A recent survey showed that approximately 40% of U.S. Consumers believe that winning the lottery, instead of investing, is a reasonable way to retire. Perhaps it is not too surprising given the survey also found that one-third of Americans think investing is overwhelming and complex1. However, when you consider that the average American will need as much as $1.7 million to be able to retire2, it’s clear that NOT investing for retirement is not a viable strategy. Amassing a sizable nest egg doesn’t just happen; you need to plan, save, invest for growth, and stay the course.

Saving and Investing Are Not the Same

When saving for retirement, inflation can be your biggest enemy – it gradually erodes the buying power of your money and decreases its value over time. For example, if you have $10,000 in cash today, assuming an average annual inflation rate of 3%, in 25 years, you will be able to purchase the equivalent of only $4,776 worth of goods. To maintain the purchasing power of your money, you’ll need to earn a rate of return that at least matches inflation. Expected returns on a savings account will typically be near the current inflation rate (usually 1%-3%) and are generally quite steady. This means that the money in a savings account is likely not increasing its purchasing power over time. So while putting some cash in a bank account can be an excellent way to save for near-term financial goals, it won’t get you where you need to be for retirement.

To achieve longer-term goals like retirement, you’ll need to grow your principal at a rate that far exceeds inflation. One way to do that is by investing in the stock market. Stocks have historically generated about 10% annually3, though those returns are much more volatile, which often makes people a little skittish. That said, these varying returns have historically tended to even out over a long enough time horizon. Of course, there are many other possible investment vehicles in addition to stocks.

Invest Early and Often

The most effective retirement saving strategy involves a disciplined approach to investing early and often. Even small contributions to a portfolio can potentially add up significantly over time and allow you to take advantage of compound earnings, essentially earning returns on your returns.

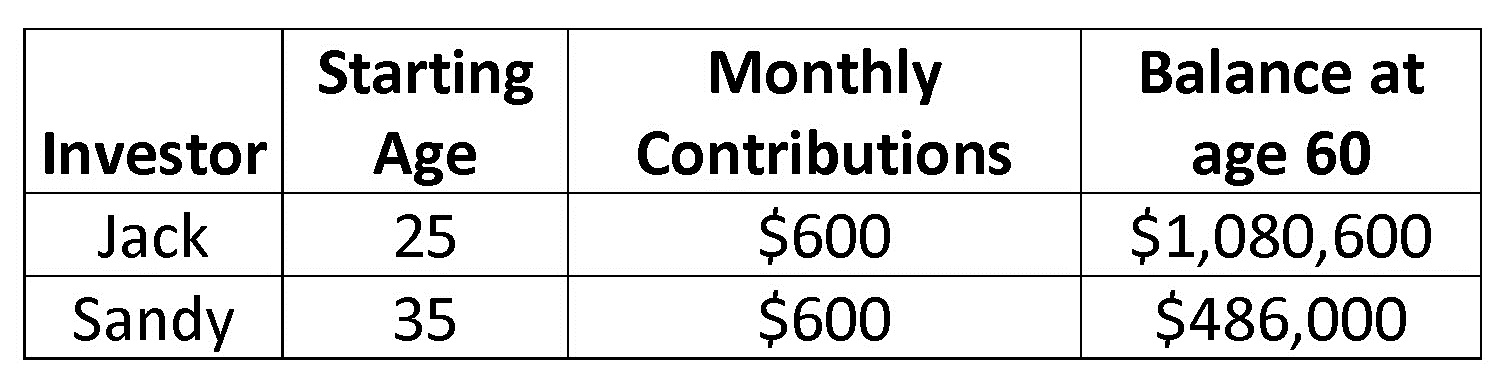

To illustrate the power of compounding, let’s compare two investors, Jack and Sandy. They both invest $600 per month, and both earn an average annual return of 7% (a relatively conservative return given the historical 10% return I previously mentioned) on their investments. The only difference is that Jack starts at age 25, and Sandy doesn’t start investing until she is 35.

By age 60, the value of Jack’s account will be more than double that of Sandy’s. In fact, Sandy would need to invest an additional $734 per month to get the same ending balance as Jack. By getting into the investing habit ten years earlier, Jack’s investment returns more than doubled Sandy’s in value!

Investing for retirement early sounds great in theory, but many people do not know where to start. One of the easiest ways is to set up automatic transfers into your investment accounts. Many companies allow employees to deduct 401(k) contributions directly from their paycheck. If your employer offers 401(k) matching, I highly recommend taking advantage of the full company match – otherwise, you are leaving “free money” on the table. Transferring money from your bank account to an IRA is also a good option.

These periodic contributions take advantage of a strategy called dollar-cost averaging. When the market as a whole is down, you are buying more shares at a lower price, and when the market is high, you are buying fewer shares at a higher price. In essence, you end up buying into the market at the “average” price over time.

I’ve been investing ever since I started my career, and it quickly became second nature. Allocating a portion of any raises or bonuses to your retirement savings is another strategy I recommend, as it can get you to your goals even faster.

Stick to Your Plan

Although news reports of stock market ups and downs — or predictions about the next crash — might tempt you to second-guess your investment strategy, keep in mind that news outlets try to grab attention and that fear is an easy hook. The value of staying in the market was underscored in a recent study that tracked the performance of investors in the stock market, as measured by the S&P 500 Index. Over a period of 20 years, investors who missed just the ten best days (0.20% of the total) saw their returns cut by over half. The returns of investors who missed the 20 best days dropped into negative territory. Interestingly enough, most of the market’s best days have occurred during bad markets4. This is yet another example of why timing the market is almost impossible and you should just stick to your plan.

A disciplined and continuous approach to investing for retirement can potentially reward those who start early and stay the course. While investing does entail some risk, not investing is a much greater risk. You may not suffer any short-term losses, but you will almost certainly miss out on long-term gains – costing you much more than any short-term loss. If you need assistance planning for retirement or getting started, we are happy to help.

1. https://learn.stashinvest.com/why-saving-for-retirement-isnt-playing-the-lottery

2. https://www.cnbc.com/2019/07/05/how-much-money-do-you-need-to-retire.html

3. https://www.cnbc.com/2017/06/18/the-sp-500-has-already-met-its-average-return-for-a-full-year.html

4. https://www.jpmorgan.com/securities/insights/the-beauty-of-doing-nothing