Investors who are either approaching retirement or are in their retirement years often describe themselves as risk-averse. But do they truly understand what they are fearful of? While most people know that investing involves some degree of risk, defining that risk is sometimes a challenge. Is it the fear of losing money? Is it the possibility of having money locked up for an indeterminate time? Is it unpredictable outcomes? Or perhaps it’s something else entirely. Part of our job as advisors is to help counsel our clients through this risk-assessment process.

There is one risk in particular that many people are not familiar with until they actually experience it. It’s called sequence risk, or sequence of returns risk. It’s the peril that arises from the order and timing of investment returns; if the sequence is unfavorable under certain circumstances, it can have a devastating effect on portfolio value. One might argue that this risk is important throughout an investor’s entire time in the market, but it is significantly more prevalent to those that are thinking about or just starting retirement. The reason this demographic is particularly exposed is because sequence risk is amplified when there are consistent withdrawals from the portfolio over an extended time horizon.

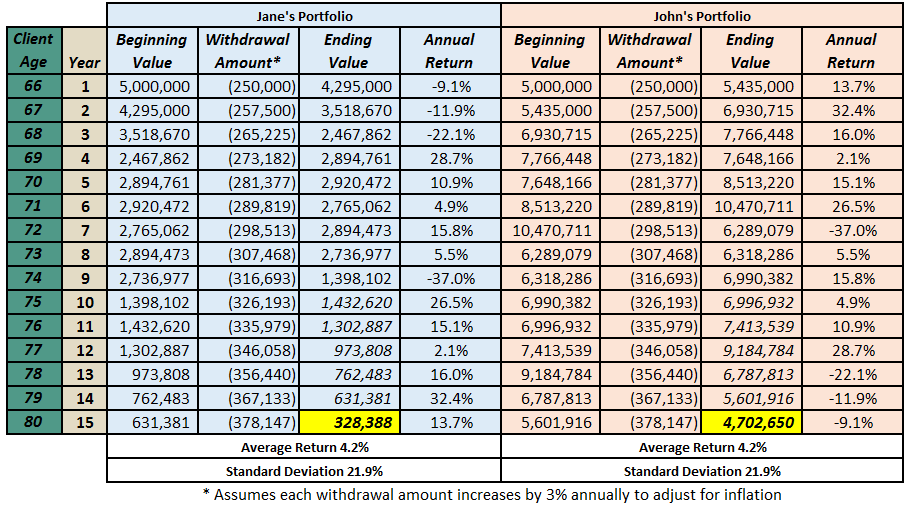

To help understand sequencing risk, consider this example:

- Two investors, John and Jane, are both 65 years old

- Each of John and Jane has a $5,000,000 portfolio

- Neither makes any contributions to the portfolio, and each needs to withdraw $250,000 per year to meet their spending needs

- The withdrawals increase by 3% each year to account for the rising cost of living

Jane’s portfolio reflects the actual returns for the S&P 500 from 2000 to 2014, while John’s shows the same average returns in reverse order. Thus, the average return and risk (as defined by standard deviation) are the same.

Note how in the table above, the ending portfolio values at age 80 (highlighted in yellow) are so different. How can two portfolios with the same average return and same level of risk yield such vastly different ending balances?

The answer is sequencing risk. Jane’s portfolio suffers losses early into retirement (four of the first 5 years) while John suffers those same losses at the end of the time period. When Jane’s portfolio rebounds, there is less money available to benefit from the good years. Jane withdrew money from a decreasing portfolio, creating a sort of a double-whammy on her retirement fund.

On the other hand, during those first five years, John’s portfolio increases in value faster than he withdraws funds. Then the losing years appear towards the end of his time horizon, his portfolio has grown sufficiently so that those losses are less impactful. Portfolio withdrawals exacerbate the risk of early losses, which can make it more difficult to increase the value of the portfolio later on. In other words, the order of your portfolio’s winning and losing periods is significantly more important when you are also regularly withdrawing funds.

Interestingly, the opposite is also true; an investor making regular deposits would actually benefit from early losses. Assuming that the returns eventually recover, getting the losses out of the way early is good! We find that this concept is typically fairly easy to grasp for people adding to their portfolio. The opposite scenario – which is the subject of this post – is a little more of an intuitive challenge.

The point of this piece is not to instill a fear that we’re all at the mercy of the market. Rather, the goal is to inform you about this risk and how it can be combatted. Some mitigating measures that can be taken include:

- Manage your portfolio’s level of volatility.

Focus on what you can control. Work with your wealth advisor to find the right balance between anticipated volatility and return. For investors who are approaching retirement or who have recently retired, it’s especially important to be mindful of how much risk is within your portfolio.

By shifting a portion of your portfolio from equities to bonds, you can smooth out annual returns and reduce the sequence risk within your portfolio. For example, if we changed our earlier example to a portfolio that was invested in 50% stocks and 50% bonds over the same period, the standard deviation decreases to 10.6% and an ending dollar value difference of only $1,800,000. Still quite a hefty gap but much more palpable than over $4,400,000. And most importantly, Jane’s portfolio ends with approximately $3.3 million in value, which allows her to continue her annual withdrawal amounts without running out of money.

The use of alternative investments is another great way to participate in generating reasonable returns while managing volatility. These investments tend to have lower volatility than traditional stocks but offer potentially higher returns than bonds. It’s something that SWP frequently uses in their portfolio construction for these exact reasons.

- Be realistic in your investment expectations.

Taking the first point above into consideration, investors must also recognize that a lower amount of volatility implies a lower average return. One needs to be aware of the risk characteristics that accompany those return expectations. Remember, a lower average risk and reward portfolio does not mean sacrificing your personal and investment goals.

- Implement a flexible spending program.

This choice involves being more dynamic in your annual spending habits. For example, you can use a “guardrails” approach. This style consistently monitors the portfolio’s annual withdrawal amount and adjusts the amount of the following year’s distributions based on how much the withdrawal is as a percentage of the overall portfolio.1 In essence, when the portfolio does well, you take out more and vice versa when the portfolio underperforms.

Warren Buffet famously said, “It is not necessary to do extraordinary things to get extraordinary results”. Our goal in writing this piece is to highlight that there is sound logic backing the ‘less is more’ theory. Achieving your goals is still possible if you take the cautious route and can make for a much smoother journey along the way.

If you’re approaching retirement, in retirement, or even just starting investing, we encourage you to talk to your wealth advisor as we are always here to help

1. https://www.kitces.com/blog/url-upside-potential-sequence-of-return-risk-in-retirement-median-final-wealth/