In honor of Financial Literacy month in April, SWP Wealth Advisors shared money lessons they have learned throughout their lives. In this piece, you will find a compilation of these lessons.

Neal Price – Spend Less Money Than You Make

When SWP Principal Neal Price and his wife Laurie got married a year or so after college, they had this innate sense that they needed to spend far less than they made. Neal doesn’t recall ever discussing how much they could or should spend, and to this day, they have never had a household budget. It was just natural to them both that they needed to live within their means. They both had good-paying jobs in public accounting, and even in those early years, they had a soft goal of saving one of their paychecks. As Neal reflects all these years later, those types of decisions got his family off to a strong financial footing that continues to this day.

When SWP Principal Neal Price and his wife Laurie got married a year or so after college, they had this innate sense that they needed to spend far less than they made. Neal doesn’t recall ever discussing how much they could or should spend, and to this day, they have never had a household budget. It was just natural to them both that they needed to live within their means. They both had good-paying jobs in public accounting, and even in those early years, they had a soft goal of saving one of their paychecks. As Neal reflects all these years later, those types of decisions got his family off to a strong financial footing that continues to this day.

Cory Rappaport – Individual Stock Picks Often Come With Greater Risk

Although not a part of SWP Wealth Advisor Cory Rappaport’s core portfolio, he does like to buy a small number of individual stocks from time to time. However, he is far less likely than he used to because of his experience in May 2019. Cory bought shares of Uber close to their IPO at around $38 per share. Right now, Uber is trading closer to $33/share, bringing his loss to a negative 13% return. Comparatively, the S&P 500 is up over 17% per year over the same period. He learned that individual stock picks are definitely more exciting, but often come with greater risk than that of a diversified index fund.

Although not a part of SWP Wealth Advisor Cory Rappaport’s core portfolio, he does like to buy a small number of individual stocks from time to time. However, he is far less likely than he used to because of his experience in May 2019. Cory bought shares of Uber close to their IPO at around $38 per share. Right now, Uber is trading closer to $33/share, bringing his loss to a negative 13% return. Comparatively, the S&P 500 is up over 17% per year over the same period. He learned that individual stock picks are definitely more exciting, but often come with greater risk than that of a diversified index fund.

Michael Karmin – Tax Planning Matters

When SWP Principal Michael Karmin joined SWP 10 years ago, he rolled his 401k from his previous employer into a new traditional IRA. Once his IRA was funded, he decided to convert the entire account to a Roth IRA. This meant he had to pay taxes, at his ordinary income rate, on the entire value of the conversion. He had to make a large one-time tax payment, but looking back, this is one of the best financial decisions that he has made.

When SWP Principal Michael Karmin joined SWP 10 years ago, he rolled his 401k from his previous employer into a new traditional IRA. Once his IRA was funded, he decided to convert the entire account to a Roth IRA. This meant he had to pay taxes, at his ordinary income rate, on the entire value of the conversion. He had to make a large one-time tax payment, but looking back, this is one of the best financial decisions that he has made.

Assets in Roth IRAs grow tax-free, and no taxes are owed on withdrawals down the road. This account has grown at over 11% per year for the past 10 years (all credit to the stock market, very little credit to him), and all that growth is tax-free! It wasn’t fun paying taxes 10 years ago on the Roth conversion, but it has worked out incredibly well. This one tax planning decision will likely generate a better financial return than any investment he has or will ever make.

Kathy Klein – The Value of a Net Worth Statement

SWP Wealth Advisor Kathy Klein creates a net worth statement on a semi-annual basis to help with the budgeting of her household. Below she lists the advantages of taking the time to do this for you and your family:

SWP Wealth Advisor Kathy Klein creates a net worth statement on a semi-annual basis to help with the budgeting of her household. Below she lists the advantages of taking the time to do this for you and your family:

- Keeps you organized

- Provides a report to share with your spouse or later with children

- Highlights an increased use of debit and prevents negative trends

- Helps you to create a balance between your spending money and retirement funds.

- Allows you to identify estate planning challenges and opportunities

Moreover, adding three agreed upon financial goals to your net worth statement will encourage your family to work together as a team. Regularly reviewing the net worth statement helps you stay on track toward meeting your defined goals.

