For many investors, the topic of concentrated stock positions can feel especially personal, particularly for those who proudly say things like, “I bought Nvidia at $40, and I’m never selling.” While such timing certainly deserves recognition, it also raises an important consideration: the risks of being heavily invested in a single stock. Regardless of how promising the company may appear, there are compelling reasons to consider the potential benefits of a more diversified portfolio.

What’s a Concentrated Stock Position?

If one stock makes up a huge chunk of your portfolio, say, more than 20%, you’re in concentrated territory. This usually happens in a few ways:

- You worked at a company and were granted stock.

- You made a great investment early and just let it grow unchecked.

- You really liked a stock and kept adding to it over the years.

Being concentrated in one stock can be risky like building a house on a volcano because the view is nice.

The Problem with Putting All Your Hopes in One Basket

Imagine you’re at a casino. You walk in, bet everything on black, and spin the roulette wheel. You might win. You might lose. But what if you just split your bet between black, red, and a few numbers in between? Way less drama. Individual stock investing is similar. The more you spread out your investments among multiple names, the lower the risk of your portfolio. It’s the most important reason why we don’t recommend individual stocks to our clients. Here’s why staying concentrated is dangerous:

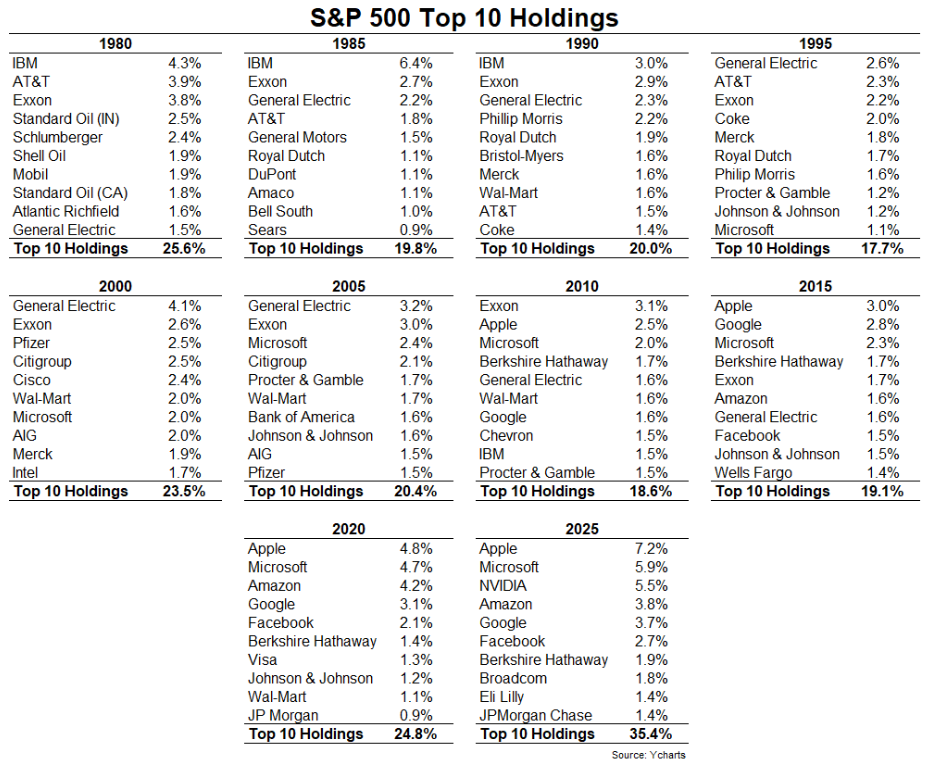

1. Company-Specific Risk: Even great companies stumble. Just ask anyone who held onto Enron, Lehman Brothers, or GE through the wrong decade, disruption, regulation, or scandal. Anything can happen. The chart below shows the top 10 companies in the S&P 500 by decade. Notice the significant changes from decade to decade! None of the top 10 holdings from the 1980s have been in the top 10 in the 2020s.

Source: The Top 10 Stocks in the S&P 500 – A Wealth of Common Sense (Link)

2. Emotional Rollercoaster: When your portfolio lives and dies by one or a handful of ticker symbols, you check the stock price constantly. One bad earnings call, and suddenly your whole net worth looks like a melting ice cube.

3. Opportunity Cost: That concentrated position might be doing well, but it’s also tying up capital that could be spread across other winners.

But What If It’s a Really Good Stock?

Maybe you hold Amazon stock, and it’s made you a fortune. Still, remember that even the best stocks go through rough patches. Amazon fell 90% in the early 2000s. Apple’s had multi-year periods of flat or negative returns, like this year, where it’s down ~20% year-to-date when the S&P 500 is up ~3%. No company is immune. Don’t forget that you can still own these stocks. The goal isn’t to run away from your great investments. The goal is to reduce your exposure so one bad day doesn’t disrupt your financial plan. The natural solution is diversified funds/ETFs/direct indexing strategies, all of which we use for our clients in favor of individual stocks.

The Magic of Diversification

Diversification is one of the very few free lunches in investing. When you spread your money across multiple companies, industries, and geographies, you reduce your risk without necessarily giving up returns.

How to Start Diversifying

Suppose a significant portion of your net worth, perhaps 20% or more, is concentrated in a single stock, such as Microsoft, or you’ve experienced substantial gains from a company like Nvidia. The question then becomes: what should you do next? Here are a few friendly tips that we’ve used with real clients:

- Set a Plan: Don’t panic-sell. Decide on a time-based or price-based strategy to trim your position. Maybe it’s “sell 10% every quarter” or “whenever it hits a new high, take some gains.” Included in this is using options to set a floor at the lowest you would want to exit the stock.

- Use Tax Strategies: Things like tax-loss harvesting, donating appreciated shares to charity, or using a donor-advised fund are all viable solutions. Direct indexing strategies can help accumulate capital losses to offset existing gains in the concentrated position as well.

- Reinvest Smartly: Take the proceeds and diversify into more balanced products. You’re not running away from the market; you’re just spreading the risk.

- Automate: If you’re still working and getting more Restricted Stock Units or options, consider selling new shares as they vest and reinvesting automatically.

Wealth management is not solely about growing your assets; it is equally about preserving them. With that in mind, it may be worth reviewing your portfolio and asking, “Am I overly concentrated in a single position?” If the answer is yes, reach out to our team to explore strategies designed to help create a more balanced and resilient financial path moving forward.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (“SWP”) is d/b/a of, and investment advisory services are offered through, Kovitz Investment Group Partners, LLC (“Kovitz), an investment adviser registered with the United States Securities and Exchange Commission (SEC). SEC registration does not constitute an endorsement of Kovitz by the SEC nor does it indicate that Kovitz has attained a particular level of skill or ability. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Kovitz Investment Group Partners, LLC, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for Kovitz’s disclosure brochure as set forth on Form ADV from Kovitz using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).