudent. Here are a few strategies that can help to reduce the risk of these concentrated stock positions.

Direct Indexing

A direct indexing strategy can work particularly well for concentrated stock positions. This approach enables you to capture market-like returns while strategically taking capital losses to alleviate the tax burden on your portfolio.

Rather than owning a mutual fund or exchange-traded fund (ETF) that tracks a specific part of the stock market, a direct indexing strategy seeks to own shares of individual companies that make up the index. Since individual companies tend to fluctuate more than the market as a whole, this strategy can opt to sell shares of companies that are temporarily down to book a loss while purchasing shares of another company that should behave similarly. Taking this approach allows for the systematic harvesting of losses, which can be used to offset capital gains elsewhere while staying invested in the market.

For example, suppose you have $200,000 of stock in Company A and $300,000 of cash. In that case, you could use direct indexing to build a diversified portfolio around the concentrated stock of Company A with the cash. Then, take advantage of any tax losses from that part of the portfolio to slowly unwind the Company A position, further diversifying the portfolio in a more tax-advantageous way.

Exchange Funds

Using an exchange fund can be a clever tactic for reducing concentration risk. These funds accumulate individual concentrated stock from many individuals and collectively use these positions to build a well-diversified fund. By contributing shares of stock in exchange for an interest in the fund, you can accomplish immediate diversification without needing to sell stock. However, you may not realize much tax benefit. The basis (cost) in the stock does not change, so if you are contributing a highly appreciated position, you could still owe capital gains tax based on what you realize from the exchange fund.

Cashless Exercise

A cashless exercise is when options are exercised and shares are sold as soon as possible. As shares/options become available, they can instantly be sold at the current market price. While it likely has some degree of tax consequence, it can quickly diversify a concentrated stock position. Depending on the type of stock owned (stock options vs. restricted stock units), this strategy may rely heavily on the stock’s market price at the time it is sold. It’s best to consult a tax advisor to ensure you fully know the financial implications before pursuing this action.

Covered Calls

Another strategy that can help reduce a concentrated stock position’s impact on a portfolio over time is a form of options trading known as covered calls. This approach allows you to sell a contract for someone to buy your stock shares at an agreed-upon price at some future point.

For example, assume you own Company A shares, which are currently worth $40 per share. You sell a covered call option on Company A that allows someone to purchase the shares for $50 anytime in the next month. You collect a $3 “premium” for giving them this option. The share price grows to $55, and the option to purchase these shares is “exercised.” You earn a profit of $13 per share ($10 appreciation + $3 premium).

True, you would be giving up some of the upside in this scenario. However, you can determine a clear exit strategy at a price you are comfortable with.

Suppose the stock price instead dips to $30 a share. In that case, you’ve still collected your premium, which can help mitigate some of the potential losses over time.

Covered calls don’t instantly solve your concentration risk issue. Still, they provide a potential exit strategy while helping mitigate some downside.

Charitable Donations

If you are charitably inclined, consider using a highly concentrated stock position to make in-kind donations. Doing so can allow you to avoid paying capital gains tax on any appreciation while still being eligible to receive a charitable deduction (assuming you itemize).

You can then redirect the money you would have donated and purchase a diversified equity fund so exposure to the overall stock market doesn’t change while increasing the overall diversification of your portfolio. This is a tax-advantaged way to donate to charity while reducing exposure to a single stock.

Final Thoughts

Executive compensation often includes company stock, which can appeal to top-tier executives as it provides financial rewards and a stake in the organization’s success. While potentially lucrative, relying heavily on a concentrated stock position also comes with financial risks. Several strategies can help mitigate those risks while achieving other goals and objectives. Whether you’re an experienced executive or an emerging leader, having a wealth advisor with deep experience to help you understand and manage these strategies can be vital for your financial success. If you’d like to explore any of these concepts in more detail or discuss how to coordinate stock from executive compensation with the rest of your portfolio, please don’t hesitate to contact the SWP team.

[1] Cembalest, M., & Morgan, J. (2021, March 12). The Agony & The Ecstasy. J.P. Morgan Private Bank. (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).