Adam Rudolph – Balancing What is Important to You

SWP Wealth Advisor Adam Rudolph has found throughout his life that sometimes a great financial decision isn’t what’s best on paper. This can apply to little things like starting your morning with a Starbucks. It can also apply to bigger ticket items like house expenses. Adam drastically reduced his savings into his 401k for several years prior to purchasing his first condo. On paper, it always makes sense to maximize your retirement savings, but he really wanted to buy a condo. In order to help him do that, he built up his taxable assets.

SWP Wealth Advisor Adam Rudolph has found throughout his life that sometimes a great financial decision isn’t what’s best on paper. This can apply to little things like starting your morning with a Starbucks. It can also apply to bigger ticket items like house expenses. Adam drastically reduced his savings into his 401k for several years prior to purchasing his first condo. On paper, it always makes sense to maximize your retirement savings, but he really wanted to buy a condo. In order to help him do that, he built up his taxable assets.

While others may question why you are making a financial decision, you may feel it is what makes the most sense to you and makes you happy. Life is about balance. You can balance what makes sense financially as well as what makes sense emotionally.

Andrew Denenberg: Focus on What You Can Control

One of SWP Principal Andrew Denenberg’s favorite quotes about money and investing is from Peter Lynch, a famous fund manager: “Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” It’s important to note, however, that the only way that this can be true is if one does not sell their long-term growth assets when markets are down. Far too many people who invest without professional help succumb to their emotions and sell when the market is down, either because they expect it to go down further or because they simply can’t take the pain anymore. Or, perhaps equally destructive, they never invest at all, and simply sit on cash that loses purchasing power over time.

One of SWP Principal Andrew Denenberg’s favorite quotes about money and investing is from Peter Lynch, a famous fund manager: “Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” It’s important to note, however, that the only way that this can be true is if one does not sell their long-term growth assets when markets are down. Far too many people who invest without professional help succumb to their emotions and sell when the market is down, either because they expect it to go down further or because they simply can’t take the pain anymore. Or, perhaps equally destructive, they never invest at all, and simply sit on cash that loses purchasing power over time.

Andrew finds that by focusing on things he can control, such as saving money every month and investing with regularity regardless of market conditions, he can eliminate worrying about things he can’t control, such as short-term market fluctuations or geopolitical conflicts.

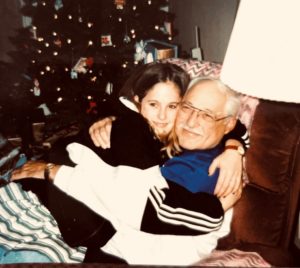

Ashley Bebeau: The Trouble With Timing the Market

In January of 1984, SWP Principal Ashley Bebeau’s parents purchased $1,000 of Apple stock for her right when it went public. Her grandfather also bought shares of Apple. He loved to gamble! When Ashley was little, she and her grandfather would talk about how “their stock” was doing. You may recall that Apple stock was a horrible investment in the ‘80s. As expected, her grandpa sold his position shortly before they announced a stock split in 1987. Ashley was only 4 or 5 years old, but her dad trained her to use this as an opportunity to pick on her grandpa for selling. They hung on for a little while, but her parents eventually decided to cut their losses as Apple continued to struggle. Sometimes Ashley likes to give herself a harsh reminder, so she will Google, “what would $1,000 invested in Apple in 1984 be worth today?” The answer is $1.2M.

In January of 1984, SWP Principal Ashley Bebeau’s parents purchased $1,000 of Apple stock for her right when it went public. Her grandfather also bought shares of Apple. He loved to gamble! When Ashley was little, she and her grandfather would talk about how “their stock” was doing. You may recall that Apple stock was a horrible investment in the ‘80s. As expected, her grandpa sold his position shortly before they announced a stock split in 1987. Ashley was only 4 or 5 years old, but her dad trained her to use this as an opportunity to pick on her grandpa for selling. They hung on for a little while, but her parents eventually decided to cut their losses as Apple continued to struggle. Sometimes Ashley likes to give herself a harsh reminder, so she will Google, “what would $1,000 invested in Apple in 1984 be worth today?” The answer is $1.2M.

