I will admit it. I am part of the problem. I often gravitate towards what went wrong, or what could have gone better, rather than celebrating what went well. This applies universally to my life, whether it is professional or personal.

Take my recent trip to Grand Beach, Michigan, as an example. My fiancée and I went up to a friend’s lake house, where it was 50 degrees and windy the entire time. On our drive home, I spent most of my time complaining about all the outdoor activities we missed out on due to the weather. I immediately overlooked the movies we watched, the games we played, and the laughs we had.

I would like to think I am not alone, so I asked myself why our brains work this way. Maybe this is just the way we are wired as humans. Or maybe it’s a learned behavior with some sort of survival of the fittest mentality. Perhaps, if a person focuses on the bad, it is more likely one will be able to persevere. It may be as simple as the bad things in life hurt more than the good things feel good.

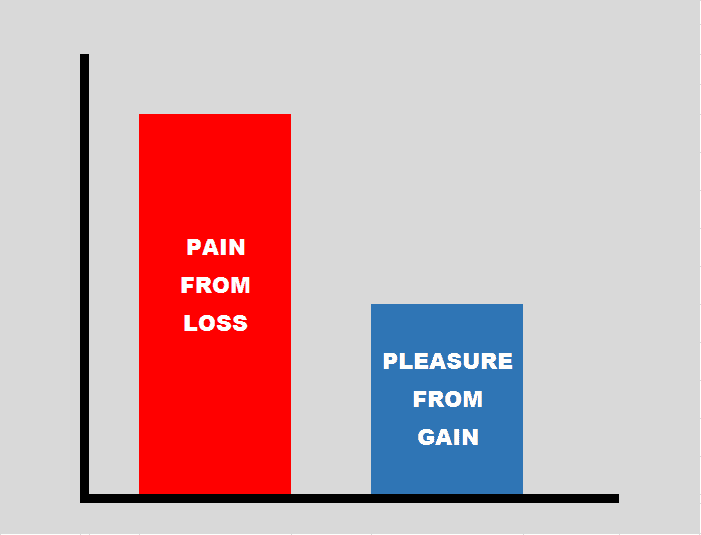

Famous psychologists Kahneman & Tversky published a study in 1979 to highlight this idea. Their study can be summarized as the pain of losing is psychologically about twice as powerful as the pleasure of gaining[1].

Source: https://www.pdsplanning.com/behavioral-finance-loss-aversion/

So why should you care? How does this apply to your portfolio?

When thinking about the stock market, people tend to focus on the potential black swan event – the next 2008, for example. In reality, events like this don’t happen very often. Since 1900, the stock market (as measured by the S&P 500) has only had a market sell-off greater than 30% thirteen times[2]. Over a 120 year period, that really puts things in perspective. Looking at things more positively, the stock market has been up 74% of the time (per calendar year) between 1928-2020[3]. That’s not to say that bad things don’t happen – 2020 has shown us that anything is possible.

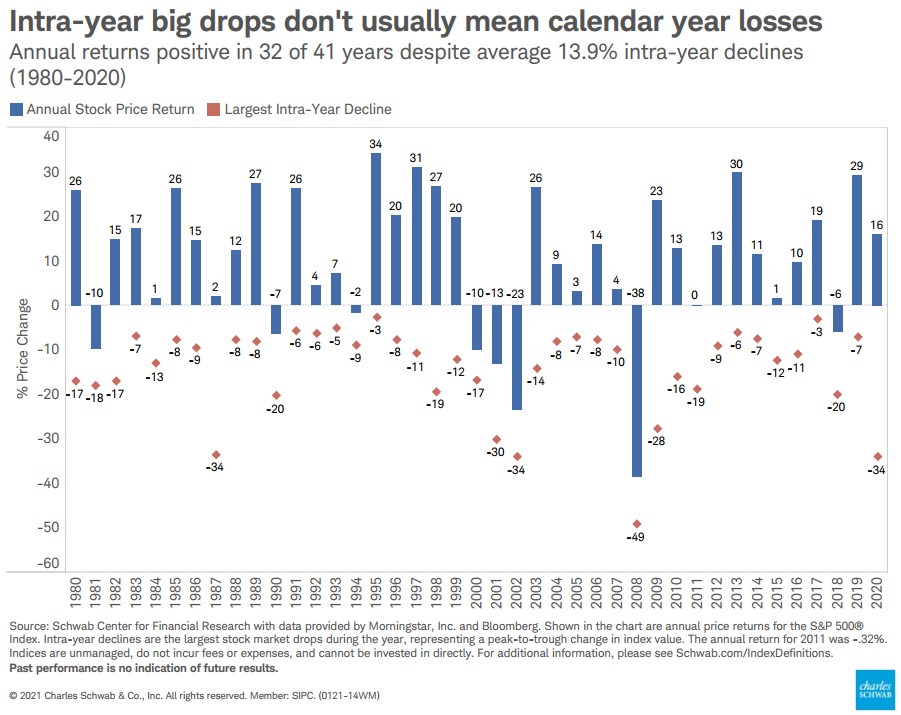

Take the graph below as another example. This bar graph shows (from left to right) the annual returns for the S&P 500 going back to 1980, with the red dots representing the largest intra-year decline during each of these years.

Let’s look at 2009. The S&P 500 ended the year +23%, but there was a 28% draw-down at one point during the year. At the time of the draw-down, it was probably easier for investors to dwell on the negative – how poor the market was doing. But in hindsight, it ended up being a really strong year for investors!

With all that said, it is important to keep an eye on the negative some of the time. There is nothing in life that goes perfectly. But for the most part, there are positives that can outshine the negatives, whether you are going to a lake house or investing in the markets.

I have decided that a top priority in my life is refocusing my negative thought process to a more positive one. I’m finding this easier and easier to do now that we are back in the office and meeting more frequently with our clients. It always helps to hear about all of the fulfilling work that our clients do and the great experiences our clients are having.

Please reach out to your SWP team if you would like to discuss further or if we can help in any way.

[1] An Analysis of Decision Under Risk by Daniel Kahneman and Amos Tversky (Link)

[2] S&P500 +10% DrawDowns since 1870 by A. Casey (Link)

[3] Percent of Time S&P 500® Was Positive, 1928 – 2019 by BMO Global Asset Management (Link)

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Past performance is no guarantee of future results. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).