Interest rates and your portfolio are interconnected. This relationship creates market behavior that affects investors and borrowers alike and is often reflected in shifts within the economy. Understanding how they impact one another is necessary for making sound financial decisions.

Why Are Interest Rates Important?

Interest rates play an essential role in the economy by influencing individual and business borrowing and spending decisions. Lower rates tend to stimulate economic growth as people are more inclined to borrow for personal or business needs, such as purchasing a new home, buying a car, home renovations, or for companies to expand operations through equipment purchases.

Too much stimulation can cause the economy to overheat and also lead to inflation – a well-covered topic in recent years. Alternatively, a rise in interest rates tends to dampen such borrowing activities, potentially slowing down the economy, sometimes to the point of causing a recession.

Over the past few decades, interest rates have undergone significant transformations that have shaped economic landscapes worldwide, from Federal Funds rates as high as 19-20% in the early 1980s to effectively being at 0-0.25% after the pandemic.

While the recent increase over the past two years was notable for how quickly rates climbed, the current levels are actually on par with the long-term average.[1]

While it would be helpful to have insight into the future direction of interest rates, predicting rate changes is inherently complex and elusive. The financial landscape is littered with examples of seasoned “experts” who have fumbled their predictions, underscoring the challenges in forecasting these crucial shifts accurately. Interestingly, even established “experts” like voting members of the Federal Reserve’s Federal Open Market Committee (FOMC), the professionals who actually set rates, have had trouble making accurate long-term predictions of interest rates. At each meeting, members forecast the federal funds rate at the end of the current year, two years in the future, and for the longer term. These predictions are collected as the “dot plot,” a visual representation of where policymakers think the rate is headed.

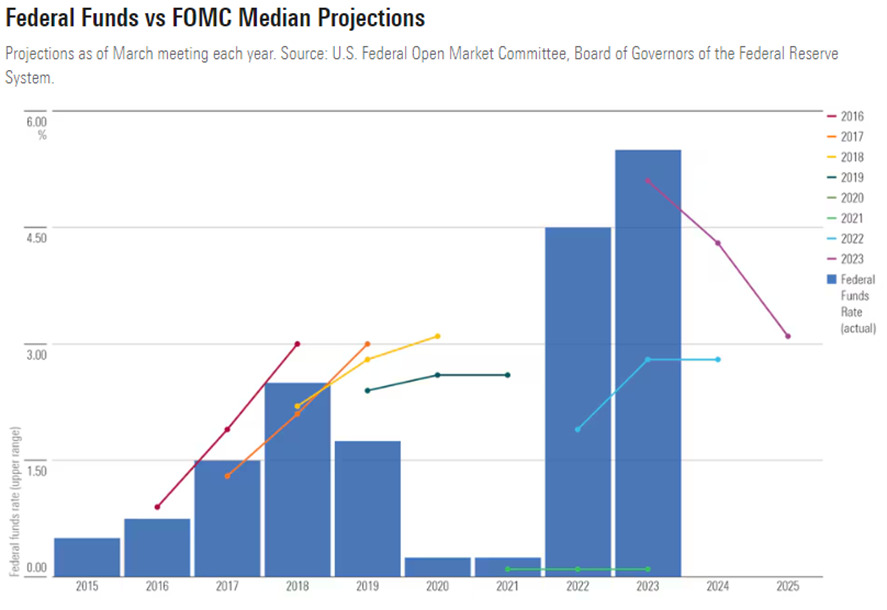

As you can see from the chart below using the median or average of the “dots,” the future often evolves in ways that defy expectations. In many cases, the Fed members miss the actual level of rates and sometimes even the direction of change.

For example, at the end of 2018, “experts” predicted that rates would climb in 2019, but they actually fell. This is illustrated by the yellow line showing a higher value than the blue bar in 2019. So, the yellow line was the Fed’s prediction, and the blue bar below was the actual outcome. You can see that the rates (blue bar) actually decreased instead of increased, as indicated by the yellow line.

If you look more recently, there were widespread predictions that rates would fall by a meaningful amount this year, but we have yet to see a rate cut. This is shown in the graph where the teal and purple lines fall on the right-hand side, but the blue bars do not.

The Impact of Interest Rates on Your Portfolio

Interest rate adjustments can sway the balance of your portfolio in different ways. For equity holders, interest rates may influence market sentiment and the intrinsic value of stocks, thereby affecting returns. Historically, equities have reacted positively to rate decreases and negatively to increases. This is due to rising rates making it more expensive for companies (particularly small and medium sized) to borrow money, while making bonds more attractive, putting pressure on share prices.

When rates are lower, businesses have an easier time getting access to capital, which can help fuel growth and lift share prices. Much of the current market’s bullish run can be attributed to ongoing consumer spending (despite rate increases) and expectations of rate cuts in the near future.

For fixed income investments, rising rates – which translate to increased yields – have historically been a strong predictor of future returns. For instance, when rates rise, the price of bonds tends to fall (yields and prices have an inverse relationship), causing the resale value of bonds to drop. However, long-term bond investors can benefit from a hike in interest rates over time as their existing bonds mature and they acquire new bonds with higher interest payments. Then, when rates fall, the inverse is true. Prices of the bonds typically increase, allowing the investor to benefit from capital appreciation, though future bond purchases are at lower yields.

With the recent considerable changes in interest rates, there’s been a notable shift towards alternative investments. These investments, often characterized by floating rate structures (instead of fixed rates), come with the unique benefit of fluid adaptability to changing interest rates.

More specifically, the appeal of floating-rate private credit investments highlights this, as they consistently prove more compelling than investment-grade bonds. This holds true even amidst declining rates, highlighting the versatility and robustness of using such strategies.

The calendar year 2022 was a testament to this – traditional fixed-income markets were down ~13%, whereas certain private credit investments were up 6% or more, marking a spread of nearly 20%. (Learn more about this trend in Our View on Alternative Investments). This was largely due to the floating rate feature of many private credit strategies, which made them less susceptible to negative returns from rising rates.

Asset Allocation Challenges

For long-term investors, interest rate fluctuations are a part of the big picture and often do not require significant portfolio shifts. However, the dynamic nature of the financial landscape suggests that regular reviews and adjustments, when necessary, are helpful to ensure your asset allocation remains appropriate for achieving your goals.

Alternative investments have become a popular way to diversify portfolios beyond traditional stocks and bonds, especially in the face of fluctuating interest rates. Alternative investments often have a low correlation with the stock and bond market, meaning they can be less affected by interest rates or other market factors. These investments can help to smooth out the overall volatility of a diversified portfolio from dramatic shifts that impact different asset classes.

Closing Thoughts

Understanding the relationship between interest rates and your portfolio is critical to making informed financial decisions. The influence of interest rates on equity and fixed-income investments and the value of diversification through alternative investments are all factors to keep in mind.

Remember, no single strategy fits all scenarios, and maintaining an appropriate asset allocation tailored to your individual goals is crucial. Therefore, it is a good idea to connect with your financial advisor to discuss the impact of potential interest rate changes on your portfolio and make any necessary adjustments.

[1] Andrew C. Chang and Tyler J. Hanson, The Accuracy of Forecasts Prepared for the Federal Open Market Committee (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).