Needless to say, Ashley is not a gambler. She doesn’t own a single individual stock today. She would much rather put her hard-earned savings in a well-diversified portfolio, so she will never again Google search what her investment would have been worth had she just sold/bought at a particular point in time.

Marcie Nach: An Unexpected Inheritance

SWP Financial Planner Marcie Nach’s dad passed away 20 years ago. True to her dad’s nature, he left a surprise insurance policy for Marcie and her sister. It wasn’t a substantial sum of money, but neither of them expected anything, so the first thing they did was to take some time to decide upon their goals and purpose for their “inheritance.”

SWP Financial Planner Marcie Nach’s dad passed away 20 years ago. True to her dad’s nature, he left a surprise insurance policy for Marcie and her sister. It wasn’t a substantial sum of money, but neither of them expected anything, so the first thing they did was to take some time to decide upon their goals and purpose for their “inheritance.”

It was fun to think about making improvements to their homes or buying themselves something extravagant. They did neither of these. Without much discussion, they both adopted a “what would dad like” policy. They have carefully invested the funds, and they occasionally withdraw for items that they think their dad would have liked.

For example, Marcie took her family on a vacation to Israel, knowing that her dad would have loved that decision. Her sister used the funds to help pay for a start-up business. There have been times they have withdrawn funds for an emergency, something their dad would have helped with had he been here. Marcie feels lucky that she is on the exact same page as her sister, and they have the same goals for the funds. They think their dad would be proud that they have been good stewards of his thoughtful gift.

Neal Price & Michael Karmin – Risks of Chasing Investing Fads

Last year, in the midst of the ‘meme stock’ mania, SWP Principals Michael Karmin and Neal Price wrote the following. It’s great advice, regardless of the ‘hot’ idea at any given moment. They understand that despite their best advice about long-term investing, not chasing fads, not timing the market, and other well-worn but prudent concepts, some of their clients may want to dabble… here’s what they think about that:

Last year, in the midst of the ‘meme stock’ mania, SWP Principals Michael Karmin and Neal Price wrote the following. It’s great advice, regardless of the ‘hot’ idea at any given moment. They understand that despite their best advice about long-term investing, not chasing fads, not timing the market, and other well-worn but prudent concepts, some of their clients may want to dabble… here’s what they think about that:

- Think of this as gambling and not investing, because that’s what it is.

- Like at any casino, do not gamble more than you can afford to lose. In fact, you should assume that you will eventually lose 100% of what you gamble…

- Do not confuse success with expertise. They’re entirely different. (Please read that again.)

- …eventually the fundamentals of a company matter. You don’t want to be caught on the wrong side of the trade when that inevitably occurs.

So dabble if you must, even if they’d prefer that you not. And remember that at SWP, we remain focused on one thing – helping our clients achieve their goals. All SWP advisors are long-term investors and don’t trade to make a quick dollar. Aligning your financial plan and portfolio with your goals and your personal situation is the key to success. Markets may be moving faster than ever, and trendy investments will keep hitting the airwaves and the CNBC ticker, but our advisors won’t let that push our clients off course.

Conclusion

We hope that you have found these money lessons insightful. If you would like to discuss how any of these money lessons may apply to your own portfolio, please reach out to a member of our team.

Disclosure:

This article contains general information that is not suitable for everyone. The information contained herein should not be constructed as personalized investment advice. Reading or utilizing this information does not create an advisory relationship. An advisory relationship can be established only after the following two events have been completed (1) our thorough review with you of all the relevant facts pertaining to a potential engagement; and (2) the execution of a Client Advisory Agreement. There is no guarantee that the views and opinions expressed in this article will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Strategic Wealth Partners (‘SWP’) is an SEC registered investment advisor with its principal place of business in the State of Illinois. The brochure is limited to the dissemination of general information pertaining to its investment advisory services, views on the market, and investment philosophy. Any subsequent, direct communication by SWP with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of SWP, please contact SWP or refer to the Investment Advisor Public Disclosure website (http://www.adviserinfo.sec.gov).

For additional information about SWP, including fees and services, send for our disclosure brochure as set forth on Form ADV from SWP using the contact information herein. Please read the disclosure brochure carefully before you invest or send money (http://www.stratwealth.com/legal).